THE OPENING

Mountains of shrimp, acres of oysters, a river of caramel, an ocean of booze. There was no stopping the party once it got started.

The grand opening of Denver’s Four Seasons Hotel had been planned for months, like a royal wedding or a Super Bowl halftime show, and boy, was it grand. Anybody who was anybody was there, and even some nobodies shelled out the $325 admission fee — a portion of which was earmarked for the Denver Zoo, the Denver Center for the Performing Arts and other civic causes — just to get in the door.

OneRepublic played the ballroom while aerial performers fluttered above and stilt-walkers stooped to serve hors d’oeuvres. Guests took turns riding a mechanical bull, sampled the candies and chocolate fountains in the Willy Wonka dessert room, checked out the outdoor pool and the five-star pampering offered in the third-floor spa. They marveled at the fancy hotel rooms, which would command prices upwind of $300 and even $1,000 a night, and speculated about the multimillion-dollar private residences not yet completed on the upper floors of the 45-story high-rise.

The dancing, the imbibing, the gawking went on until four in the morning. Penny Parker proclaimed the bash to be “most likely the party of the year,” the year being 2010 — back when the Denver Post could still afford the luxury of a society columnist like Parker, who left the newspaper sixteen months later and died in 2016.

Parker duly noted the luminaries in the crowd, ranging from actress Kerry Bishé (soon to have breakout roles in Argo and Halt and Catch Fire) to the usual crew of downtown business promoters, hospitality industry hangers-on and media mooches. But it wasn’t the Boldface Names that made the soirée so special; it was the fact that the Mile High City had finally landed a Four Seasons, one of the most esteemed brands in the world of luxury hotels. The company’s highly coveted imprimatur signaled that Denver was ready to take its place among the truly cosmopolitan cities of the globe. It was also proof that the former cowtown had emerged from the Great Recession of 2007-’09 stronger than ever, with a roaring economy and a cultural scene appealing to one-percenters and arrivistes, trust-funders and tech kings — the kind of folks who stayed at the Four Seasons and plunked down millions for a high-rise condo.

Not many at the party knew it, but that outcome had been much in doubt just a few months earlier. At one point it seemed entirely possible that the construction of the hotel and residences, one of the most expensive privately financed projects ever undertaken in Colorado, would become yet another casualty of the financial meltdown. The battle to complete the building, which at the nadir of the recession was mired in more than $250 million of debt, had involved white-knuckle showdowns with lenders, struggles for control among investors, eleventh-hour infusions of fresh capital, and related intrigues.“There was nobody who believed we could do this. You build a hotel, and it’s more expensive than it should be, than you wish it was.”

tweet this

By some accounts, the savior of the project was a Mexican businessman named Salomón Juan Marcos Villarreal. The president of one of the largest jeans manufacturers in the hemisphere, Marcos had been brought into the development to provide additional equity capital and, after sinking more than $32 million into the venture, emerged as the head of the ownership group. (Four Seasons doesn’t own most of the properties it manages; typically, developers acquire the land, finance the construction, and pay licensing fees and a percentage of profits to the hotel chain, which oversees the day-to-day operations, while the developers recoup on condo sales.) On opening day, it was Marcos who stood next to Mayor John Hickenlooper for the ribbon-cutting ceremony, his gleaming, well-tailored blue suit in stark contrast to the mayor’s drabber, off-the-rack number.

Marcos’s moment in the limelight of the opening rituals was brief, and that seemed to be the way he preferred it. Few of the guests knew who he was or how he came to be the principal owner of Denver’s newest and most lavish hotel. He was more likely to be found at a Super Bowl, a World Cup match or in one of the exclusive baccarat salons reserved for high rollers in Las Vegas casinos than calling a press conference. (Marcos didn’t respond to phone or email requests for comment for this article.)

In 2009, Marcos acquired a 50 percent interest in the Ritz-Carlton Bachelor Gulch Hotel in Beaver Creek. His LinkedIn profile notes that he has expanded his empire from textiles to real estate and overseeing hotel operations, “including providing vast knowledge of business financial planning...and helping to determine hotel financing and capital structuring.”

