Hannah Metzger

Audio By Carbonatix

With just over three weeks left in the Colorado Legislature’s 2025 session, action is increasing on outstanding proposals. Here are updates on three bills we’ve been watching that could affect the state’s dining scene.

HB25-1282: Payment Card Network Practices & Fees

✅ Passed House

â© Next Stop: Senate Judiciary committee

Interchange fees, commonly known as “swipe fees,” are fees businesses pay to card issuers – such as Visa and Mastercard – every time a customer uses a credit or debit card. Under the proposed legislation, payment card networks would be prohibited from fixing or conspiring to fix interchange fees, or from using fee schedules created by other issuers. Most significantly, the bill bans swipe fees from being charged on the tax or tip portion of a transaction, a common practice that drives up costs for businesses.

The bill also protects merchant choice by prohibiting “honor-all-cards” rules, as well as penalizing businesses that offer price discounts and incentives for customers to pay in cash.

The bill seems straightforward enough – so you might be surprised to hear that a coalition of small businesses, local credit unions and banks oppose the measure. Large retailers, like Target, Walmart and King Soopers, would be the main beneficiaries if the bill is passed, saving millions of dollars, while small businesses will only see an average of $140 in savings per year. Additionally, small businesses would have to upgrade legacy credit card processors that cannot separate tax and gratuity.

“This bill will impact your local financial institutions that reinvest in our community and the implementation will be very chaotic,” says Scott Sager, chief financial officer for Colorado Credit Union in Littleton. “Although well-intended, let’s not pad the pockets of mega retailers and find a better way to support local restaurants, small businesses, credit unions, community banks and the people who need it – not via HB1282.”

Although the bill sailed through the House, it encountered some difficulty in the Senate from these opposition groups and was laid over for vote in its scheduled Judiciary committee hearing.

HB25-1208: Local Governments Tip Offsets for Tipped Employees

✅ Passed House

✅ Passed Senate Local Government & Housing Committee (5-2)

â© Next Stop: Senate floor

After weeks of heated debate, amended language and divided testimony, HB25-1208 just cleared another hurdle in the Senate by passing the Local Government and Housing Committee 5-2.

The most recent iteration of the bill leans into local control, allowing local governments to adjust the tip credit as local minimum wages increase. However, the language also mandates that the tip credit cannot go below $3.02 per hour, which was a rallying point for opponents such as One Fair Wage, Women’s Lobby and labor advocates.

“This bill gives us one option: raise the tip credit,” says Denver City Councilwoman Shontel M. Lewis. “I do stand in solidarity with nine of my Denver City Council colleagues as they remain in an ‘amend’ position, as this bill still does not grant municipalities the full local control we need over the issue because the bill, in its current form, only allows municipalities to increase the tip credit and not decrease.”

Another argument against comes from employment lawyers who suggest that the bill (even amended) might not be constitution, as Article 18, Section 15 of the Colorado Constitution “explicitly states no more than $3.02…may be used to offset the minimum wage of employees who regularly receive tip,” says Ridge Wrath, representing the Plaintiff’s Employment Lawyers Association. “HB25-1208 would be in direct contravention of our state constitution, as it would allow Denver, Boulder and Edgewater restaurants to take a tip credit towards employees’ hourly wages, which are larger than the constitutional maximum.”

Restaurant groups and restaurateurs remained in support of the amended bill with the core argument that front-of-house workers often earn $35 to $45 per hour with tips and the fixed tip credit forces restaurants to raise those already-high wages further, hurting back-of-house staff and the restaurant’s business model.

“Our payroll has gone from 30 percent to almost 50 percent in the last six years, which is unsustainable. We have cut staff and laid off employees. We operate with half the staff that we did before [minimum wage] started going up. The owners have not pulled money out of here for over ten years,” says Chrissy Strowmatt, general manager at the Blue Bonnet, a five-decade-old Mexican restaurant in Denver. “I understand the bill would not give us immediate relief, but it will give us hope and we can hold on if there’s some hope of a resolution of this.”

The bill passed the committee 5-2, with Vice Chair Julie Gonzalez and Katie Wallace voting no; it’s now moved onto the Senate floor for vote.

SB25-033: Prohibit New Liquor-Licensed Drug Stores

✅ Passed Senate

✅ Passed House

âœï¸ Signed into Law April 10

After years of ballot measures and legislative stalemates, SB25-033 is the latest attempt by lawmakers to bring regulatory clarity to the state’s fragmented alcohol sales landscape.

A short recap for those who haven’t been following the decades-long journey of alcohol regulation in Colorado: Prior to 2016, the state’s laws were extremely favorable to independent liquor stores; liquor license holders were only allowed to operate one store in the entire state, and grocery and convenience stores were limited to selling 3.2 percent ABV beer. then came the compromise of SB16-197, that allowed grocery stores to sell full-strength beer and gradually increased the cap of liquor licenses from one to twenty locations over the next twenty years. In return, grocery stores agreed that if a location wanted a liquor license, it was required to purchase the liquor license of any existing stores within a 1,500-foot radius. But then, according to independent liquor stores, grocery stores “betrayed” the compromise by putting Proposition 125: Wine Sales in Grocery and Convenience Stores Initiative on the 2022 ballot. It squeaked by, and since then independent liquor stores have been in a tailspin.

