The MED hired the Marijuana Industry Group and the University of Colorado Leeds School of Business to compile a report on the state of the green market in 2019, analyzing data connected to marijuana sales, supply, consumers, pricing and other industry factors to measure how far the legal pot industry has come since 2014, when recreational sales began.

And according to the report, Colorado's pot industry has come a long way.

"This year’s update shows the regulated marijuana market continues to meet resident and visitor demand, concentrates continue to gain market share in the legal marijuana marketplace, Colorado remains a competitive place for marijuana businesses and price stabilization suggests market maturity," according to MED statement on the results.

But what does a mature market mean besides more hash and increased competition? We checked the MED's 2019 market report to find out, and came away with five highlights:

Weed is getting cheaper

Marijuana prices and supply are still seasonal and commodified, but at least those price peaks are lower than they used to be. According to the MED report, the average price per gram of marijuana flower bottomed out around $4 last year — that includes the cost of gram per ounce, half-ounce, quarter-ounce and so on — and eventually settled at a $4.53 average by the end of 2019. That's a decrease of nearly 59 percent from 2014, when recreational sales began. Concentrate prices also dropped significantly during that span, falling nearly 63 percent, from $45.61 to $17.06.

The price of marijuana edibles has fallen, too, shrinking by 35 percent between 2017 and 2019.

"The regulated market is nearing maturity now. Several observations indicate the market is past its introductory and rapid growth phases and nearing maturity," the report reads. "These include current price trends, supply patterns and consolidation."

Seasonal supply patterns created by outdoor marijuana production, dependent on one harvest per year, are "emerging strongly" in Colorado, the report explains, but the lower cost of outdoor marijuana leads to cheaper prices overall at the dispensary.

...and stronger

Dispensary shoppers are getting more bang for their buck, according to the MED, with THC content in both flower and concentrate increasing since 2014. The average gram of flower tested at 18.8 percent THC in 2019, the report shows, up from 16.4 percent in 2014, while the average amount of THC in a gram of concentrate rose from 56.6 percent to 69.4 percent in the same span.Tourism plays a big part in sales, but Coloradans really love their pot

Among the many discoveries in 2020 was that Colorado's marijuana industry could stay afloat despite declining tourism during the COVID-19 pandemic.And the industry hasn't just stayed afloat, it's thrived, setting multiple monthly sales records as dispensaries sold over $1 billion from March to August, according to the MED.

While the MED's market report attributes over 20 percent of state pot consumption in 2019 to tourists, data also shows that more Colorado adults were consuming the plant last year, with about 18.5 percent of residents 21 and up reporting marijuana consumption within the past month, compared to a 9.6 percent national average. Colorado also had more regular marijuana users last year than the nationwide average, the report notes, with an estimated 4.4 percent of adults consuming 26 days or more per month here, as opposed to 2.9 percent across the country.

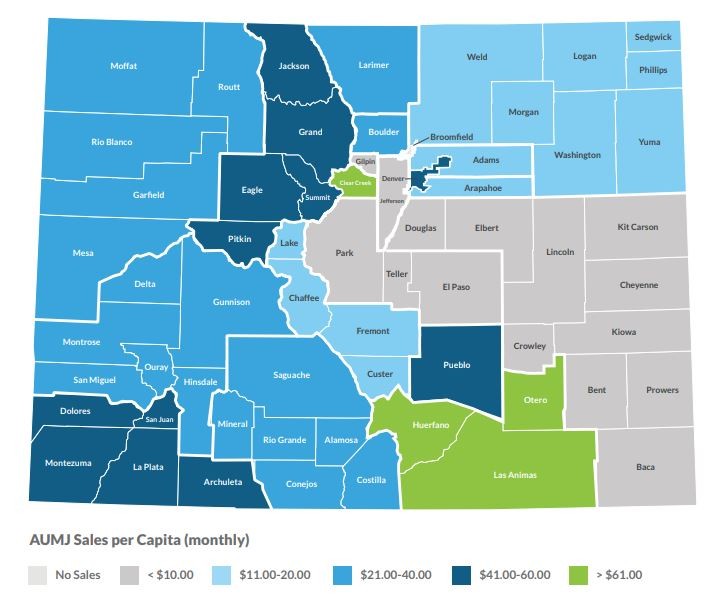

Want to get away from weed? Move to southeastern Colorado

If you want to avoid weed (or avoid places that don't have weed), then consider the image above, a state map of recreational marijuana sales per capita by county. While several of the counties in gray do have dispensaries, such low sales figures indicate that dispensaries are few and far between in southeastern Colorado.

That's been a common complaint from readers over the years. And medical marijuana sales are even lower in the eastern portion of Colorado, according to the report — an important distinction for medical marijuana patients who can't grow their own plants.

Medical marijuana businesses are slowly fading away, but it remains a lucrative market

The slow, inevitable decline of the medical marijuana industry in a recreational state has been reflected in monthly MED reports showing stagnant medical sales and a decrease in new medical marijuana licensees across the state since 2014. A smaller customer base hasn't totally doomed the medical side, though, since it enjoys a much lower tax rate than that of recreational pot, and the report shows that medical patients spend enough money to make it worthwhile for the industry to keep medical-only counters alive. In 2019, medical patients spent an average of $97.92 per purchase, while recreational customers spent $51.89. Barely more than 10 percent of recreational purchases crossed $100, compared with 23 percent of medical purchases.

Since 2020 began, medical sales have enjoyed a small resurgence. They only eclipsed $30 million twice in 2019, but this year have beaten that number every month since March, with July medical marijuana sales hitting $43.3 million, the highest tally in that category since recreational sales began in 2014.

The report doesn't see that growth continuing, however. "The medical market in Colorado has reached its endstage, where sales will likely stay stagnant and decline," it suggests. "Adult use market pricing is falling closer to medical market pricing, and while key differences in edible products and purchase quantities remain, it is now clear that the adult use market has cannibalized the medical market for growth."

Here's the full MED 2019 market report below: