Getty Images

Audio By Carbonatix

Metro Denver is currently the least affordable market in the country for first-time home buyers, according to newly released statistics. Major factors include millennial newcomers whose willingness to pay more is boosting prices higher and higher and higher.

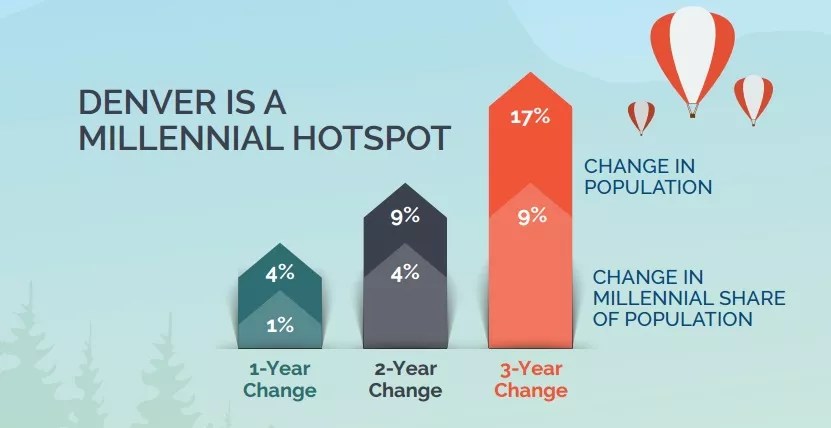

This information comes from Daren Blomquist, senior vice president of ATTOM Data Solutions, who notes that the number of millennials in metro Denver went up by 9 percent from 2012 to 2015 – and that trend shows no sign of slowing.

“The influx of millennials (and other populations, for that matter) is putting more upward pressure on home prices,” notes Blomquist, corresponding via e-mail, “especially given the low supply of starter homes and particularly condos available for these first-time home buyers.”

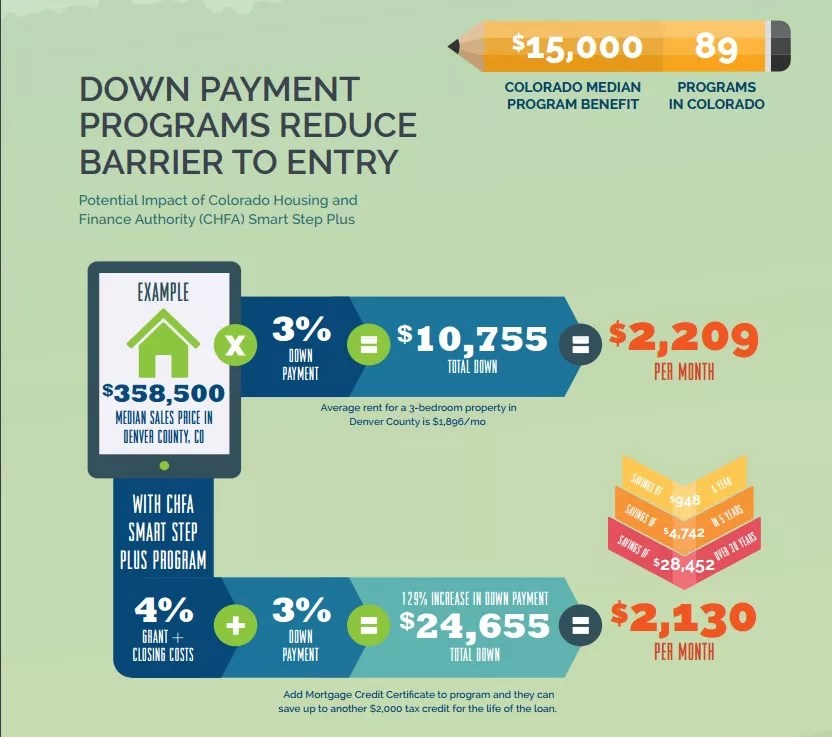

Down Payment Resource, which collaborated on the new study with ATTOM Data, is trying to assist such consumers by directing them to down payment assistance programs available through assorted national, local and state agencies, including the Colorado Housing and Finance Authority. People interested in buying their first home can increase their down payment on a median-priced home by as much as $13,900, or 129 percent over the minimum down payment of 3 percent, through the use of such programs – at least 89 of them – with potential monthly house-payment savings of $5,000 over five years.

Denver, make your New Year’s Resolution Count!

