Google Maps

Audio By Carbonatix

Earlier this year, a study from California-based CoreLogic argued that homes in Denver were seriously overvalued and predicted a 10 percent price fall by the spring of 2021. But since then, the scenario has shifted substantially, with Denver single-family home prices hitting a record average high of more than $600,000, with bidding wars at a fever pitch.

One indication of how profoundly the situation has changed: CoreLogic’s latest home-price index (HPI) report now predicts that the cost of a house in Denver will dip by only a tiny 0.2 percent by July 2021.

Selma Hepp, CoreLogic’s deputy chief economist, didn’t address the huge prediction adjustment. But she notes via email that “with a 4.6 increase in home prices in June, Denver’s price growth is moderately slower than the 5.5 percent national HPI, however, still robust compared to some regions that have been notably impacted by the pandemic.”

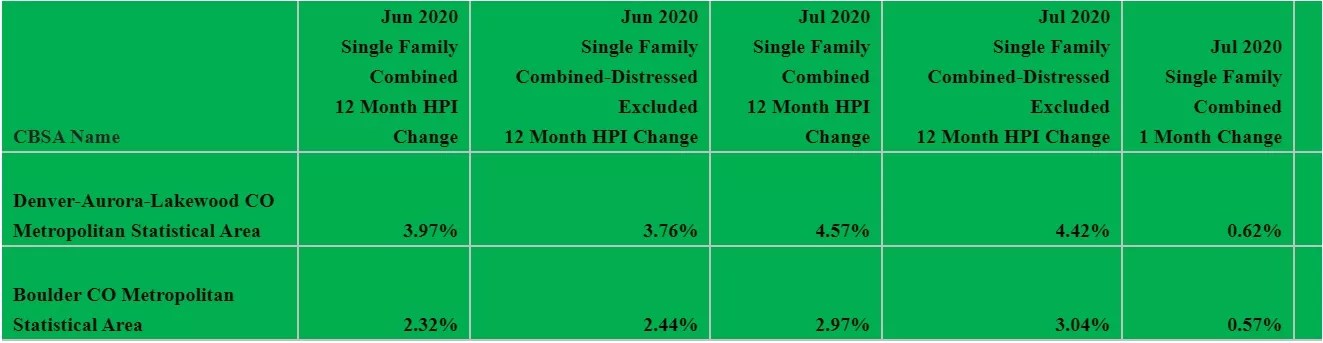

Here’s a graphic that CoreLogic provided to Westword, which tracks the home-price index jump from June to July in the Denver and Boulder metropolitan statistical areas:

The 5.5 percent national home price increase in July compared to the same month in 2019 represents a 1.2 percent leap from June and the fastest price growth rate in almost two years. The CoreLogic report attributes the phenomenon to plummeting interest rates, which slid below 3 percent for the first time ever in July, and what the document describes as “further constriction of for-sale inventory.”

Simply put, the dearth of homes for sale, exacerbated by the decisions of potential sellers to sit tight and stay put amid the COVID-19 crisis, means demand is outstripping supply – and that’s pushed prices into the stratosphere in Denver.

Other markets are having wildly different experiences. Many densely populated areas are undergoing a marked exodus, as seen in the smallish 0.4 percent price increase in July for the New York-Jersey City-White Plains metro sector. Likewise, communities whose economies are tied to tourism and live entertainment are seeing a trickle-down effect on real estate: in Las Vegas, home prices are predicted to drop by 7.8 percent as of July 2021. Other areas likely to see big price tumbles by next year include Lake Charles, Louisiana; Huntington, West Virginia; and communities with retiree-heavy populations struggling with COVID-19 such as Prescott, Arizona, and Miami, Florida.

In contrast, San Diego is forecast to boast a home-price increase of 5.8 percent by next summer.

Nationally, CoreLogic’s Hepp writes, “home prices are expected to slow to a 0.6 percent increase in the next twelve months,” while “the forecasted decline in Denver fares lower than the national index.”

Still, she adds, “Home prices in Denver are expected to continue to grow in the coming months and see only a slight 0.2 percent decline by July 2021.”