Illustration by Patrick Faricy

Audio By Carbonatix

Update: On February 4, Gannett’s board of directors unanimously rejected an unsolicited offer to buy the company from MNG Enterprises Inc. – something that a source speaking to Westword essentially predicted. Continue for our previous coverage.

Earlier this month, MNG Enterprises Inc., a firm under the umbrella of Alden Global Capital, the vampiric hedge fund that owns the Denver Post, made an offer to buy Gannett, the largest newspaper publisher in America as measured by circulation. Gannett’s flagship paper is USA Today, and its portfolio includes the Fort Collins-based Coloradoan.

At first blush, this would seem to be bad news for the Post, since the move might result in a transfer of resources away from a publication still recovering from a brutal round of layoffs last year, not to mention an editorial insurrection led by Chuck Plunkett, the man behind a package that attacked Alden in the broadsheet’s own pages for its greed and lack of love for journalistic verities.

But a knowledgeable source says an MNG purchase of Gannett, which this insider feels is all but inevitable, could actually be good news for the Post, because Alden’s focus would shift from Denver to its shiny new toy. Under that scenario, the Post would be able to operate with considerably less interference from bean counters obsessed with maintaining what’s been estimated at a 20 percent profit margin.

Gannett’s initial response to the MNG bid was cool and noncommittal. It reads: “Gannett…confirmed that it has received an unsolicited proposal from MNG Enterprises Inc. to acquire Gannett for $12 per share in cash. Gannett’s stock closed at $9.75 on Friday, January 11, 2019. Consistent with its fiduciary duties and in consultation with its financial and legal advisors, the Gannett board of directors will carefully review the proposal received to determine the course of action that it believes is in the best interest of the company and Gannett shareholders. No action needs to be taken by Gannett shareholders at this point.”

MNG is the investment subsidiary of Media News Group, which was rechristened Digital First Media; the latter moniker is the equivalent of a brand name rather than a legal entity. The MNG offer came in the form of a letter reproduced below, and our source considers it to be fair, if not so generous that Gannett will simply accept it rather than try to ratchet up the price.

The value of the MNG package is around $1.6 billion – a total arrived at by multiplying the $12 per share offer for Gannett’s approximately 113 million shares and adding its current debt of around $300 million. That would translate to about five times Gannett’s EBITDA – an acronym that stands for Earnings Before Interest, Taxes, Depreciation and Amortization. The metric essentially means the profit or cash-flow line of a given company’s financials.

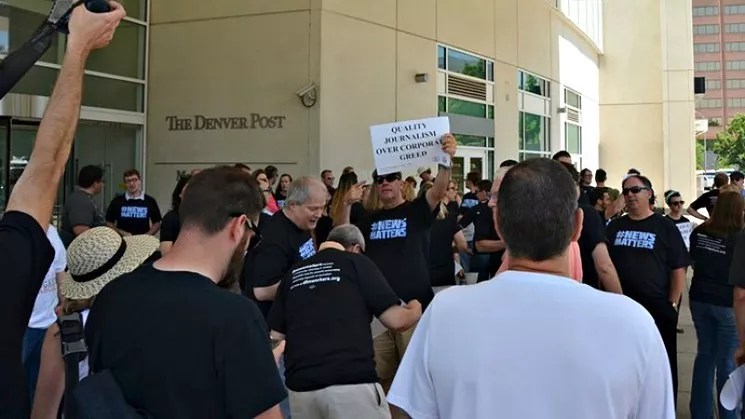

A 2016 protest against Alden Global Capital.

Lindsey Bartlett

Of late, newspaper prices have tended to range between four and six times EBITDA, putting the MNG proposal smack-dab in the middle. But Gannett executives may well try to nudge the price up to six times EBITDA or so by asking for $14 or $15 per share, the source feels.