We’re $17,500 away from our End-of-Year campaign goal, with just a five days left! We’re ready to deliver — but we need the resources to do it right. If Westword matters to you, please contribute today to help us expand our current events coverage when it’s needed most.

Still, these programs are not without risk, especially in a market as supercharged as Denver’s – and other places in the state aren’t far behind. As Blomquist reveals in a Q&A on view below, metro Denver is one of four Colorado communities that were among the ten least affordable for first-time home buyers nationwide during the first quarter of 2017.

Here’s the conversation, supplemented by RealtyTrac infographics. That’s followed on page two of this post by annualized Denver wage information for every quarter since the beginning of 2005 through the third quarter of 2016, and fair market rents for three-bedroom properties in Denver County from 2009 to 2016. During the latter period, rents for such abodes went up more than 32 percent.

Gulp.

Westword: Your data shows that Denver is the least affordable market for first-time home buyers in the entire country. Is that for Denver proper or the metro Denver area?

Daren Blomquist: Our Q1 2017 affordability report shows three Denver-area counties ranking as the top three least affordable markets in the country based on our affordability index, which is an index grounded in percentage of average wages to buy a median-priced home relative to historical norms for any given county. Ranked No. 1 was Adams County, followed by Arapahoe at No. 2 and Denver County at No. 3.

Has Denver been edging closer to the least-affordable spot over the past year or two – and if so, what place has it landed in over, say, the quarters in 2015 and 2016?

Before Q1 2017, the most recent quarter in which a Denver-area county ranked as least affordable was in Q2 2016, when Denver County ranked as the No. 1 least affordable in the country. It also ranked No. 1 least affordable in Q1 2016. Denver County has consistently ranked among the top three least affordable counties for six consecutive quarters ending in Q1 2017.

What other U.S. cities follow Denver in the least-affordable ranking?

After Denver, the metro areas with counties ranking least affordable are Greeley, Colorado (not too far, obviously); Houston, Texas; Austin, Texas; Flint, Michigan (might be a bit of a surprise); Charlotte, North Carolina; Fort Collins, Colorado; Nashville, Tennessee; Boulder, Colorado; and Detroit (maybe another surprise, but keep in mind this is affordability relative to historic norms for that county).

Are wages failing to keep pace with housing costs, and is that the main reason that Denver has become so difficult to afford for first-time home buyers?

Yes, absolutely. Our affordability report for Q1 2017 shows that median home prices in Denver County have risen 147 percent since bottoming out in Q1 2009. During that same time period, average weekly wages according to the Bureau of Labor Statistics have risen 10 percent.

Has the influx of millennials into Denver exacerbated this situation?

Yes, the influx of millennials (and other populations, for that matter) is putting more upward pressure on home prices, especially given the low supply of starter homes and particularly condos available for these first-time home buyers. The condo situation is exacerbated by the state’s onerous condo-defect law that has resulted in builders shying away from building condos.

What factor has high rent costs played?

The millennial population growth combined with low supply of homes and condos for sale has also put tremendous upward pressure on rents. Those high rents in turn make it more difficult for millennials and other first-time home buyers to save up for a down payment on a home.

What other factors have contributed to make Denver the least affordable city for first-time home buyers?

It may be somewhat implicit in the above, but some of the influx of population to Denver has come from even higher-priced markets, where buyers are accustomed to spending a higher share of income on housing or where buyers are coming in flush with cash from a sale of a property in that market. So the increase in population also comes with a combination of an influx of many cash-rich buyers and a cultural shift in the expectations for housing costs. This is changing the affordability landscape in Denver.

Continue for more about Denver ranking as the least affordable market in the country for first-time home buyers, including information about down payment programs, wages and rising rents.

Is the size of a down payment the biggest impediment for first-time home buyers in Denver?

The affordability challenge in Denver is equal parts the down payment and the monthly house payment, which now requires 43 percent of an average wage earner’s income each month. Renting is slightly more affordable, requiring 37 percent of average wages, but still does not leave much disposable income for the renter to save up for a down payment.

How can down payment programs help first-time home buyers in this situation?

Down payment programs can actually help on both fronts: the down payment itself as well as the monthly house payment. Many down payment programs available for Denver buyers provide at least the minimum 3 percent down payment (and sometimes more) in the form of a grant, meaning the buyer doesn’t need to pay it back. That helps the prospective buyer get over the hump of saving for the down payment. Additionally, this type of grant in tandem with the borrower’s own savings can help that borrower put down more than the minimum 3 percent, which in turn will help lower the monthly house payment.

What are the risks, if any, involved in these programs?

