Unsplash/Diane Helentjaris

Audio By Carbonatix

If you were planning on using that TABOR check to help top off your vacation budget or help pay some bills, we have some bad news.

Sent to Colorado taxpayers each year there is a budget surplus, TABOR payments are a welcome consequence of the Colorado Taxpayer’s Bill of Rights (TABOR), a constitutional amendment approved by voters in 1992 that requires voter approval for tax increases and limits annual growth of government revenues and spending. The amendment also mandated that the state to stick to its budget estimates (the constitution already required a balanced budget), and send out payments via check or on tax returns when tax revenues exceeded predictions.

The TABOR budget estimate is based on inflation and state population growth, and it must be returned to taxpayers unless voters approve ballot initiatives that earmark TABOR funds.

Although TABOR is still controversial in Colorado and an arguable factor in the $1.2 billion budget shortfall Colorado currently faces, residents have come to expect a nice chunk of change in recent years as Colorado’s economy flourished, with most single filers receiving $750 for their 2022 taxes and $800 in 2023, and joint filers receiving double those amounts. As state tax revenue declined in 2024, however, TABOR payments dwindled to $177 for single filers and $354 for joint filers this year, although payments would go up for filers in higher tax brackets.

Will you step up to support Westword this year?

At Westword, we’re small and scrappy — and we make the most of every dollar from our supporters. Right now, we’re $22,750 away from reaching our December 31 goal of $50,000. If you’ve ever learned something new, stayed informed, or felt more connected because of Westword, now’s the time to give back.

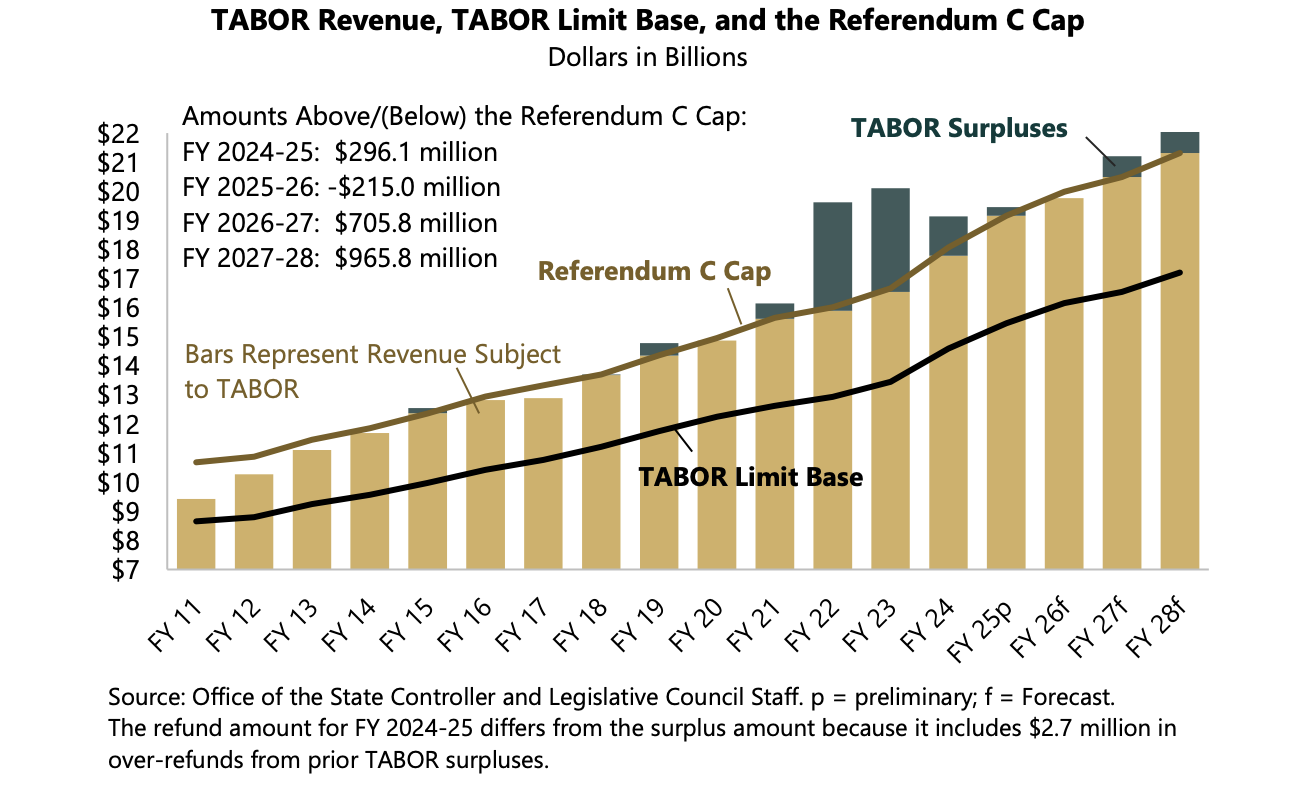

And when it’s time for 2025’s TABOR payments next year, we can expect another deep drop. According to fiscal budget data and new forecasts from state economists, Colorado’s budget surplus for the 2025 fiscal year, which ended June 30, hit approximately $296 million. A little less than $3 million of that money will be returned to the state budget after accidental TABOR overpayments last year, and a significant portion will go toward state Homestead Property Tax refunds.

Colorado Legislative Council Staff

The rest will go back to us in 2026, and that amounts to just $20 for single filers making $56,000 or less, and $62 for people making up to $329,001, according to data compiled by the Colorado Legislative Council staff, a nonpartisan research arm of the state legislature.

Try not to spend it all in one place.