Google Maps

Audio By Carbonatix

Home prices in Denver, which some people had expected to drop during the ongoing COVID-19 crisis, are on the rise, with one expert likening the bidding wars to panic buying of toilet paper at the pandemic’s onset.

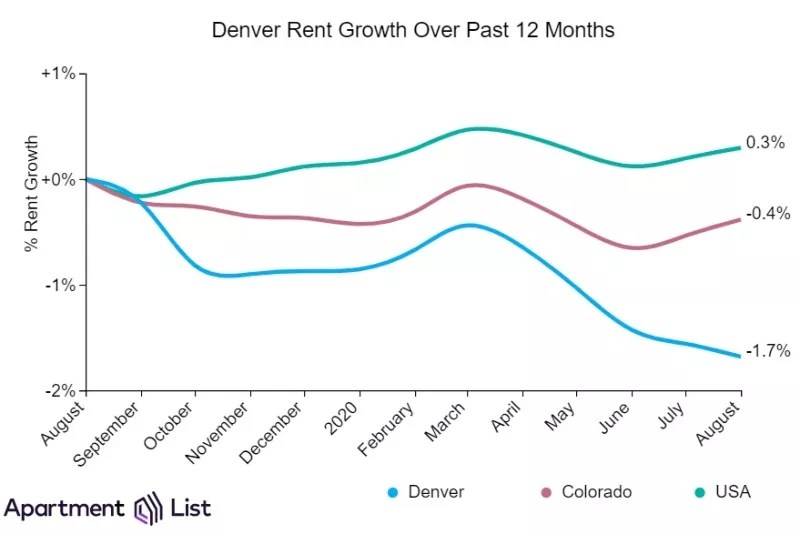

In contrast, rents in the Mile High City have actually dipped, but not by much. And while evictions are still below 2019 totals, there are plenty of people being ousted despite initiatives touted by Governor Jared Polis that are designed to keep people in their homes despite the economic downturn.

The just-released September Denver rent report from Apartment List shows that rents for August, the most recent month for which data is available, fell .1 percent from July and are down 1.2 percent from March through August and 1.7 percent over the same period last year. That means a $1,000 apartment available for $1,000 in August 2019 would cost $973 now – a whopping savings of $27.

Apartment List estimates the current median one-bedroom rent in Denver at $1,060 and the median two-bedroom rent at $1,342. But that’s an average of every neighborhood in the metro area, and much lower than the current prices in trendier parts of the city. Take the Liv on Steele apartment complex, located at 1412 Steele Street in Congress Park. Right now, one-bedrooms in the building start at $1,440 and the floor for two-bedrooms is $1,780, though a $500 discount is available for those who apply within 24 hours of touring the structure.

Still, rents in Denver have slipped more quickly than in Colorado or the nation as a whole, as seen in this graphic:

Moreover, rents in many other cities along the urban corridor are currently flat or up slightly during 2020, according to Apartment List stats. Six examples:

Aurora

M/M rent growth: +0.3 percent

Rent growth March-August: +0.3 percent

Y/Y rent growth: -0.8 percent

Arvada

M/M rent growth: 0.0 percent

Rent growth March-August: +0.5 percent

Y/Y rent growth: +1.9 percent

Fort Collins

M/M rent growth: 0.0 percent

Rent growth March-August: +1.1 percent

Y/Y rent growth: +0.1 percent

Parker

M/M rent growth: +0.8 percent

Rent growth March-August: +0.5 percent

Y/Y rent growth: +0.4 percent

Colorado Springs

M/M rent growth: +0.1 percent

Rent growth March-August: +1.1 percent

Y/Y rent growth: +2.1 percent

Loveland

M/M rent growth: +0.4 percent

Rent growth March-August: +0.2 percent

Y/Y rent growth: +1.5 percent

Meanwhile, the Colorado Apartment Association is continuing with its campaign, launched this spring amid talk of widespread rent strikes, to downplay the impact of the novel coronavirus on tenants’ ability to pay. CAA figures show that the percentage of rent collection from August 1 through August 20 was 94.7 percent – up from 93.9 percent from July 1-July 30, and approximately 1.8 percent below the 96.5 percent registered in August 2019. All of these are higher than the national average of 90 percent in August 2020 and 92.1 percent in August 2019.

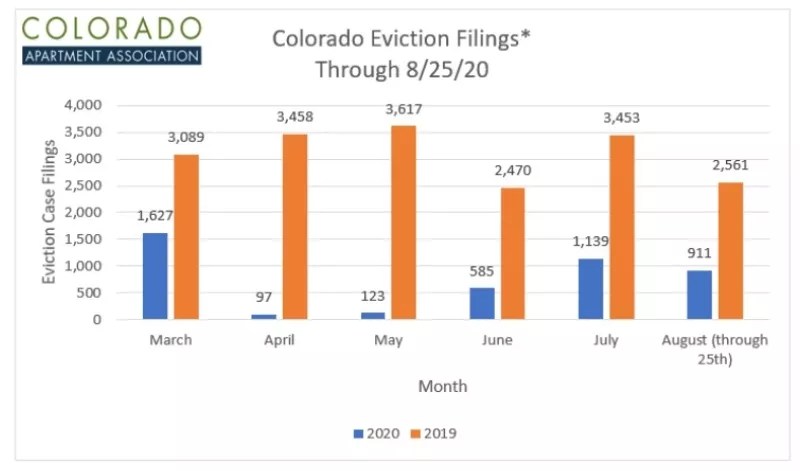

As for evictions, they’re happening less frequently than they did last year, as seen in this CAA graphic:

Of course, any evictions right now are controversial, and during an August 26 press conference, Governor Polis announced the creation of a new task force to tackle the problem.

Still, Mark Williams, CAA’s executive vice president, sees the situation through a positive lens. “As Coloradans return to work and once the state’s EHAP [Emergency Housing Assistance Program] and POP [Property Owner Preservation] programs begin to provide funding for residents with COVID-19 related need, we will continue to see strong rent payments and low eviction filings,” he says in a statement. “These low numbers show that our members, who represent 75 percent of the rental properties in the state, continue to work with residents on payment arrangements and other solutions if a resident has been impacted by the COVID-19 closures. Colorado’s rental property managers’ innovation in helping their residents navigate this challenging situation has been inspiring.”

Williams adds: “Rent collection payments remain strong in Colorado, as they have since the COVID-19 pandemic closed many businesses. The continued strength in rent collection numbers and the low eviction filing data showcases our members’ dedication to residents. We understand some residents may be facing challenges, and we encourage those residents to communicate with their housing providers to work on solutions.”

For more assistance, visit CAA’s renter-resources page.