The risk is having homeowners who don’t have much “skin in the game” and therefore are at higher risk for default, particularly if they face a difficult life circumstance such as loss of job. FHA loans, for example, consistently have higher foreclosure rates than the overall foreclosure rate for all loans. The marketplace can handle this additional risk in exchange for a larger pool of buyers, but these programs should continue to be done in the context of strict underwriting standards to keep that risk in check.

During the housing crisis a decade or so back, many people stretched to make home purchases only to see the value of the house drop to the point where they either lost the property or had to sell at a loss. Do down payment programs have the potential of putting buyers in a similar situation, where they can get in over their head – and if so, what’s the best way to avoid this kind of problem?

Yes, there is more risk for default here because these borrowers have less skin in the game. Each program may have some checks and balances in place to mitigate this type of risk…but the single best way to prevent a repeat of the bubble-bursting scenario from ten years ago is to maintain strict loan underwriting standards, continuing to carefully document the borrower’s income and ability to repay.

There are a lot of frustrated people trying to buy homes for the first time in Denver right now. What advice would you give them?

Be pro-active in continuing to look and make offers and find down payment assistance programs that might help you, but at the same time be patient. Don’t adopt the mentality that you must buy a home at all costs. Although it seems right now the market will never cool off, it will eventually. We have seen this time and time again thanks to the cyclical nature of the market.

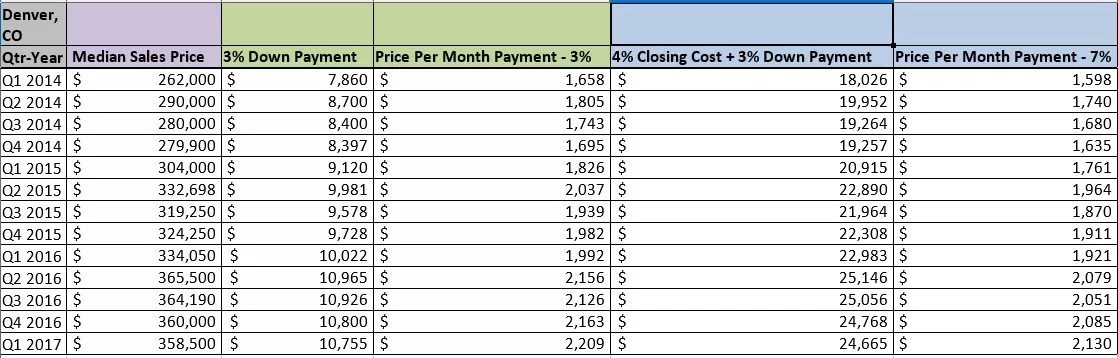

Denver down payment data, 2014-2017

Courtesy of ATTOM Data Solutions

Annualized wages in Denver by quarter, 2005-2016

Q1 2005 $50,063

Q2 2005 $50,063

Q3 2005 $50,063

Q4 2005 $50,063

Q1 2006 $51,207

Q2 2006 $51,415

Q3 2006 $51,935

Q4 2006 $52,793

Q1 2007 $53,469

Q2 2007 $54,119

Q3 2007 $54,210

Q4 2007 $54,990

Q1 2008 $55,627

Q2 2008 $56,017

Q3 2008 $56,485

Q4 2008 $56,264

Q1 2009 $55,913

Q2 2009 $55,796

Q3 2009 $55,913

Q4 2009 $56,472

Q1 2010 $56,706

Q2 2010 $57,005

Q3 2010 $57,122

Q4 2010 $57,902

Q1 2011 $58,617

Q2 2011 $59,124

Q3 2011 $60,112

Q4 2011 $59,423

Q1 2012 $60,177

Q2 2012 $60,385

Q3 2012 $60,190

Q4 2012 $60,970

Q1 2013 $60,918

Q2 2013 $60,983

Q3 2013 $61,139

Q4 2013 $61,165

Q1 2014 $61,958

Q2 2014 $62,387

Q3 2014 $63,076

Q4 2014 $63,466

Q1 2015 $63,765

Q2 2015 $64,467

Q3 2015 $64,714

Q4 2015 $65,208

Q1 2016 $64,714

Q2 2016 $64,649

Q3 2016 $65,351

3 Bedroom Monthly Rental Amount in Denver County, 2009-2017

2009: $1,265

2010: $1,308

2011: $1,430

2012: $1,350

2013: $1,470

2014: $1,504

2015: $1,696

2016: $1,788

2017: $1,896

Percentage change, 2012-2016: 32.4 percent