Google Maps

Audio By Carbonatix

The latest statistics from the Colorado Association of Realtors echo much of the data from the Denver Metro Association of Realtors, which recently reported all-time records for detached, single-family homes as measured by both average and median prices. But many of the realtors quoted in the CAR report for April offer at least a glimmer of hope for potential purchasers, even as they acknowledge that plenty of people are bailing, at least temporarily, from what remains a seller’s market.

According to Aurora-area realtor Sunny Banka, “We are seeing more price reductions on some homes and in some areas. … Buyers should note that, while the market is still hot, they have a better opportunity at getting the home they are looking for.” But Barb Ecker says that in the Jefferson County/Golden area where she specializes, “The market hit a bit of a wall in the last couple weeks of April. With increasing interest rates, some buyers are now being priced out of the homes they were once seeking to buy. Buyers may need to lower their price range to stay in the market, as they simply can’t afford the home they were considering just a few weeks ago.”

CAR’s April numbers show that prices for Colorado as a whole aren’t much lower than those in metro Denver. The statewide median price for a single-family home landed at $600,000, versus $660,000 in the seven-county metro area. The difference in the median price for townhomes was even smaller: $440,000 for Colorado and $445,000 for the metro region.

Average prices were in the same ballpark, too: $747,226 and $578,237 statewide for a single-family home and a townhome, respectively, versus $793,486 and, surprisingly, $523,693 in Denver. And in both metro Denver and Colorado overall, the list prices are just starting points. In Denver, the amount at closing averaged 106.5 percent of list; in Colorado, 104.9 percent.

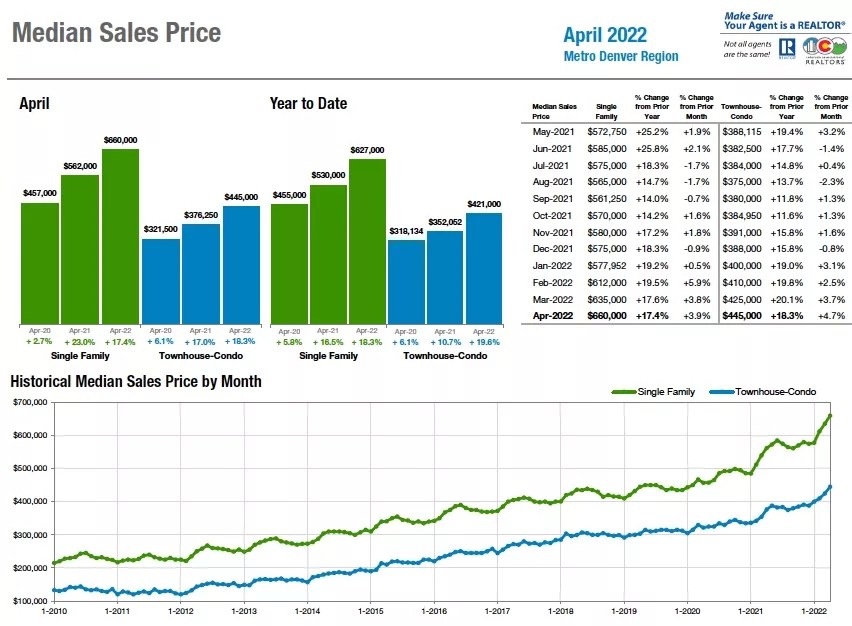

Look below to see month-over-month and year-over-year changes in the seven-county Denver area for April related to new listings, sold listings, sales prices and more.

And here’s a graphic detailing the rise in median prices for both single-family homes and townhomes in metro Denver:

Banka reveals that homes in the 80013 zip code, which corresponds to the central part of Aurora, “saw inventory up slightly over March numbers. However, the inventory is still down 48 percent compared to the same time in 2021. The median price in 80013 is up 17 percent over 2021, from $455,000 to $535,000. But in March that median price in Aurora was $550,000, which is a $20,000 reduction from the median price last month.” In the 80016 zip code area, “inventory is almost double what it was just one month ago, [but] the median price hit $805,000,” she concedes.

“Buyers need to be proactive in a still-low-inventory environment,” Banka adds. “That said, sellers need to be prepared that they may not have twenty offers in the first three days and their pricing may need to be adjusted. Buyers may find a little less competition in the market but still need to be aggressive in their search and pricing to find their dream home.”

Kelly Moye, a realtor with an expertise in Boulder and Broomfield, has seen a decrease in demand. “We have reported over the last eighteen months about a market where listings sell in a matter of days for upwards of 15 to 20 percent over list price, with five to ten offers as a standard, typical occurrence,” she say. “With extremely low inventory and high demand still ruling our market, it seemed the end was nowhere in sight.” But after interest rates went up, she continues, “buyers’ purchasing power was significantly reduced, and that’s the day the market changed. It was Easter weekend, and based on showing reports, that was the weekend showings averaged more like five or six per weekend instead of twenty to thirty, and suddenly homes were still on the market come Monday morning. Sellers expecting a flurry of activity were sorely disappointed, and we started to actually see price reductions trickle in on our morning email alerts.”

Owing to “a half-a-month supply of inventory, sellers are still enjoying a strong market,” she says. “But as the buyer pool diminishes due to rising rates and lower purchasing power, the change we all expected someday has finally arrived. They say you only know when the downturn comes right after it happened. It seems to have happened a few weeks ago, and with more rate hikes on the horizon, we expect a very different second half of the year compared to 2021.”

Matthew Leprino’s assessment of the Denver County situation is less definitive. “Every single month for the last eight, the year-over-year median price increase has still gone up – but far less than the year before, and less than half as much in some instances,” he says. “Between Aprils of 2022 and 2021, the median price for a freestanding home in Denver went up 16.3 percent, down from the previous year’s 21.5 percent. February shrank from a 21.9 percent growth to an 11.7 percent growth over the previous year, and with all except two of the last twelve months, the rise has declined. It’s not that prices aren’t increasing. They are, but not nearly as fast as they were.”

Still, he warns, “we must be cautious at this point. … We don’t have any indicators that prices will decline or regress in the foreseeable future. They may, and we can hope, simply reach level ground and hang around for just a moment – until we refuel the tank.”

Click to read the Colorado Association of Realtors’ housing market report for April 2022.