Chris Perez

Audio By Carbonatix

Property values across the state have skyrocketed, prompting counties and municipalities that aren’t restricted by Colorado’s Taxpayer Bill of Rights to lick their chops at the prospect of collecting more taxes this year.

But what about the places that aren’t exempt from TABOR?

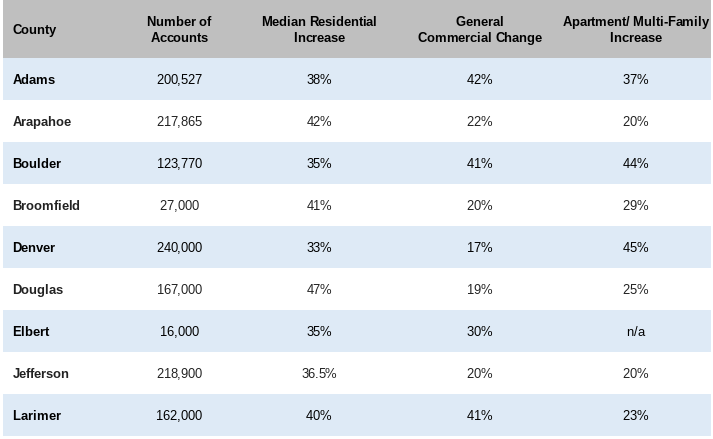

In Arapahoe County and Jefferson County, for instance, property values may be going up at an unprecedented rate – with median residential increases reported at 36.5 percent and 42 percent, respectively – but the amount of tax money that the counties get to spend is capped because of TABOR, the constitutional amendment pushed by real estate investor and California import Douglas Bruce that was designed to limit the revenue that the state and local governments can retain and was passed by Colorado voters in 1992.

Meanwhile, officials in places like Denver County, Douglas County and other counties that have become exempt from TABOR limitations through voter approval can reap the unrestricted benefits of the high assessments, without having to refund taxpayers.

“Arapahoe County is almost entirely reliant on property taxes for providing all services – everything from repairing county roads to protecting the most vulnerable residents and providing public safety and motor vehicle services,” says Anders Nelson, spokesperson for the county commissioners. “Even as property values rise, the portion the county receives is still not keeping pace to support essential services at a rate consistent with growth. The county will consider various options to address funding challenges to maintain and enhance the quality of life for its residents.”

Over the past three decades, TABOR has been one of the state’s most controversial constitutional amendments, especially in the eyes of politicians and officials.

“I don’t like TABOR,” offers Jefferson County Assessor Scot Kersgaard.

“It artificially limits – and as I’m saying this, I can see how people like it – how much we can collect in taxes and what we can do with those taxes,” Kersgaard says. “My office is underfunded; we need more people, we need to pay better salaries. Other counties pay a lot better than we do for similar jobs. … And so I feel like my hands are tied a little bit.”

Since TABOR passed, the majority of municipalities and counties in Colorado have become at least partially exempt from its provisions through a process known as “de-Brucing” – receiving voter approval to retain and spend “excess revenues above the TABOR limits,” according to Colorado Counties, Inc.

As a result, these local governments do not need to abide by the same TABOR rules that places such as Arapahoe and Jefferson counties are held to, which also means they don’t need to issue TABOR refunds and can just hold on to any extra money that comes in over the TABOR revenue limit.

To put this in perspective, in 2021 Jefferson County collected $17.3 million in revenue over the TABOR limits, and officials were forced to refund the overage to property taxpayers – 213,000 of them, to be exact, according to a September announcement. If Jeffco had de-Bruced, it would have been able to keep and spend that money.

In order to determine the actual property taxes in Colorado, the statewide assessment rate is multiplied by whatever property value is calculated by the county assessor. The result then gets multiplied again by the local mill levy rate, with mills being $1 payments on every $1,000 of assessed value.

Here’s how Investopeedia‘s Chris Seabury describes it: “Suppose the total assessed property value in a county is $100 million, and the county decides it needs $1 million in tax revenues to run its necessary operations. The mill levy would be $1 million divided by $100 million, which equals 1%.”

In response to this year’s record assessments – which could lead to record property taxes – on the last day of the 2023 legislative session Colorado lawmakers approved House Bill 23-1311, which calls for putting a property tax relief measure dubbed Proposition HH on the November ballot. If passed by voters, it could help alleviate some of the tax pain for homeowners while also leading to smaller or bigger TABOR refunds for certain people, depending on their income.

If the measure is approved, the state’s TABOR refund pool would shrink by around $167 million, according to legislators, but property tax rates would be reduced, too. The state would be allowed to retain and spend revenues that would normally have been given back to residents as TABOR refunds.