“My business, Argonaut Wine & Liquor, we have lost 35 percent of our revenue since the passage of the grand compromise in 2016. Our sales fell nearly 11 percent in 2024 alone, largely in part to Prop 125, and we’re on pace to lose another 15 percent this year,” says Josh Robinson. Evergreen Liquors, which is co-located with Safeway, has seen a 44 percent drop in wine sales.

To stem the bleeding, a bi-partisan effort was made to put together SB25-033, which prohibits grocery chains from acquiring additional liquor licenses. It doesn’t stop grocery stores from selling full-strength beer or wine, it just tries to keep spirits in the domain of the remaining independent liquor stores.

Many owner insist this is a stopgap, not a solution. “You know some people say, ‘Oh, free market this, free market that.’ They are fucking killing Colorado-owned businesses, like killing us with predatory pricing, just so many things. [SB25-033] is just like putting a bandaid on a severed leg. It doesn’t stop the hemorrhaging, it just means they’re not going to cut off your other leg next year,” says Mat Dinsmore, owner of Wilbur’s Total Beverage. “This is a way to save Colorado small businesses, not just liquor stores but also craft breweries, Colorado wineries, craft distilleries because none of these companies are getting into these big companies.”

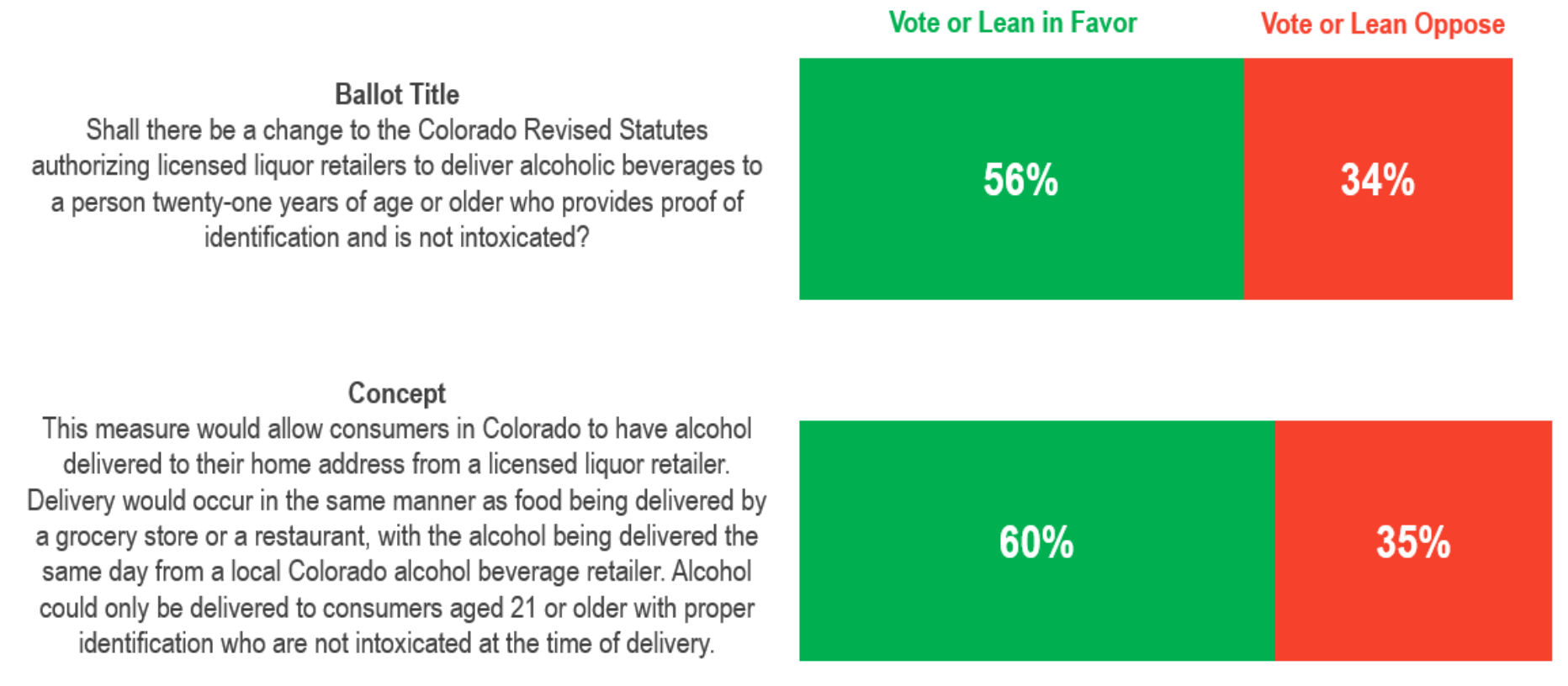

The bill was heavily opposed by grocery store chains and their retail advocates. And according to a Coloradans for Consumer Choice survey (backed by grocery and convenience store lobbying groups) of 600 Coloradans conducted in March, 43 percent of consumers also opposed the proposal, favoring more competition in the belief that it leads to lower prices.

Although the bill was signed by Governor Jared Polis, the debate is far from over. As foreshadowing, the same C4CC survey asked likely voters their thoughts on a potential ballot proposal to basically overturn SB25-033.

Coloradans for Consumer Choice

“Senate Bill 33 disrupts this balance, contradicts the will of voters, and does nothing to improve public safety,” says Ray Rivera, executive director of Coloradans for Consumer Choice. “If we now need to go to the ballot on behalf of Colorado businesses and consumers we will.”