One of the hottest topics in the Denver area these days is high rent prices.

As evidence, we note that a recent post featuring eight reasons why Denver-area rents are so high has been among our most viewed in recent months.

But now, a new analysis from California-based RealtyTrac suggests that renting makes more sense than buying in many (but not most) places around the country.

And that includes three of five counties in the Denver-metro area.

This trend is hardly universal. RealtyTrac's Buy-to-Rent and Buy-or-Rent figures, based on data through May 2015 (see the complete methodology below), show that making monthly payments on a three-bedroom property are more affordable than paying fair-market rents on a similarly sized place in 188 of 285 counties analyzed across the country.

That breaks down to 66 percent.

Denver County, however, represents the smaller slice of the market.

Here's an excerpt from RealtyTrac's report:

Renting is more affordable than buying in 97 of the 285 counties analyzed (34 percent). Major counties where it is cheaper to rent than to buy include Los Angeles, California (69 percent of median household income needed to buy), San Diego, California (56 percent), Orange, California (57 percent), Riverside County, California in Inland Southern California (43 percent), King County, Washington in the Seattle metro area (45 percent), and Denver County, Colorado (51 percent).

“We are finding many first time homebuyers in a short-term-versus-long-term quandary along the Front Range in Colorado,” said Greg Smith, owner/broker at RE/MAX Alliance, covering the Denver market. “In today's market, many buyers are not willing to take the leap to increase their monthly payment to lock in the fixed payment of a mortgage. This tends to be a short-term perspective that can have a staggering long-term effect for a person’s net worth. When you consider rents are increasing at historically high rates of over 13 percent in many areas it makes a lot of sense to lock in a monthly payment with a mortgage.”

Of course, Denver County is only part of the Denver-metro area — and while the metric that suggests renting makes more sense than buying wins the day in a couple nearby counties as well, the script is flipped in two others.

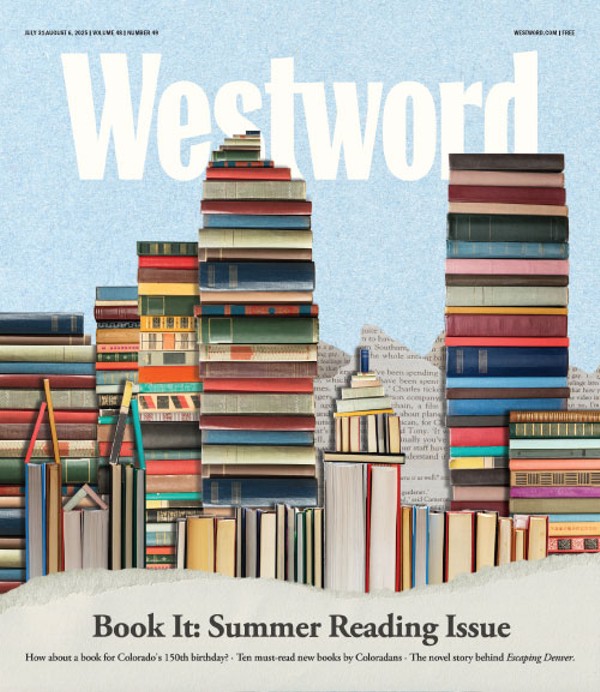

Here's a RealtyTrac graph showing the results for Denver, Araphaoe, Jefferson, Adams and Douglas counties.

As you can see, the digits in various counties are often mighty close. Note that the difference between the percentage of median income needed to rent versus buy in Arapahoe County is less than 1 percent — and the totals in Jefferson and Adams counties are 5 percent or less apart, but represent opposite conclusions.

The bottom line? While it's expensive in these parts whether you rent or buy — right now, anyhow — it's possible to save a little depending where you live.

Here's RealtyTrac's methodology.

MethodologySend your story tips to the author, Michael Roberts.

For this report, RealtyTrac analyzed all U.S. counties with a population of 100,000 or more and with sufficient home price and rental rate data. Rental returns were calculated using annual gross rental yields: the 2015 average fair market rent of 3-bedroom homes in each county from the U.S. Department of Housing and Urban Development (HUD), annualized, and divided by the average sales price of 3-bedroom residential properties in the first five months of 2015.

RealtyTrac also incorporated average weekly wage data from the Bureau of Labor Statistics and median household income data from the U.S. Census into the report.

Estimated home payment amount was made assuming a 10 percent down payment, a 30-year fixed rate loan with the average interest rate from the Freddie Mac Primary Mortgage Market Survey, mortgage insurance of 1 percent of the home price annually, property insurance of 0.35 percent of the home price annually and property taxes based on average property taxes for all 3-bedroom residential properties using tax assessor data collected by RealtyTrac.

Affordability for rent was calculated by dividing the annual fair market rent for a 3-bedroom property in each county by the estimated median household income for that county. Affordability for buying was calculated by dividing the annualized house payment for an average-priced 3-bedroom property in each county by the estimated median household income for that county.