But that summary doesn’t quite capture the complexity of Marcos’s role in the creation of the Four Seasons. The original developers were, in fact, two other men, Jeff Selby and Michael Brenneman, who’d purchased the land, planned the high-rise for years with Four Seasons executives, hired the architect, lined up financing and overseen the construction — until Marcos took control of the entire project.

The sums involved were startling enough to draw the attention of the economic-crimes unit in the Denver District Attorney’s Office. Three months ago a grand jury issued an indictment against Daniel Wolf, a close associate of Marcos’s in the Four Seasons project, charging him with felony theft in connection with more than $2 million in management fees and expenses collected in 2012 — transactions that were apparently disclosed to other investors at the time but only came under scrutiny as possibly fraudulent in 2017.

Wolf had been hired initially by Brenneman and Selby as an administrative assistant but had ascended to a managerial role in Marcos’s companies. At present, he is the only person facing criminal charges, but the indictment names Marcos and a controller employed by Marcos as conspirators in the theft, claiming that Marcos “or his entities ultimately ended up with most of the money obtained” by the scheme.

Through his attorney, Wolf declined to comment on the charges. His defense team has filed a motion seeking to have the case dismissed, contending that he did nothing wrong. A spokesman for Denver District Attorney Beth McCann also declined to comment on the case, saying the indictment is part of an ongoing investigation. But other interviews and a review of documents related to that investigation indicate that the total amount of disputed fees may well exceed what’s described in the indictment. The case provides a glimpse into the backstage wheeling and dealing, feuding and maneuvering among the Four Seasons investors, a high-wire act featuring more thrills and spills than any of the acrobatic performances offered on opening night.

“We’re still invested in the building,” Selby acknowledges. “The good news is that it’s a long-term asset. At some point in time, we’re going to get paid back. But when someone steals from us, that’s when we have issues.”

THE DYNAMIC DUO

By the time they got involved in the Four Seasons project, Selby and Brenneman had extensive track records in Denver real estate circles. Both men were familiar with the city’s history of stomach-churning boom-and-bust cycles, having ridden that roller coaster through some of its giddiest ascents and most drastic plunges.

Selby came to the city in the early 1980s from Vail, where he’d been involved in office and condo development and helped launch a bank. At the time, Denver was in the grip of an oil boom, which quickly turned into a feeding frenzy of Canadian exploration and land-acquisition companies.

“From 1979 until 1982, it was going development-crazy downtown, and a lot of the developers were Canadian,” recalls Brenneman, who came down from Calgary during that period to open a Denver branch of a commercial real estate firm.

Brenneman and Selby traveled in similar circles and became fast friends, though they wouldn’t work on a project together until a decade later. Brenneman went on to join the Rosewood luxury hotel chain, working in Denver and Dallas. Selby and his partners became involved in renovating historic buildings in the heart of downtown, including the Masonic Building and the old Neusteter department store on the 16th Street Mall. At a time when most developers still scoffed at the notion that people might actually want to live downtown, Selby was transforming vacant and neglected properties into lofts.

“Denver was on fire in the early 1980s,” Selby recalls. “It was going to be the new Calgary. It was all great until the savings-and-loan crisis. Then it was a very challenging time to stay here.”

When Selby and Brenneman arrived, Denver was one of the fastest-growing cities in the country. By 1985, Colorado led the nation in business failures. Declining oil prices and Exxon’s failed flirtation with oil shale on the Western Slope prompted many energy companies to fold up their rigs and go home. Banking and real estate interests felt their pain. The 1988 failure of Silverado Savings & Loan, amid corruption and self-dealing, turned the recession into a rout. Downtown Denver became known for its procession of empty office buildings, stalled projects and super-cheap rents.“Denver was on fire in the early 1980s. It was going to be the new Calgary. It was all great until the savings-and-loan crisis."

tweet this

Silverado’s implosion left the Neusteter project in arrears; it was eventually taken over by the Resolution Trust Corporation. But Selby toughed it out, waiting for the economy to turn around. When it did, he had a promising property in his sights, and a new partner: Michael Brenneman.

