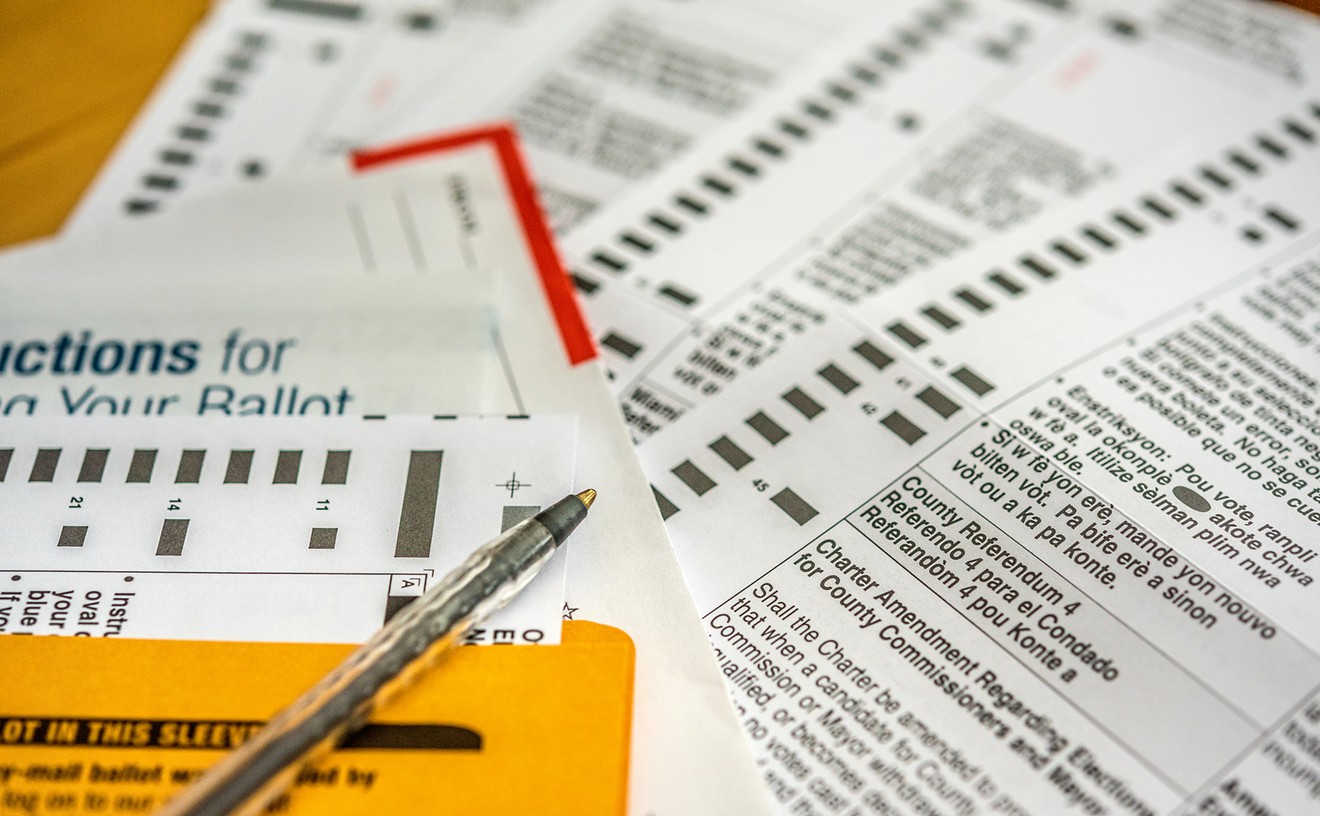

According to the document, which resides on the state's Colorado.gov website, retail MMJ sales in the State of Colorado were $199,118,715 for fiscal year 2012, generating $5,409,622 in state sales taxes.

There's also a breakdown for more than twenty individual counties. Sales in Denver were by far the highest, at $88,462,453, with a corresponding $2,407,341 in state sales taxes. El Paso County follows with $34,903,683 in sales and $924,509 in state sales taxes.

Attorney Warren Edson, who stumbled upon the document while searching for something else on the state's site, provides some perspective on the numbers as a whole, as well as how they might give us a glimpse of the recreational-marijuana-sales future."Keep in mind two things," Edson says. "This is medical marijuana only, so this is based on roughly 100,000 patients statewide. And it's based on the state sales tax of 2.9 percent."

As Edson points out, "Denver has a 7.2 percent sales tax. So to get an idea of how much in city taxes Denver collected, take the state number [of $2.4 million] and double it -- and you'd still be underestimating it."

No wonder Denver's City Council voted to move forward with a recreational marijuana sales system yesterday.

Using these digits to predict recreational marijuana sales and tax revenue requires conjecture. But note that the sales tax voters will be asked to approve in November is 15 percent, plus a 15 percent excise tax -- and that doesn't include separate city taxes.

Edson concedes that "everyone is guessing" about demand -- "but let's make the math easy. Those 100,000 patients are probably going to turn into a million consumers. So take those numbers and multiply them by ten."

Using this formula, marijuana sales would be just shy of $2 billion for the state as a whole for a single fiscal year. And multiply the state sales tax figure by five -- representing the tax increase from 2.9 percent to 15 percent -- and the total is around $27 million. Add the tax revenues for individual cities, not to mention the money generated by excise taxes and, as Edson says, "you've got some pretty big numbers. Wow."

Here's the document:

Colorado Medical Marijuana Retail Sales and Sales Tax for 2012

More from our Marijuana archive from May 7, 2013: "Marijuana: How an Amendment 64 repeal measure almost passed last night."