In the meantime, our expert guesses that Gannett is on the lookout for a so-called white knight – likely another private equity firm that would consider paying even more than MNG. But such outfits are in short supply right now, given the poor fiscal performances being turned in by newspapers, which continue to struggle with the transition from print to digital distribution.

The most likely potential player is New Media Investment Group, the holding company for GateHouse Media Inc., which has been the busiest buyer of newspapers over the past three years; last June, it acquired the Pueblo Chieftain. Like Alden, GateHouse has a reputation for slashing costs at the publications it buys, often through staff cuts and layoffs, but like Gannett, it’s run by people with a background in newspapers. In contrast, Alden’s executives tend to be Wall Streeters who, according to our source, see such papers as mere products rather than torch bearers for a journalistic tradition worth preserving.

Gannett, too, has tried to bolster its share value by way of severe cuts on the editorial side of its newspapers. Indeed, the company instituted company-wide layoffs this month, including three at the Coloradoan. The expert says this round of downsizing has been in the works since late last year and is unrelated to the MNG bid.

One tactic Gannett might try to fend off suitors, the insider hints, would be to either buy Tribune Publishing, the company behind the Chicago Tribune, or to allow Tribune to purchase it. After all, Tribune spent much of 2018 trying to sell itself to another newspaper company, McClatchy Co., before the deal fell apart last month. But given that Tribune’s market cap is about $500 million, any private equity firm that could pay $12 per share for Gannett would probably be able and willing to pick up a Gannett-Tribune tandem. As such, combining forces would probably delay but not prevent a sale to MNG, the source says.

Meanwhile, Gannett is in disarray to a significant degree, at least from a leadership standpoint; CEO Robert J. Dickey recently announced his plan to retire this year, and there’s no obvious successor waiting in the wings. Our expert feels that makes it even more likely that MNG will end up with Gannett.

Here’s the MNG Enterprises letter regarding its proposition, sent to Gannett’s Board of Directors on January 14:

A screen capture from the Media News Group website.

January 14, 2019

Gannett Co., Inc.

7950 Jones Branch Drive

McLean, Virginia 22107

Attn: John Jeffry Louis III, Chairman of the Board of Directors

To the Board of Directors:

MNG Enterprises, Inc. (“MNG” or “we”), through its managed investment account, has a 7.5 percent ownership stake in Gannett Co., Inc. (“Gannett” or the “Company”), making it the Company’s largest active stockholder. We also are one of the leading Newspaper operators in the U.S., with approximately 200 publications including The Denver Post, The San Jose Mercury News, The Orange County Register and The Boston Herald. Because we know how to consolidate and operate successful newspaper businesses over the long term, we have approached members of your Board and management on multiple occasions about a potential strategic combination. Despite our overtures, Gannett has not meaningfully engaged with us.

Gannett has lost 41 percent of its value since its debut as a public company two and a half years ago, significantly underperforming its peer group and indices. During this period, Gannett suffered from a series of value-destroying decisions made by an unfocused leadership team – overpaying for a string of non-core aspirational digital deals and pursuing an ill-fated hostile for Tribune Publishing, all while Gannett’s core revenue, EBITDA, margins and Free Cash Flow continue to decline. With Gannett’s CEO departing by May and its key digital executive leaving later this month, there’s now an even greater leadership void. Frankly, the team leading Gannett has not demonstrated that it’s capable of effectively running this enterprise as a public company. Gannett shareholders cannot sit by and watch further value erode while the Board casts about for a strategy and a leader, especially when there is an opportunity to maximize value right now. We believe Gannett shareholders deserve better.

Accordingly, MNG proposes to purchase Gannett for $12.00 per share, representing a substantial cash premium, and requests the Board immediately take the following actions to maximize value for stockholders:

• Enter into discussions with MNG about a strategic combination;

• Hire an investment bank to conduct a review of strategic alternatives, including a potential sale of the Company;

• Commit to a moratorium on digital acquisitions; and

• Commit to a feasible, strategic and financial path forward before hiring a new CEO.