The building, an eight-story tower wrapped in glazed red brick and terra cotta, stood at 14th and Arapahoe streets. Built in 1911 to house the offices of the Denver Tramway Company, it had been purchased by the University of Colorado Denver for classrooms and faculty offices, but the school outgrew the site. In 1991 the university sold the three-story car barn next door to the Denver Center for the Performing Arts, which was looking for additional office and storage space. The tower, though, remained vacant for years.

“The first time I saw the building, Jeff said, ‘Take a walk through and tell me what you think,’” Brenneman recalled in a promotional video prepared many years later. “I walked the building, knocking pigeons out of the way. It was an interesting structure. It was built like a battleship. And the depths, from the elevator cores to the windows, were highly conducive to the module you would use for an urban hotel room.”

Brenneman and Selby spent $18.5 million on the purchase and renovation of the Tramway tower, which, with the aid of David Owen Tryba Architects, emerged as a premiere boutique hotel — dubbed Hotel Teatro, a nod to its proximity to the Denver Performing Arts Complex. The hotel opened in 1999 to glowing reviews; after the company initially hired to manage the place ran into troubles of its own, Brenneman and Selby took over operations. As the hotel began to garner awards and national attention, they decided to approach Four Seasons executives about possibly managing the property.

“They came out and looked at it and loved it,” Selby says. But Hotel Teatro had only 118 rooms; the typical Four Seasons operation has more than twice that number. Selby wasn’t easily dissuaded. Suppose, he suggested to Brenneman, they could find a way to expand their boutique hotel, erecting an annex of some kind on the other side of 14th Street?

“There was a sliver across the street from us, about 25,000 square feet,” he explains. “We were able to convince the landowners that we’d like to buy that parcel. It was too small for an office building, but it would be perfect for a hotel.”

Because of the historic character of the Teatro property, any physical connection between the two buildings would have to be underground. The cavelike lower levels of the Tramway building made that seem not so crazy of an idea. But the amount of duplication involved — two housekeeping services, two valet services, multiple kitchens and laundries and so on — ultimately proved too daunting.

Yet the developers persisted in their conversation with Four Seasons, even after the dot-com crash and the post-9/11 economic downturn. During that period, another developer gave up on a proposed project across the street, allowing Selby and Brenneman to expand their “sliver.” They soon had 68 percent of the block, enough of a footprint for a major high-rise with several levels of underground facilities and parking. The conversation shifted to a stand-alone Four Seasons that would have 240 rooms on the first eighteen floors, with more than 100 residential properties above that and six stories below grade. The entire project would be more than 600 feet high, about fifty stories — though it would have only 45 floors, since some of the floors would be two stories in height.

The cost of such a project was, of course, well beyond anything Brenneman or Selby had attempted before. They arranged a complex package of loans for $225 million, much of it to be paid off through condo sales, with units expected to command prices of $1,000 a square foot or more. “There was nobody who believed we could do this,” Selby observes. “You build a hotel, and it’s more expensive than it should be, than you wish it was. But it’s financeable because you make your profits on the condominiums above, paying down the debt.”"It’s more important that we preserve our capital and our ability to make it happen.”

tweet this

They tapped John Carney, an architect based in Jackson, Wyoming, whom Selby knew from previous projects in Denver in the 1980s, to design the high-rise. Carney envisioned a “sculpted” building that would appear to recede in the upper stories, in order to allow for balconies and a less boxy look. They also hired Daniel Wolf, whom they’d met when he was still completing his master’s degree at the University of Denver’s Franklin L. Burns School of Real Estate and Construction Management, to assist with market studies and organizing the project.

“He was a great administrative assistant,” Selby recalls. “He was so good, we made him a minor partner.”

“He was a very bright guy, energetic and affable,” Brenneman adds. “Everything you’d want to see in someone you’re about to hire.”

In 2006, Selby and Brenneman sold the Hotel Teatro in response to demands from their principal lender, Cairn Real Estate Fund, that additional equity be invested in the Four Seasons project before the loan could be finalized. The proceeds from the sale brought their total stake in the high-rise to $27 million, including the value of the land they’d bought up along 14th Street. But it still wasn’t enough. Before they could break ground, CREF wanted to see additional cash on the table.

