Thinkstock file photo

Audio By Carbonatix

The latest economic indicators for the Denver metro area show that the local economy remains red-hot. But while that’s generally a positive, the pace of growth is creating shortages of affordable housing to buy, rent or lease.

Those are among the observations of Patty Silverstein, president and chief economist for Development Research Partners, the firm that crunches the numbers for the Metro Denver Economic Development Corporation. For the most part, she’s upbeat about the direction Denver’s economy is heading, but when she learns about a new survey showing that Colorado is one of the worst states for first-time home buyers, she’s not exactly surprised.

“Increases in home prices are making affordability a concern in the marketplace,” Silverstein says. “It’s one of the biggest challenges for the metro Denver area right now.”

The monthly economic indicators page on the MDEDC website summarizes the latest data collected by Silverstein in eighteen categories. However, she points to “four key market areas to focus on” when it comes to judging the health of the economy: employment activity, consumer activity, residential real estate and commercial real estate. Here are her thoughts on each, illustrated with graphics from the site.

Employment Activity

Earlier this month, according to Silverstein, data showed that the employment-growth rate for the seven-county Denver metro area rose by 3.2 percent, with “non-farm employment growth” for an eleven-county zone that includes Boulder going up by approximately 50,000 jobs on a year-to-year basis. But in recent days, the first figure was revised downward to 2.5 percent, as were the number of new jobs, now estimated at closer to 40,000.

Even so, Silverstein says, “the region is growing at a nice clip. It’s still in line with our historic averages. But nonetheless, it was definitely a slower pace of growth than the preliminary figures indicated.”

There were also mid-month adjustments in the unemployment rate for the area, though they weren’t enough to alter the previous estimate of 3.1 percent in Denver for 2016 — way below the current national average of 4.7 percent.

Another revision makes that sum look even better. Denver’s unemployment rate for 2015 was originally set at 3.6 percent, but it’s now seen as having been closer to 3.7 percent, resulting in a year-to-year improvement of more than half a percent.

Consumer Activity

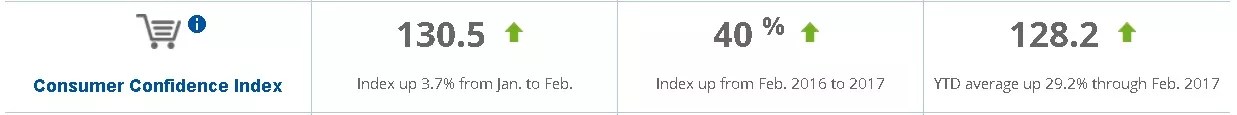

The consumer-confidence index value of 130.5 for February 2017 represented a 3.7 percent increase from the previous month and a stunning 40 percent rise over the figures for February of last year.

“That’s a rather large increase,” Silverstein points out, and it’s not unique to Denver. “We’ve certainly seen consumer confidence go up in the mountain region, which includes states like Utah, Idaho and Montana. But we’ve also seen confidence rising at a pretty significant rate ever since the completion of the presidential election.”

Is the presidency of Donald Trump responsible for this bullish outlook? Perhaps to a small degree, Silverstein acknowledges. But this kind of shift has historical roots.

“We find that consumers are very much influenced by local political news and local economic news, and what we see in presidential election cycles is that confidence kind of goes down because everybody gets tired of hearing about it,” she reveals. “But once the election is over, you tend to see confidence rising, because now we know the environment we’re operating in. People feel like, ‘The election is over, and now we’re going to see more certainty in policy directions.'”

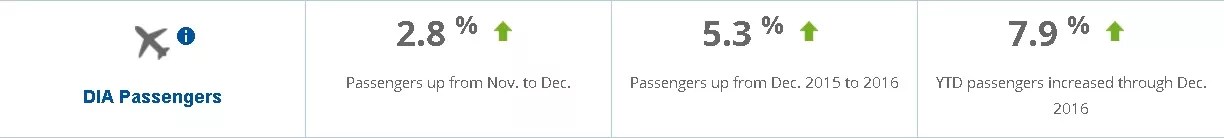

Visitors are also having a positive impact on the Denver economy. Hotel occupancy was down a bit last month compared to January, “but not significantly,” Silverstein stresses. “That’s more a reflection of us having more hotel rooms available in the market in January 2017 than we did a year ago. And tourism activity has still been running at a pretty strong pace. An indicator is DIA passenger traffic through December 2016, which was up substantially. That 7.9 percent increase was one of the stronger increases in passenger traffic that we’ve had in quite some time.”

