Google Maps

Audio By Carbonatix

Since the Great Recession, which officially began in December 2007, the Denver area’s median home prices have risen by a greater percentage than in any other major U.S. city.

That’s among the most significant takeaways from a fresh report by ATTOM Data Solutions, but it’s hardly the only one tied to Colorado. Of the 149 metro areas analyzed by the service, Greeley finished first, with prices 87 percent above pre-recession peaks – even higher than Denver’s 80 percent. And Fort Collins wasn’t far behind, with a bump of 76 percent.

Todd Teta, ATTOM’s chief product and technology officer, supplied Westword with the raw numbers behind the study’s major conclusions, including those pertaining to Denver and other locations in Colorado, particularly along the urban corridor. But while he acknowledged via email those signs indicating that Denver may be shifting to a buyer’s market, as theorized by local real estate expert Veronica Collin in a July post, he doesn’t think the transition has taken place yet.

Indeed, the seller’s gain (the difference between the median purchase and median sales prices, which reflects how much the typical seller earns on a transaction) in the Denver-Aurora-Lakewood metropolitan statistical area, or MSA, currently stands at $133,000, nearly double the national average of $67,500. And that’s modest compared with Boulder, where sellers are typically reaping $194,741.

As for home prices, ATTOM uses a different metric than does the Metro Denver Association of Realtors; the former sets the median tag in the Denver MSA for the second quarter of 2019 at $408,000, while the latter lists the average sold price at $499,807. But ATTOM’s figures indicate how much prices have skyrocketed over the past decade-plus. In the first quarter of 2005, for instance, the median Denver home price was $213,000, and it bottomed out in the first quarter of 2009 at $167,500.

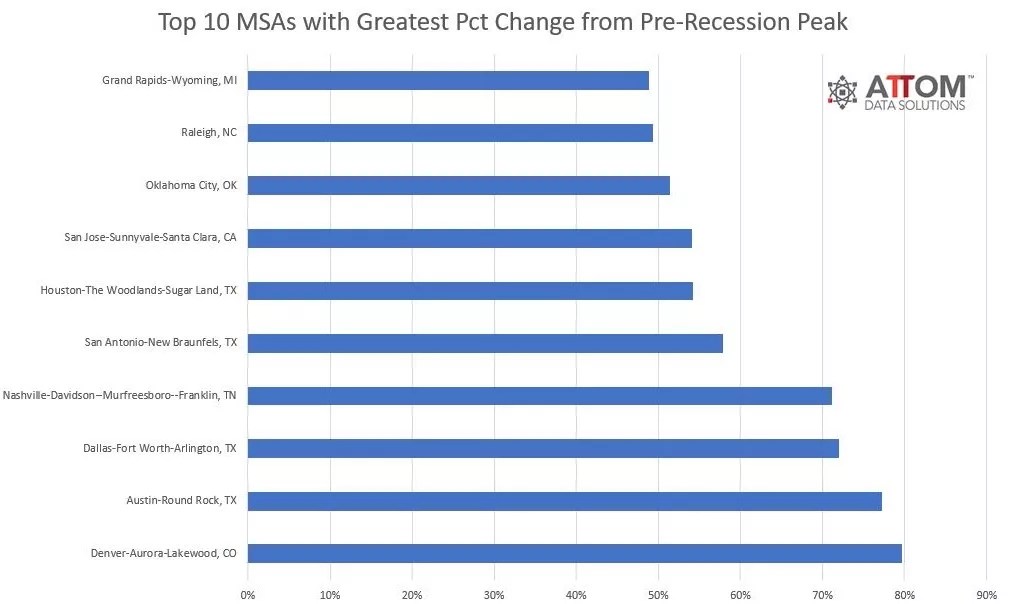

Here’s an ATTOM graphic that shows the ten MSAs with a population greater than one million that have seen the largest median percentage price rises since before the recession, with Denver leading the pack.

According to Teta, Denver’s preeminence in this regard has to do with “multiple factors,” including “regional employment, wages, cost of living, property taxes, politics, reputation, demographics and lifestyle.”

He underscores “the relatively large drop in Colorado’s unemployment rate since the end of the Great Recession, from 8.7 percent in 2010 to 2.7 in 2017 and 3.3 in 2018. The state had the second-lowest rate in the country in 2017 and ranked 14th in 2018. That’s well below its rank of 31st in 2012. At the same time, Denver’s average annual wage has increased at about the same rate as the national gain since 2012.”

In addition, Teta goes on, Denver’s large population growth (the number of metro-area residents went up more than 388,000 in eight years), has led to “demand for housing, which plays a huge role in how home prices fluctuate.”

Trendiness also comes into play, he notes. As seen above, Austin, which, like the Mile High City, is widely seen as a cool place to live, especially by millennials, was second to Denver in the percentage of median home price increases since the recession among major U.S. cities, at 77 percent.

When asked about the price rises in places such as Greeley and Fort Collins, Teta cites low unemployment and relatively high salaries there, too: “Average wages in Denver, Boulder, Arapahoe and Douglas counties range from $64,000 to $70,000, putting them above the national average of about $57,300 in the fourth quarter of 2018.” But there could be headwinds: He acknowledges that during this same period, “Larimer County was below the national average.”

The money to be made from selling homes in Denver has also influenced housing tenure – the amount of time metro-area types stay in their abodes. “Homeowners in the Denver area move sooner than almost anywhere in the country, staying in their homes an average of 6.9 years versus 8.1 years nationwide,” Teta reveals. “Denver has the third-shortest tenure period of the MSAs analyzed in the latest report.”

The listed price for this home at 475 Madison Street is .5 million.

Google Maps

Granted, he goes on, “Denver’s number is down a bit in the past two years, while the nation’s is up. But the Denver area has pretty much followed national trends, with the average time period before selling growing significantly. Denver’s number is nearly triple what it was in early 2009 (2.4 years in early 2009); the national number was more than double what it was in early 2008 (3.5 years).”

Despite the high prices, the market in Colorado remains healthy in Teta’s estimation, as evidenced by the state having the tenth-lowest number of distressed sales, which “shows that Coloradans bought homes at prices they could afford more so than most of the country. Fewer foreclosures mean fewer neglected or vacant homes, which boost values and makes neighborhoods more attractive.”

At the same time, however, the amount of money sellers earn from a home purchase has fallen 5 percent in Denver over the past year. “Caution should be taken here in reading too much into a year-over-year change for a single quarter,” Teta warns. “The number is down a bit from the second and third quarters of last year, but still really excellent. Nevertheless, any potential seller or real estate agent paying attention to the Denver-area market will see that profit margins have ticked downward. Even though prices are at all-time highs, the downward profit trend is a key factor to look at, given that real estate markets run in cycles and this one has never been higher.”

Does that suggest the local market has peaked, potentially triggering the aforementioned change to a buyer’s market? Teta doesn’t dismiss the prospect. “Denver saw a 6 percent price gain from the first to the second quarter and a 2 percent gain over a year ago. Not bad, but not great. Both numbers were well below national jumps of 10.8 and 6.4 percent, respectively. Despite the usual spring price boost, the Denver-area numbers were kind of tepid and followed a period last year when prices declined a bit.”

Nonetheless, he continues, “the Denver-area market has blown past pre-recession highs better than most areas of the country, and it’s still a big-time sellers’ market. But recent trends suggest that the regional market, like many around the country, may be cooling down and ready for some kind of dip.”