With all of their own resources tied up in the project, Selby and Brenneman turned to someone who seemed to have plenty of liquidity. A few months earlier, Brenneman had been contacted by an attorney representing a Mexican national who owned property in the Beaver Creek area and had expressed interest in purchasing several of the Four Seasons condos. At some point the discussion turned to whether it might be better for the man to become an investor instead.

The man, Salomón Juan Marcos, eventually agreed to put $10 million into the project. At that point, Selby says, it was understood that Marcos was going to be a passive investor, with a minority share in any profits. But CREF still wasn’t satisfied; the investors had to come up with more equity or the loan wouldn’t go forward.

Marcos agreed to put in another $10 million. His increased participation came with a steep price: If he was going to double his investment, he wanted a 51 percent ownership share in the project.

Selby and Brenneman weren’t eager to agree, but they believed they had too much at stake to refuse. They didn’t want to jeopardize the loan, and there was no guarantee that another investor wouldn’t demand even greater concessions. As they saw it, they were still the managers of the project, still in a position to realize their dream and protect their investment.

“We still have our capital, they have theirs, and it’s our project,” Selby says. “Is it more important that we get 22 percent, 28 percent or 33 percent? No, it’s more important that we preserve our capital and our ability to make it happen.”

THE KING OF JEANS

The addition of Salomón Juan Marcos to the Four Seasons ownership team generated considerable curiosity among those involved in the project — curiosity that only intensified after the new partner started to make his presence known.

“I remember Jeff saying, ‘We’ve got this pretty interesting investor — he’s the largest manufacturer of blue jeans in the world,’” recalls one source who met frequently with the developers over construction issues. “We had meetings with as many as thirty people in the room. But when Salomón Juan Marcos walked in, he cut quite a figure: two-thousand-dollar suit, swept-back hair, trailed by three gorgeous women. We were like, ‘Holy shit, this guy travels in style.’”

Flashy, perhaps, but Selby and Brenneman had ascertained that their new partner’s wealth came from mundane and legitimate sources — including, primarily, the family business, Grupo Denim, a jeans manufacturer started in the 1950s by his grandfather, Antonio Juan Marcos, in Coahuila, Mexico. Over generations the business has expanded, now boasting several modern factories in Mexico and Nicaragua and a client list that includes Wrangler, Lee and Tommy Hilfiger. The company claims to produce approximately two million garments a month — almost all of them bound for the American market — and Salomón Juan Marcos is the CEO and chairman.

Marcos’s father, Salomón Juan Marcos Issa, served in Mexico’s Congress from 2012 to 2015; he’s also a former mayor of Torreón, a city roughly the size of Denver, and a prominent member of Mexico’s powerful PRI party. But the younger Marcos did not follow his father into politics, focusing instead on business opportunities, particularly real estate ventures. A former business associate who’s known Marcos for years describes him as highly driven, putting in long hours and sleeping little.

“He’s a super-high-energy guy,” says the associate, who asked that his name not be published. “Real high-strung. You would think he was on drugs, but he’s not. He’s very anti-drug. He’s just wound up.”

“Once you start building a 45-story tower, you really can’t stop at the 15th level.”