Residential Real Estate

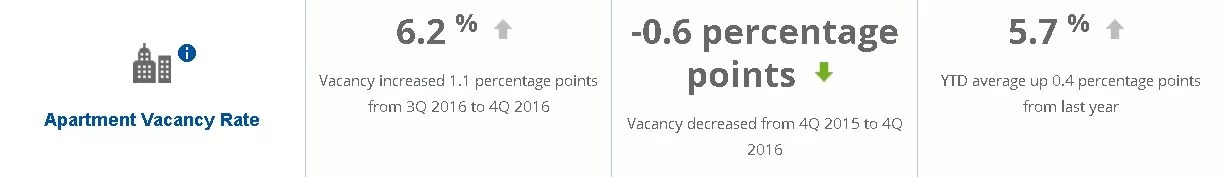

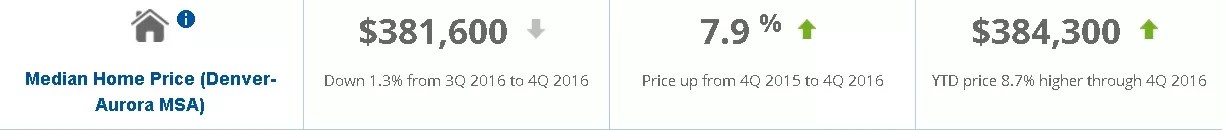

“Home sales in January were up a bit over what they had been in the January 2016 time frame,” Silverstein says. “We also continue to see some very strong increases in home prices, and that’s a factor for whether or not folks can afford to purchase a home that carries over to our next indicator, the apartment vacancy rate. In general, we’ve seen that the vacancy rate has been going down, and the apartment lease rate has been going up.”

Fortunately, she goes on, “we’re starting to see some loosening in the apartment market. Those lease rates had been increasing at double-digit rates in 2014, 2015 and the first half of 2016. But we’re finally seeing those rates taper off, and there’s some introduction of affordability into the apartment market. Home prices are seeing a little softening, too. But it’s still very challenging, especially for first-time home buyers,” as discussed in our recent post, “Why Colorado Is One of the Worst States for First-Time Home Buyers.”

To understand why, Silverstein advises looking beyond the number of residential building permits issued in Denver metro to analyze the kind of permits being issued. “A lot of the construction activity we’ve seen has been more on the apartment side, which is why the apartment vacancy rate and the apartment lease rate are softening. But we’re seeing limited construction of single-family attached homes — condominiums and town-homes, which are the typical starter homes for many new home buyers. We’re seeing very limited new construction on that side.”

On top of that, many of the single-family detached homes — those that stand alone, as opposed to being attached to other residences — are at the higher end of the market, beyond the means of many people hoping to get into home ownership for the first time. As Silverstein puts it, “All of these things play into the pricing pressures and affordability for the community.”

Commercial Real Estate

Overall, Silverstein says, “we’ve seen the office vacancy rate declining and the lease rates going up, and the industrial vacancy rate has finally started going up a little bit. It’s been such a tight market, and we had been tracking at only 3 percent vacancy. But in the fourth quarter of last year, it came up to a 4 percent range.”

This improvement happened “because we added a lot of new space,” Silverstein maintains. “We added 4.5 million feet of industrial space in 2016, and that was important, because there’s been a lot of demand for industrial space driven by e-commerce and companies that had been priced out of the market and weren’t able to find space.”

One big reason for this scenario was the pot-biz boom.

“A couple of years ago, you had marijuana grow operations that were taking a lot of industrial space,” she recalls. “But in 2016, we saw some significant construction coming on board that allowed companies to expand into some new industrial locations, including some that were more modern, I would say.”

Silverstein’s conclusion: “We continue to see strong economic activity in the metro Denver region across our variety of indicators. But it’s important to keep a close tab on those, so we can identify any type of changes in our economic position.”

For now, though, a cool-off isn’t in the forecast.