Kelly acknowledges that she gets asked about the destination of marijuana taxes "almost daily. But as we began to figure out exactly how to trace the tax revenue, we found it was so complicated to follow the pathway that we needed to create our own internal, visual system for it. We recognized that if we were having trouble understanding this information, perhaps other people were, as well. And with tax day happening this week, we thought, what better time to launch a video that talks about marijuana taxes?"

Granted, the video restricts itself to state taxes, for understandable reasons. After all, each community that allows marijuana sales can place its own taxes on the product, and those assessments frequently shift, too. In recent days, for example, Denver Mayor Michael Hancock floated a proposal to raise the city's pot sales tax to fund affordable housing.

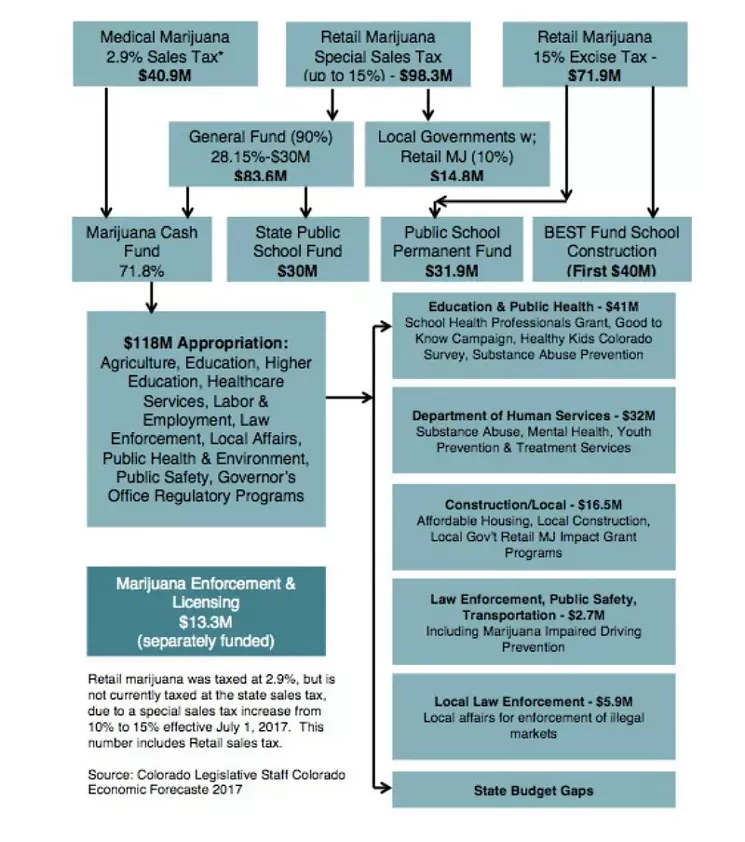

To provide a statewide perspective, MIG draws from 2017 economic forecasts assembled by staffers at the Colorado Legislature, then illustrates the expenditures using figures that will seem familiar to anyone with a fondness for Legos. The visuals help the dense and complicated details go down smoothly.

Here's the clip:

As the video points out, Colorado has three main cannabis taxes: a 2.9 percent sales tax on medical marijuana, a so-called special sales tax on retail marijuana that went from 10 percent to 15 percent on July 1, 2017, and a 15 percent excise tax on retail marijuana.

The MMJ sales tax pours entirely into the state's marijuana tax fund, which appropriated $118 million to a wide variety of government functions. Around $41 million went to education and public health via a school health-professionals grant, the Good to Know campaign, a Healthy Kids Colorado survey and assorted substance-abuse-prevention efforts.

The Department of Human Services used its $32 million on substance abuse, mental health, youth marijuana-use prevention and treatment services.

Another $16.5 million grouped under the construction/local category paid for affordable housing, local construction and a local government retail marijuana impact grant.

That 15 percent floating over this customer's head represents the 15 percent special sales tax on retail marijuana.

Courtesy of the Marijuana Industry Group

On top of that, local law enforcement collected $5.9 million earmarked to combat illegal markets. And an unspecified amount was intended to fill state budget gaps.

The special sales tax? It's divided between the general fund, which dispenses monies into both the marijuana tax fund and the state public school fund, and a silo for local governments that allow retail marijuana sales.

Finally, the first $40 million from the excise tax goes into school construction, with any additional cash going to the public school permanent fund. The $13.3 million required to run the state's Marijuana Enforcement Division isn't paid for by these taxes; it's listed as being separately funded.

This graphic provides another angle on the data.

The Marijuana Industry Group points out that Colorado received $211 million in marijuana tax revenues during the 2016-2017 fiscal year, making it the sixth-largest source of state revenues from taxes and fees. (This last figure is updated from the video, which places the cannabis biz in the eleventh slot.) In addition, the industry as a whole has created over 30,000 jobs and around $3 billion in economic impact, by MIG estimates.

For Kelly, the video clarifies what money goes where. "Often when we see specific line items, it's hard to try and track it back to an existing fund. Like, from which tax bucket is this program being paid for? And I thought it was interesting from a mapping perspective that there are three separate funds that go to public schools. There's over $100 million going to public schools from marijuana tax dollars, and that's something we can point to and be proud of."

Likewise, she continues, "there's an incredible amount of money going to education to help people understand responsible consumption and youth behavior. It puts important educational resources into the hands of Colorado's youth so they can learn what laws apply to them today versus what may be appropriate when they're 21."

At the end of the day, Kelly says, "what this tells us is that marijuana taxes are an important contributor to Colorado's economy, and it's not just one program that's benefiting."