tweet this

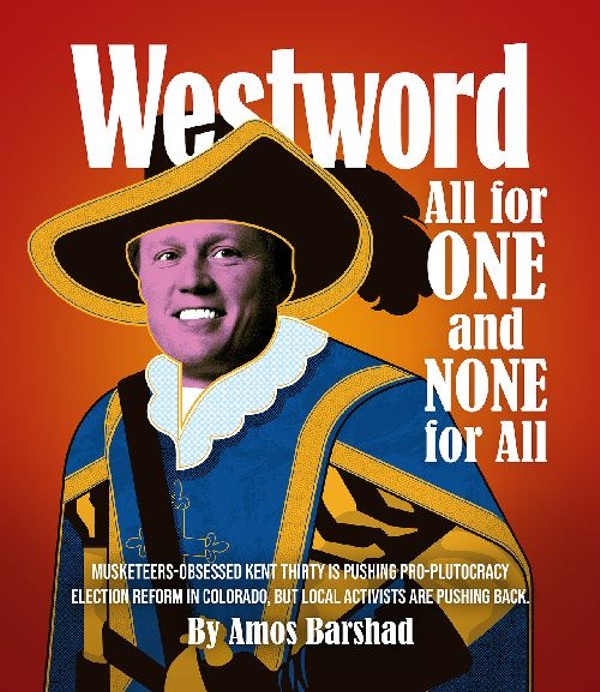

The associate says it wasn’t unusual for Marcos to spend as many months per year in the United States as his visa would allow, even before he got involved in the Four Seasons project. He opened stateside offices for Grupo Denim in downtown Denver, flipped properties in the Vail Valley, and traveled frequently, keeping his private pilot on call. One frequent destination was Las Vegas, where he was known at the Venetian for playing baccarat with the whales for as much as $25,000 a hand — and, most unusual of all, he often walked away a winner. He was also a force to be reckoned with in any business deal.

“He acts very generous, but there’s no free lunch,” the associate says. “He wants a lot in return, a lot more than you think you’re getting involved in. When he snaps his fingers, you’d better be ready to jump.”

In recent years, Marcos’s financial dealings have come under scrutiny from Mexico’s Procurador General de la República, or PGR — the equivalent of the U.S. Office of the Attorney General. According to news reports, the PGR is investigating Marcos, his father and his brother for an alleged tax-fraud and money-laundering scheme involving 441 million pesos (around $24 million U.S.). Bank accounts have been frozen and then unfrozen, arrest warrants issued and then suspended; last year, one account in the newspaper Zócalo described Marcos as “a fugitive from justice who took refuge in the Ritz-Carlton Bachelor Gulch,” the hotel in Beaver Creek he has partly owned since 2009. The family’s defenders have denounced the probe as politically motivated; a few years ago Marcos hired powerhouse Denver law firm Brownstein Hyatt Farber Schreck in an unsuccessful effort to prevent the IRS from turning over information on his U.S. finances (including the fact that he has a $3 million line of credit with a subsidiary of Wynn Resorts) to Mexican tax authorities, claiming that the Mexican government was engaged in a “harassment campaign.”

Marcos has also drawn unwelcome attention from local law enforcement in Eagle County, following a 2015 New Year’s Eve party at his Bachelor Gulch home, where underage guests were reportedly served Patrón tequila and Cristal champagne. Facing four felony counts of contributing to the delinquency of a minor, last year he pleaded guilty to a single charge of providing alcohol to an intoxicated person, a misdemeanor, and was sentenced to a year of probation and 150 hours of community service. (His attorney was Pamela Mackey, best known for representing Kobe Bryant in another Eagle County case.)

None of these mishaps had yet occurred at the time that Marcos became involved in the Four Seasons project. As Brenneman and Selby saw it, bringing in Marcos offered them a way out of their lender’s squeeze play. But the squeeze was just starting.

Construction crews broke ground on the Four Seasons in September 2007. At the time, the stock market was rocketing upward, investment banks were thriving, and the financial industry’s appetite for debt and risk seemed to be insatiable. But within a few months, as the housing bubble popped and toxic, subprime mortgages began to leak all over the three-piece suits of whoever got stuck with them last, it became apparent that the country — the world — was facing something more than a slight correction."He acts very generous, but there's no free lunch. He wants a lot in return."

tweet this

Big-ticket construction projects were among the first to feel the fallout from the Great Recession. Before it would advance any further loan draws, CREF wanted additional security of $15 million. The demand touched off a desperate search for additional investors — not easy to come by in an increasingly grim economic climate. Marcos, understandably, wasn’t keen on any deal that would dilute his interest or jeopardize his priority position for return on his investment. After some negotiations, a Chicago developer agreed to put up $7.5 million, in the form of a letter of credit; with Brenneman’s assistance, Marcos found financing to pledge an additional $7.5 million letter of credit. Both investments came with conditions that demanded “preferred returns” and further weakened the position in the project held by Brenneman and Selby.

