This November, education advocates are trying again by way of Amendment 73, and Lisa Weil, executive director of Great Education Colorado, insists that the measure isn't simply a rehash of proposals state voters have already rejected.

"We decided it wasn't enough to simply put more money into the same funding system," Weil says. "We needed to be more equitable, more fair and more student-centered to meet the needs of every student, as well as to take into account the unique characteristics of each district. And Amendment 73 does both."

The amendment's approach to achieving these goals is complicated. Here's the summary shared by the Colorado Secretary of State's Office:

Amendment 73 proposes amending the Colorado Constitution and Colorado statutes to increase funding for preschool through twelfth grade (P-12) public education; raise the state individual income tax rate for taxpayers with taxable income over $150,000, and increase the state corporate income tax rate to provide additional funding for education; and for property taxes levied by school districts, set the assessment rate at 7.0 percent for residential properties and decrease the assessment rate to 24.0 percent for most nonresidential properties.The path that led to this approach was a long one, Weil acknowledges. "This started back in July 2016. We were looking at 2018, and we didn't know if it would be a great year to go, but we knew we had to do things differently. It couldn't be rushed. It had to be well thought out and to have a foundation of understanding and agreement. So we put together a group that wasn't just made up of the usual people."

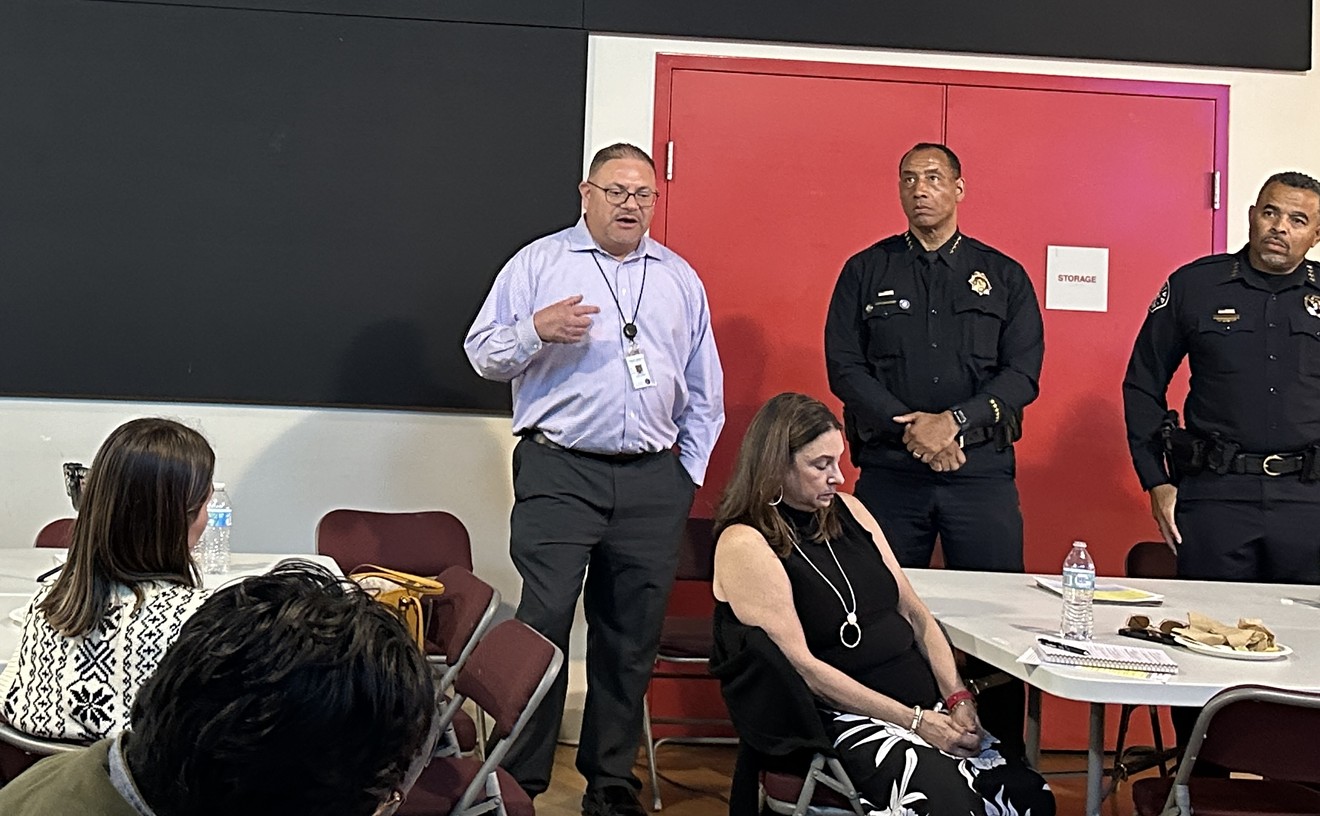

Lisa Weil, executive director of Great Education Colorado.

Colorado Education Association via YouTube

According to Weil, Amendment 73 "will raise $1.6 billion that will be placed into a new fund, the Quality Public Education Fund. There's a provision calling for the legislature to pass a school finance act that is more equitable geographically, more equitable to ensure the needs of kids in poverty and special-needs kids. So the Quality Public Education Fund would build on kids getting that extra funding and make up for funding we've lost. Since the recession, the state legislature has taken away $7.2 billion in funding, which breaks down to about $672 million a year. This adds it back."

In addition, she goes on, "this will pay for full-day kindergarten. Most districts provide it for some of their students, but it's frequently tuition-based. I understand that more than $100 million is spent for parents to pay for the second half of the kindergarten day."

At the same time, local districts will be able to choose how best to use their share of the funds, which Weil thinks "is a big selling point. This is not one tax increase that's going to fund schools as a sort of general idea. It's a value proposition that we can put to folks and talk about where the dollars come from and where they can see the accountability of local decision-making. Districts can decide what their priorities are, be it mental health, counselors, safety, career, technical instruction. Districts are going to be able to use the funds in different ways."

