Jacqueline Collins

Audio By Carbonatix

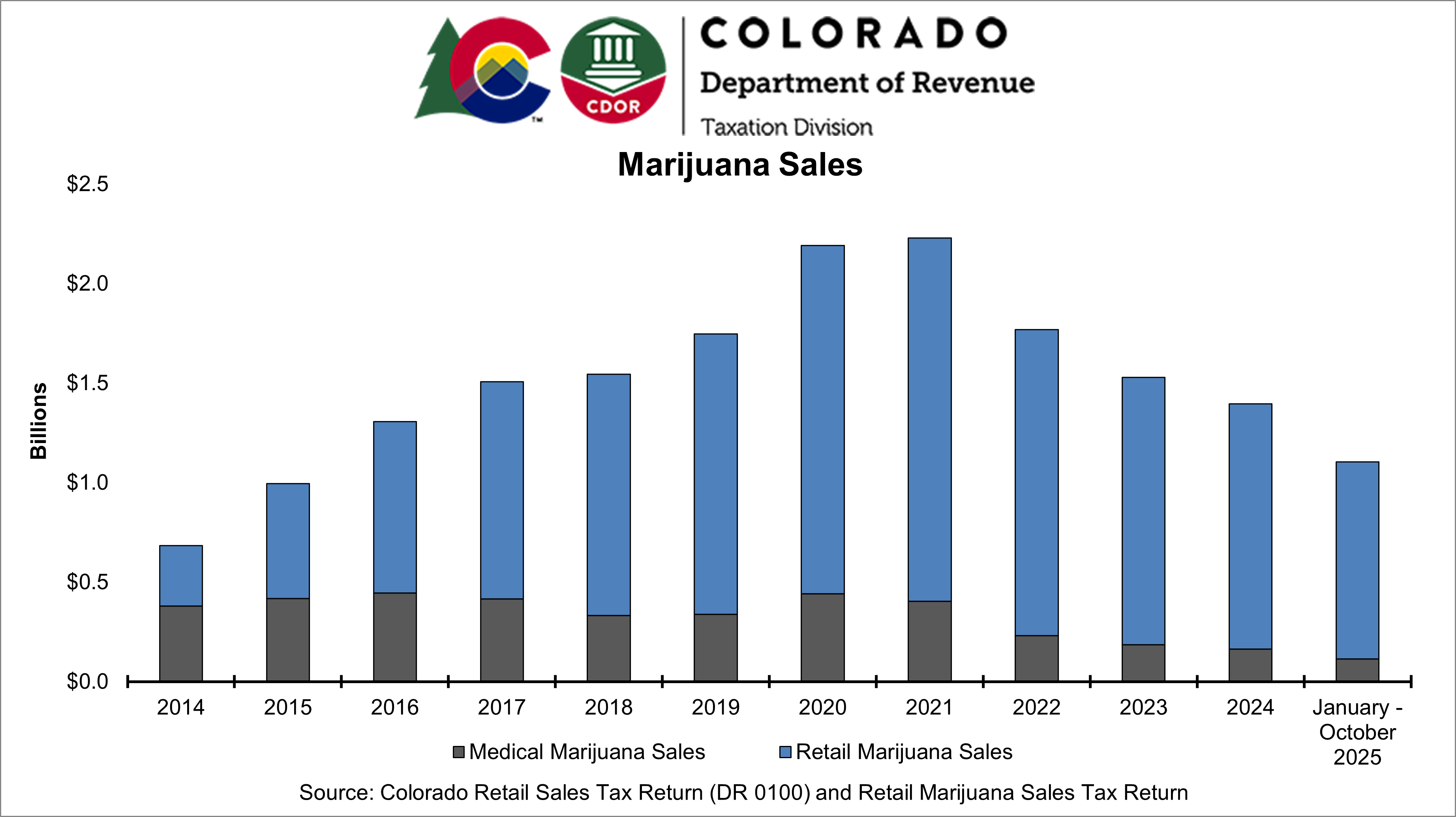

The Colorado marijuana industry’s slide continued in 2025, with state Department of Revenue records showing that a fourth straight year of declining dispensary sales is all but sealed.

According to monthly sales records, Colorado dispensaries sold just over $1.1 billion worth of cannabis products from January to October 2025. The DOR hasn’t yet released sales figures for November or December, but numbers through the first ten months of last year are about $293.5 million short of 2024’s overall dispensary revenue, which almost hit $1.4 billion.

Colorado dispensaries averaged just over $110 million in sales through the first ten months of 2025, and November and December are historically in the lower half for monthly sales every year, according to DOR records. So unless people uncharacteristically spent over $146 million on marijuana for two months in a row, we can safely assume that last year continued the downward trend. (Some of us like to burn a little extra during the holidays, but not that much.)

Retail marijuana sales reached a record high in 2022, hitting over $2.2 billion. But wholesale prices and dispensary sales both started falling in the second half of that year, as COVID restrictions ended and an oversupply of products flooded Colorado. Around the same time, a handful of additional states legalized retail marijuana or turned a blind eye to intoxicating hemp sales, further hurting Colorado’s cannabis tourism market.

Colorado Department of Revenue

Slower dispensary traffic eventually led to lower prices. After peaking in 2021 at $1,721 per pound, the median price per pound of Colorado marijuana has consistently decreased, according to the DOR, hitting a record-low $648 last December. This followed a few other points of record-low flower prices in 2024 and 2025.

In addition to steep drops in wholesale prices and dispensary sales, Colorado has seen a large chunk of growers shut down or leave the state. According to DOR records, there was a 48 percent drop in licensed recreational marijuana cultivations from 2021 to 2025, with 488 registered as of December.

Popular cannabis businesses haven’t been immune to the hurting market. In 2025 and 2025, brands such as Bubba’s Kush, Dablogic, L’Eagle, Verde, Maggie’s Farm and the original ownership behind Terrapin Care Station all closed shop or left for other states. Other notable dispensary chains, including Lightshade and Good Chemistry, have also closed and sold locations after reporting declining sales.

Cannabis business owners across the country are hopeful that the looming reclassification of cannabis to a Schedule III substance will bring more tax breaks and access to financial help and services, which could help ease the pain. President Donald Trump issued an executive order this fall directing the federal government to pursue reclassification, endorsing a move that his predecessor, Joe Biden, started in 2023.