The arrangement bought the developers a few months of breathing room while the skeleton of their luxury hotel and residences began to rise on 14th Street. But pre-sales of the condos fell far short of expectations. People who’d already paid hefty deposits walked away from their contracts, choosing to perform triage on their battered portfolios rather than splurge on a pied-á-terre. Buyers backing out, in turn, made the project’s lenders as nervous as a lamb on Greek Easter. The condo sales were how the loan was supposed to get paid off. In 2009, with the financial meltdown in full blaze and condo sales at a standstill, CREF informed the partners that their loan was “out of balance” and pressed for an additional $5 million in equity — with a substantial portion of that amount, Selby says, to be paid as a “fee” to the lender for its continued cooperation. It was an audacious move, but one the developers couldn’t afford to ignore.

“At this point we’ve got everything we own bound into the deal,” Brenneman observes. “Once you start building a 45-story tower, you really can’t stop at the 15th level.”

“There were three options,” Selby says. “Don’t come up with it and the building goes into foreclosure; that’s probably the last thing the lender wanted to do. Or bring in another developer and everybody’s out. Or Salomón puts up the money. But Salomón wants control.”

The situation came to a head at a meeting with the lender in London that summer. It quickly became clear to Selby and Brenneman that Marcos was putting up the money and, with the lender’s blessing, taking over management of the project — even though he had no previous experience with high-rise property development. Selby was out as a project manager. Brenneman would stay on until construction was completed. (In the version of events detailed in court filings by Wolf’s attorney, Marcos “terminated” Selby’s and Brenneman’s managerial roles “due to their financial and project mismanagement.” Selby and Brenneman deny any mismanagement and point out that Marcos continued to use the same team they’d assembled.) And Dan Wolf, who’d served as a liaison between the developers and the lender, soon left Teatro Tower Investors, the Selby-Brenneman company with an ever-dwindling share of the project, to work for Marcos.

Some people in the room suspected that Wolf had already been working for Marcos, in one way or another, for months. CREF executives had met separately with Marcos before the London showdown, and Selby believed there had been back channels of discussion about how the need for another cash infusion could be of mutual benefit to Marcos, the lender, and Wolf. Selby thought back to meetings with Wolf in which his protégé had defended Marcos.

“He was remarkably overprotective of Salomón for a guy who was our partner,” he says. “Then I realized he had already sold his soul.”

CRAMDOWN & FIRE SALE

The construction loan that the original developers had obtained for the Four Seasons, while costly in many respects, had one unusual and highly prescient component: a “credit enhancement insurance policy” issued by Mitsui Sumitomo, a major Japanese company, that was designed to protect the lender from losses due to default or insolvency. The policy turned out to be a life preserver, keeping the project from being washed away in the general financial panic of the meltdown.

“That single element proved to be, head and shoulders above everything else, why the project didn’t fail,” says Brenneman. “Many other projects in that recession went upside down, and ours had every prospect of doing that. It was a little bit of foresight, but a lot of it was our inability to put up tens of millions ourselves.”

With condo sales lagging, construction completed and the note becoming due, Mitsui was on the hook for the difference between the value of the existing loan, around $250 million, and what could reasonably be extracted from a new lender. The policy paid out close to $120 million, allowing the partners to pay CREF the remaining $130 million by obtaining a new loan for that amount. The new loan was actually two separate transactions — one for $55 million, secured by the hotel, and one for $75 million, secured by the unsold condos.

The new loan came from the multinational investment bank UBS, the terms negotiated by the new management team of Marcos and Wolf. But the loan hadn’t yet been finalized, and Selby and Brenneman say they hadn’t even been informed of its existence, when they were summoned to an investors’ meeting in 2011 to address a “capital call” approved by Marcos: essentially a demand that investors contribute millions to the partnership to pay off the construction loan or risk losing their investment completely.