MNG’s proposal to buy Gannett for $12.00 per share in cash, represents a 41 percent premium to where the stock closed at YE 2018. [i] Such an acquisition, subject to confirmatory due diligence, would provide a substantial premium over Gannett’s $8.53 closing price on December 31, 2018 and its closing price of $9.75 on January 11, 2019, and would provide compelling and immediate cash value for stockholders. Further, unlike other potential buyers, as a proven operator in the newspaper business, we are able to provide a home for the Company’s businesses and valued employees so they can continue to serve their local communities. We do not believe that any material regulatory issues would stand in the way of completing this transaction.

MNG has invested in Gannett because we see significant value in Gannett’s assets, particularly its core newspaper business. However, Gannett has been moving in the wrong direction, resulting in a declining stock price and lack of confidence that the Board and existing management are willing and able to take the steps necessary to turn the Company around. Based on our industry experience, we believe that it will be very difficult for Gannett to address its operational and strategic issues as a public company, and that a sale of the Company presents the best path forward for Gannett stockholders, employees, business partners and customers.

We are keenly interested in working constructively with the Board, with the goal of getting to a successful transaction with value, speed and certainty. We ask that the Board promptly contact us to arrange an opportunity to discuss our proposal to purchase the Company. We are not asking for exclusivity, and believe that running a sale process open to other serious bidders would be in the best interests of all stockholders. We believe that our substantial “skin in the game” as a major stockholder, as well as our extensive operational experience and successful track record in the newspaper industry, enabling us to provide a home for the Company’s businesses and valued employees so they can continue to serve their local communities, should make our proposal particularly compelling. Our interest in Gannett is a reaffirmation of MNG’s commitment to the newspaper industry and our desire to grow in the newspaper business over the long term.

Who We Are

MNG runs one of the largest newspaper businesses in the U.S. by circulation with approximately 200 publications including The Denver Post, The San Jose Mercury News, The Orange County Register and The Boston Herald. We are experienced newspaper operators with a successful track record of acquiring newspaper businesses and running them in a profitable and sustainable way.

Seasoned Newspaper Operators: This is a team of veteran and seasoned Newspaper Executives that believe in what we are doing. Our top 4 Executives have a total of 128 years in the business, and an average of 32 years each. Our goals are simple: to run profitable newspapers so they will be around to serve their local communities well into the future.

Leading Industry Consolidator and Operator: MNG employs a continued focus on consolidation of operations (real estate, printing, shared services, IT, finance and administration), zero based budgeting and rationalization of labor costs. A consolidation strategy works when the consolidator is a best in class operator and brings the most value to its targets. With one of the best in class margins and a strong unlevered balance sheet, we are one of the leading industry consolidators who are able to make acquisitions of newspapers on our platform successful today and well into the future. We also recognize the importance of our valued employees to our success, and compensate our newspaper operators well and incentivize them to thoughtfully maintain and grow EBITDA the best way they know how, even in this challenging environment of secular decline.

In stark contrast to Gannett’s declining EBITDA margins as shown in Chart A, Chart B and Chart C, we have increased EBITDA margins for each of the last 4 years, and have a consolidated EBITDA margin near the top of the industry.

We Save Newspapers: When other people won’t step up, we do. We save newspapers and position them for a strong and profitable future so they can weather the secular decline.

Take our last two acquisitions – The Orange County Register and The Boston Herald. Both papers were left for dead and put into bankruptcy by their former owners, which could have caused a liquidation and a loss of all the jobs. MNG stepped up and invested in them when others wouldn’t, saving many of those jobs and providing for new jobs. We improved operations and made them viable and profitable by providing them with new leadership, a seasoned executive team and a new strategy when others clearly had failed.