To pay for all this, Weil allows, "we wanted to ensure that the new revenues were raised in a more fair way. Everybody is paying for our schools right now, but the way our tax system works, if you're a teacher, you're paying about 8.7 percent of your income in state and local taxes. But if you make $1.5 million, you're paying about 5.3 percent of your income in state and local taxes. This tries to even that out a little bit — and the way it works, 92 percent of tax filers will not see an increase in their income tax."

How would it work? "The tax starts at $150,000 taxable income, or about $180,000 taxable gross income after deductions," she explains. "It's something that hasn't been done before, and to do that, we'll have to change the constitution — Colorado's constitutionalized tax code, which currently says all income has to be taxed at the same rate. This changes that and allows for a tax structure that is more fair for all taxpayers. And there's also an increase in the corporate income tax rate, from 4.63 percent to a flat 6 percent. This takes Colorado from the third-lowest corporate income tax in the country to the ninth-lowest."

That's not all. In Weil's words, "We also worked to stabilize the local share of property taxes, which has dropped by two-thirds since 1982 in the percent of the value of residential property that's taxed. Back then, it was 21 percent, and now's it at 7.2 percent. This drops it to 7 percent and then freezes it. And non-residential property, which has been taxed at 29 percent, would go to 24 percent. That provides some tax equity for everyone and makes this sustainable in the future."

This approach has plenty of opponents, including TABOR author Douglas Bruce, who speculated in our recent roundup of his recommendations about 2018 Colorado ballot measures that the creators of Amendment 73 "were high when they wrote it." He added: "They get rid of the flat income tax rate that's in the constitution because of TABOR. They have six income tax brackets — five for individuals and a new, higher rate for corporations. They don't have equal treatment for everybody, and that's the only way you avoid the pressure to create loopholes. If you punish rich people for their success, that creates pressure and complicates the income tax returns. And it really complicates the property tax bills people will have. Talk to assessors: They'll tell you it will create a big headache, because you'll have an assessed rate for school districts and one for everything else. It's a total mess."

Weil couldn't disagree more. "Right now, we're 49th in the country in supporting higher education, and that's not a way to maintain our economic prosperity. This is the Colorado paradox, where we import workers instead of helping our own students to make it. This will help change that, so our students will graduate ready for college and a career."

Click to read Amendment 73.