Selby and Brenneman didn’t have that kind of cash. Wolf and Marcos proposed an alternative. They showed the investors projections that indicated the sale of the residences could yield as much as $173 million, enough to whittle down the restructured debt and still allow the partners to recover their investment and preferred returns on capital. But one condition of the proposal required Selby and Brenneman to reduce their profit share even more; they had gone from 49 percent to 11 percent, and now would be reduced to 1 percent. (Although their $27 million stake wasn’t diminished, their subordinate position meant that they wouldn’t receive any returns on their money until the top priority owners, Marcos and the Chicago developer, had been paid in full.) Selby describes the move as a “cramdown,” a term from bankruptcy court that describes how creditors’ claims get discounted, much against their wishes, in the course of settlement.

But the new loan, and the new deal, didn’t yield the expected results. Seeking to stimulate interest after two years with no sales at all, Wolf directed the marketing agents for the condos to list them at deep discounts; units that had been offered at $1,000 a square foot were now available for half that amount. Sales took off — and to Selby’s dismay, the discounts continued, with some prices slashed 60 percent. Several units, snapped up by speculators, quickly resold at much higher prices.

"They got rid of 85 units in seven or eight months.The whole inventory. It was staggering."

tweet this

“They got rid of 85 units in seven or eight months,” Selby notes. “The whole inventory. It was staggering. They left at least sixty or seventy million dollars in sales on the table.”

A real estate market report from 2012 notes that Denver luxury home sales increased by a third over the previous year and describes the city as “one of the top housing markets in the nation, with an active seller’s market and tightened inventory.” Developer Chris Crosby, who was involved in sales of condos at the Spire, down the street from the Four Seasons, says the market for such properties was on the rebound in 2012 — steady, albeit not spectacular. “We were climbing out of the downturn,” he notes. “It took longer than we wanted, and our target market was not the Four Seasons target market. But we were selling six or seven a month.”

Brenneman says he urged Wolf to raise prices on the condos as sales picked up and was told it wasn’t worth the risk of losing momentum. “Many people in town, including the Spire, used the rapid increase in demand to notch up their sales,” Brenneman says. “Dan and Salomón decided not to bother with that.”

The Four Seasons fire sale yielded far less than the $173 million that Marcos and Wolf had projected. It was enough to reduce the UBS loans from $130 million to $30 million (and ultimately replace them with a lower-interest twenty-year mortgage), but not enough for Selby and Brenneman to see any returns. As minority investors with an almost negligible piece of any profits, they say they found it increasingly difficult to obtain detailed information about the project’s financials or when they might expect to recoup their investment.

They did hear, however, about the buyer who scored the biggest prize in the price-slashing condo sale, the building’s lavish Grand Penthouse. The three-bedroom, five-bath penthouse spans nearly 7,000 square feet over two floors and has some of the best views of the Front Range in town. It had originally been under contract to a billionaire for $10 million, but he’d been among the many prospective buyers who’d walked away during the downturn. In late 2011, it was purchased by a limited liability company for $6.6 million.

The paper trail on the LLC leads back to Dan Wolf and the Denver address of El Grupo Denim. Other documents indicate the property later served as collateral for a $7.5 million loan taken out by Salomón Juan Marcos and several of his companies. Marcos had decided to invest in and leverage the premier address in the entire building, taking advantage of the bargain prices being offered by the new management team.

ROOM AT THE TOP

It’s not unusual for developers of big-ticket projects to defer capital returns, as Selby and Brenneman did, in favor of other investors who also have huge sums tied up in the deal. It’s also not unusual for investors who bail out beleaguered or undercapitalized projects, as Marcos did, to demand various concessions in return, including increased control over key decisions.

Depending on how the financing is structured, such projects may also offer ways for the principals to extract substantial amounts of cash, in the form of management or consulting fees, without diminishing their capital position in the slightest. The sums involved can be quite prodigal and the methods excruciatingly complex — while remaining perfectly legal.