Gannett is Moving in the Wrong Direction

Gannett has not been successful as a public company investment. The Company’s stock price has declined 41% from approximately $14.37 to $8.53 since its spin-off from TEGNA Inc. (NYSE: TGNA) in 2015. As shown in Table A, the Company has trailed its media peers, proxy peer group, and the S&P 500 index since its spin-off, underperforming the S&P 500 index by a staggering 67 percent over the past three years.

Approximately 90% of Gannett’s Revenue and EBITDA is from publishing. A lack of focus on managing the core business and poor capital allocation have resulted in the business experiencing a severe decline, with Adjusted EBITDA dropping by 31% from $472mm in 2014 to a projected $328mm for 2018, and Free Cash Flow down close to a staggering 50% from $274mm in 2014 to $145mm on a trailing twelve month basis. [iii] We believe that Gannett’s newspaper business could be improved and made more profitable by optimizing the Company’s cost structure and showing discipline in capital allocation with a goal of optimizing EBITDA and Free Cash Flow per share every year. However, instead of focusing on its core newspaper business and acting as the industry consolidator pitched to investors at the time of the spin-off, the Company has spent approximately $350mm on digital acquisitions since 2015. That $350mm equates to over $3.00 per share, or 36% of Gannett’s entire market capitalization.

Despite the Company’s poor stock and operating performance since the spin-off, the Company seems to be doubling down on its current strategy. As we have heard from senior leadership, and as reported in the news media, the Board appears to be looking for a new CEO with a digital rather than newspaper background.

As Gannett’s largest active stockholder, with insight and expertise in the Company’s core newspaper business, we ask the Board to shift its focus away from questionable digital acquisitions and finding a new CEO to pursue them, and toward consideration of strategic alternatives. It is imperative to act with urgency, as the Company is on its way to putting Gannett’s stockholders, valued employees, and the local communities they serve in jeopardy.

The Best Path Forward for Gannett – A Sale of the Company

The Company is at a critical juncture. Its core newspaper business is in decline. President and CEO Robert J. Dickey will step down by May 2019 and Sharon Rowlands, the CEO of ReachLocal, Inc., is leaving later this month, each of them a key figure in the Company’s current strategy. The $350mm in digital acquisitions have not yielded positive results in our view, with the Company experiencing an extended period of stock price declines, poor operating performance, and a substantial deterioration in EBITDA, EBITDA margins, Free Cash Flow and free cash flow per share, destroying more than $650mm of shareholder value. Gannett now trades at a meaningful discount relative to peers.

This has taken place while the Board has been driving the questionable digital acquisition strategy (in part by compensating senior officers based on contributions to the Company’s strategic plan, including its acquisition strategy), the Company’s corporate expenses and executive compensation have been consistently increasing, and director stock ownership has been minimal, undermining investor confidence that the Board’s interests are aligned with stockholders.

We believe that a sale of the Company presents the best path forward to maximize value for Gannett stockholders, rather than attempting in full view of the public markets to address its operational issues, find new leadership to pursue its unsuccessful strategic transformation and regain the trust of a skeptical investment community.

To reiterate, we believe that the Board should immediately take the following actions:

• Enter into discussions with MNG about a strategic combination;

• Hire an investment bank to conduct a review of strategic alternatives, including a potential sale of the Company;

• Commit to a moratorium on digital acquisitions; and

• Commit to a feasible, strategic and financial path forward before hiring a new CEO.

We request that the Board promptly contact us to arrange an opportunity to discuss our proposal to purchase the Company. If the Board refuses to engage with us in good faith and in a timely fashion, we reserve our rights to take action to protect the value of our investment, which may include seeking changes to the composition of the Board. Put plainly, MNG is committed to maximizing value for all Gannett shareholders and growing our newspaper business over the long term.

We hope that the Board will work with us to maximize value for all Gannett stockholders, and we look forward to receiving a response in an expeditious manner.

Sincerely,

/s/ R. Joseph Fuchs

On behalf of the Board of Directors, MNG Enterprises, Inc.

Chairman, R. Joseph Fuchs