Patrick Campbell/University of Colorado

Audio By Carbonatix

Colorado’s economy is still strong despite national worries about what President Donald Trump’s new tariff policy could bring.

In a new quarterly report from the Leeds Business Research Division at CU Boulder and the Colorado Secretary of State’s Office, economic signs for Colorado are largely positive despite the national GDP decreasing in the last three months.

“The indicators in this report do not show any immediate or significant economic disruption to Colorado in Q1 of this year, but it does show that business leaders in Colorado are nervous about these disruptions and how they can impact them,” Secretary of State Jena Griswold said in a briefing about the report on May 5.

According to the report, business leaders’ confidence in the economy is the third lowest it has been since 2005, when the modern iteration of the report began. Business leaders have grown significantly less confident in the first few months of 2025 than they were at the close of 2024, Griswold noted.

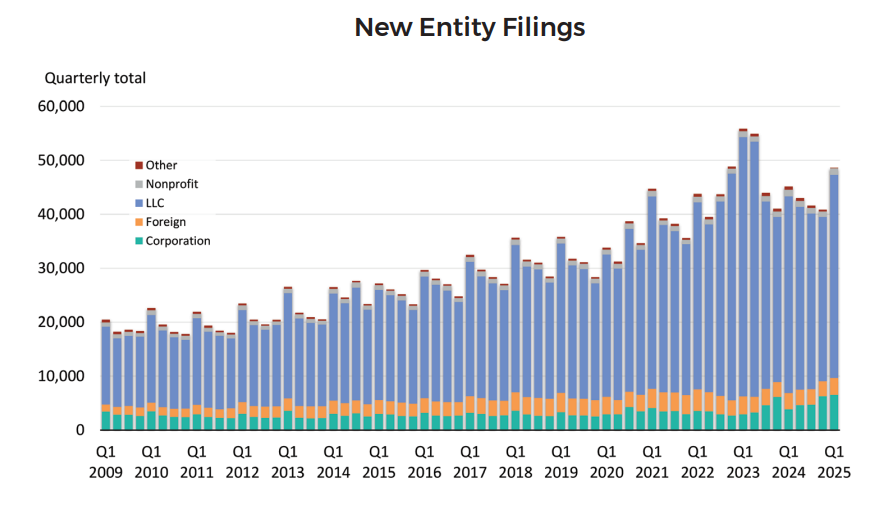

Despite that lack of confidence, Colorado’s businesses are still growing. There were 48,629 new business entities filed with the Secretary of State’s office in the first quarter of 2025, which represents 7.7 more than were filed in the first quarter of 2024. Most filings were for LLCs.

Over 200,000 existing businesses also renewed their paperwork, which was an increase from the end of 2024 but a 1.2 percent decrease from the beginning of 2024. Delinquencies also increased by 9.8 percent.

Do Colorado Businesses Grow During a Recession?

According to Brian Lewandowski, executive director of the Leeds Business Research Division, the number of business filings in previous times of recession – such as 2008 and the 2020 onset of the COVID-19 pandemic – show inconsistent results.

“When we take a look at the great recession, the financial crisis, 2008-2009 time frame, what we did see is a consistent downshift in new business filings,” Lewandowski said during the briefing. “When we fast forward to 2020, I think that was a really different situation because before COVID started, the economy was on a really pretty stable footing.”

Comparatively, in 2007 the economy was already showing signs of tumbling. In 2020, Colorado’s business filings were down for a few months and then surged because the pandemic didn’t cause a long-term impact on consumption.

“It’s not real clear right now that we’re getting a good indication, in my mind, of future economic activity,” Lewandowski said. “The growth in new entity filings does show that individuals are still eager to try out starting some of these new businesses.”

People are still starting new businesses in Colorado.

Colorado Secretary of State

Richard Wobbekind, senior economist at the Leeds School of Business, added that for an economic downturn to impact new business filings, people would have to not only lose their jobs but also their home equity or lines of credit, as happened in 2008. Usually, people are more inclined to start businesses when the economy is down – but if they lose tools for seed funding they can no longer do so.

“When you lose a job or you’re unemployed, your opportunity cost is very low,” Wobbekind added. “Back in the 2001 recession, we did see a lot of entrepreneurial activity and startups.”

At this point, Colorado’s response seems closer to 2001 or 2020 rather than 2008, but the economists emphasized that only time will tell the true impact of the stringent tariff policy.

“It’s pretty difficult to figure out where exactly we’re going in quarter two, until we see how much trade impact there is,” Wobbekind noted.

Though Colorado’s latest job growth numbers are decent (a 0.1 percent increase in March and 2,300 new jobs year over year), the unemployment rate in the state is 4.8 percent: the highest since September 2021.

Colorado’s job growth actually dipped into the negatives earlier this year before rebounding. Griswold and the CU economists suggested that dip was largely caused by the King Soopers worker strike, which ran from February 6 to February 18.

“The strike had an impact on about 10,000 jobs during the national monthly job count in February,” Griswold explained. “Those jobs have come back since the strike ended several months ago, and we have continued to see other jobs added since then.”

In Colorado, 67.8 percent of the population participates in the workforce right now, the sixth-highest rate in the country, and inflation in this state is still below the national average.

“We are seeing continued job growth, particularly in the fields of health care and education, with some job declines in information and business services sectors,” Griswold said. “The cost of goods continues to increase, though, at a consistent rate of around 2 percent. This steady but continued inflation, along with other major trade uncertainties, impacts all business and especially small businesses, which are the backbone of Colorado’s economy.”

Economic Uncertainty Ahead Despite Strong Colorado Numbers

Inflation, along with the new tariffs that took effect in April and the ones that could still come, have caused uncertainty in the economy, with the GDP decreasing by 0.3 percent from the fourth quarter of 2024 to the first quarter of 2025. The report explains that the decreased GDP was caused by a surge in imports as people and businesses anticipated higher costs once tariffs set in.

“The first quarter of GDP would likely have been positive, if not for the huge trade swing,” Wobbekind said. “That, of course, was fueled by a large amount of imports to the economy. Some of that clearly was trying to have trade before the tariffs set in.”

He added that businesses may have purchased machinery and other equipment in anticipation of the tariffs, in addition to stockpiling inventory. While the economy is expected to be slow this year, Wobbekind said, the projection is still for a small GDP growth – so he’s encouraging people not to panic.

“We still have a solid job growth in the economy. We still have a very reasonable unemployment rate at the national level,” Wobbekind said. “That sort of data, at least to us, is still not signaling that we’re recessionary even though the first quarter of GDP was slightly negative. It still is an economy chugging along, but not growing at any sort of great rate.”

Still, the study found that people are not feeling optimistic despite the decent economic indicators. The last time people were this unconfident in the economy was in 2008, Wobbekind noted.

“These are particularly low levels in terms of expectations about the future, and that’s obviously an area of concern for us as we go forward,” he said. “Whether or not that will translate into consumers actually pulling back, let’s see.”

But for now, Coloradans are still ready to start businesses.