By the time the Four Seasons project was completed, Marcos and Wolf had created a web of limited liability companies, like a stack of Russian nesting dolls, which collected various fees from the operation; in effect, one entity, controlled by Marcos and Wolf, would hire another Marcos-Wolf entity to provide “asset management” and other services. One company collected a fee equal to 1 percent of monthly hotel revenues plus reimbursement of actual expenses. Another company, Teatro Management LLC, collected a fixed fee plus expenses for overseeing the sales of the residences; UBS loan documents specified the fee payable for that service at $20,000 a month.

The criminal case against Wolf alleges that the fees paid to Teatro Management greatly exceeded what the contract called for. The indictment states that the theft wasn’t discovered until January 11, 2017 — the date that Selby reviewed a printout detailing fees paid to the Marcos-Wolf companies. The printout indicated that, at the end of a thirteen-month period in 2011 and 2012, when money was pouring in from the condo sales, Teatro Management collected not merely the $260,000 that was authorized, but $1.625 million in fees and another $406,250 in reimbursement of “actual expenses.”

In court filings, Wolf’s attorneys have contended that the management agreement was amended to pay Teatro Management $156,250 a month for overseeing the residential component of the project. They also maintain that Selby and Brenneman were aware of the fees at the time they were collected because they received monthly financial statements that indicated the payments, which were for the same amount that Teatro Management had collected under an arrangement with the previous lender, CREF. In 2012, Selby had even sent an email to Wolf, questioning the $156,250 monthly asset management fee. Wolf replied that the fee was “similar to the type of structure that was in place under the CREF loan” and that UBS had approved the increase. The date of the exchange is important, as Wolf’s attorneys contend that the current charges against him were filed well after the expiration of a three-year statute of limitations for the alleged theft.“We didn’t understand we had a fraudulent theft until 2017. It didn’t come as a bolt of lightning until I saw a consolidation of all the fees they’d taken.”

tweet this

But Selby says he didn’t discover that the fees were unauthorized by the lender until last year — and even then Wolf deflected his inquiries by insisting that he had no legal obligation to provide certain requested documents. “[Wolf] indicated he had full approval from UBS,” Selby explains. “We didn’t understand we had a fraudulent theft until 2017. It didn’t come as a bolt of lightning until I saw a consolidation of all the fees they’d taken.”

In response to a grand jury subpoena, Wolf produced a document that purported to amend the asset management agreement, signed by Wolf on behalf of Teatro Management and as vice president of 1111 Tower LLC, one of the Marcos-Wolf ownership entities. But UBS had no record of such a document, and Wolf didn’t present any evidence that the lender had given written approval for a sevenfold increase in fees. He also didn’t provide any invoices to justify the $406,250 in expenses charged under the agreement.

What happened to the $2 million in fees and expenses isn’t clear. Bank records obtained by the grand jury indicate that shortly after Teatro Management collected the funds from the loan servicer, $101,000 was transferred from Teatro’s account to Wolf’s personal checking account. Another $1.75 million was moved out to seven different business accounts; a few days later, $1.75 million was deposited again with Teatro Management, mostly from the same accounts. Some of the money — $129,000 here, $75,000 there — ended up in companies that Marcos controls, including Grupo Denim LLC and GD Holdings LLC. But the indictment states that Wolf moved most of it, around $1.7 million, to a freshly opened account and then used it to purchase euros. Where the euros went is anybody’s guess; the paperwork has Wolf’s name all over it, but that doesn’t mean others didn’t reap most of the benefit.

Brenneman says he remains optimistic that he and Selby will eventually recoup their investment in the Four Seasons. Looking at the high-rise today, he doesn’t dwell on any regrets. “I will always have a sense of pride about it because we did see it through,” he says. “We didn’t end up controlling our destiny, but we definitely saw the vision through, from idea to bricks and mortar with an open door.”

Eight years after the hotel’s opening, both penthouses at the Four Seasons are back on the market. The one facing east is priced to move at $10.75 million. The Grand Penthouse, with its panoramic mountain views, has an ask of $13 million, roughly twice what the current owner, Marcos’s LLC, paid for it in 2011. It’s a steep price for an elevated lifestyle, but certainly not out of the question for the right buyer, someone who appreciates the finer things.

It is, after all, about as high as you can go in the Mile High City, as large as you can live — until the next crash.