Prop HH would also allocate some of the excess to local governments as a way to make up for tax revenues lost to the property tax cuts. However, much like TABOR, it would still create a limit on the amount of property tax revenue that counties and municipalities take in.

Colorado saw historic property valuations this year across the Denver metro area and around the state.

Department of Finance

Eighty-five percent of Colorado’s municipalities and 51 of the state’s 64 counties have de-Bruced, according to the Denver Post.

Douglas County Assessor Toby Damisch points out that having so many places around the state that are not restricted by TABOR is a huge problem for the counties and municipalities that are, since the non-restricted governments often take a much more lackadaisical approach to legislative changes that would reduce taxes for residents.

As a result, people living in places like Jefferson and Arapahoe counties could get hit with higher taxes this year, while their county governments don’t benefit from those higher taxes whatsoever.

“If you look at all the taxing entities across the State of Colorado, of which there are thousands, most of them are not TABOR-restricted,” Damisch says. “Most of them have de-Bruced, and that includes most of the taxing entities in Douglas County. And that is actually causing part of the problem this year. Because those taxing entities have exempted themselves from TABOR, they can accept the additional revenue that is caused by these property value increases. And so for most residents of most counties throughout the state, they are facing possible tax increases that are matching their valuation increases, as TABOR does not, in fact, protect them.”

For example, he notes, Castle Rock is TABOR-restricted and required to automatically reduce its mill levy and return any extra money to taxpayers, whereas other entities in Douglas County – such as the schools, Douglas County government and the Douglas County Library – are not forced to do so because they have de-Bruced.

“So it’s an issue for Arapahoe County government and Jefferson County government and other governments that are not de-Bruced,” Damisch explains. “They don’t get to take advantage of what’s happening.”

Denver voters passed a de-Brucing measure in 2012. Before that, city government had been “struggling to maintain economic growth,” and it was “becoming difficult for Denver to maintain its public services,” reported University of Colorado researchers in 2015, citing an interview they’d conducted with then-Denver Chief Financial Officer Cary Kennedy that was part of a TABOR study published online by the Colorado Municipal League.

CML is a nonprofit group that “represents the interests of 270 cities and towns” across the state, according to its website.

“Libraries were forced to cut back hours, the road repaving schedule was delayed, parks were falling into disrepair from a lack of maintenance, and children who were on public subsidies were put on waitlists,” the report continued. “Ultimately, TABOR was preventing Denver from keeping up with real growth in the economy.”

Now, Arapahoe County officials say they are in the same situation.

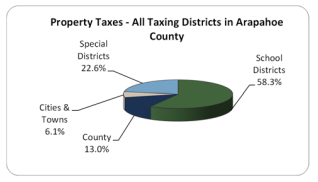

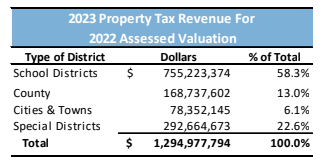

According to the county’s 2023 budget report, there are currently nine school districts, thirteen cities and towns, and 460 local and service districts within the county, but only 13 percent of the property taxes collected from those entities by the Arapahoe Country treasurer go to the county itself.

Chart showing Arapahoe County’s property tax revenue.

Arapahoe County

The remaining 87 percent is sent to the more than 420 special districts within the county for services related to school, fire, recreation, cities and towns, and library districts.

In addition to the limitations imposed by TABOR, there are special statutory mill levy limits on law enforcement authorities. “These are different than the limit for any other local governments,” says the report.

Arapahoe County’s 2023 property tax revenue for the 2022 assessed valuation is estimated at $168,737,602 – which puts it second to last for taxing districts in the county. Cities and towns bring up the rear with a total of $78,352,145 in tax revenue, or 6.1 percent of the take, according to the budget report.

School districts and special districts, meanwhile, rake in $755,223,374, or 58.3 percent, and $292,664,673, or 22.6 percent, respectively.

Arapahoe County’s property tax revenue is second to last out of all county departments.

Arapahoe County

“While values grew by double digits, the county’s coffers won’t see significant increases for critical services,” Arapahoe officials charged in an April 27 announcement after the state’s property values report was released.

“For example, if an average home valued at $500,000 has a property tax bill of $3,400, the county only retains about $430 to provide critical services that residents expect, such as public safety and road maintenance, which clearly does not cover the cost of such services,” the county officials explain. “Current growth projections suggest that the county will add almost 200,000 new residents in the next seven years, so this challenge will be further compounded absent an increase in the County’s revenues.”

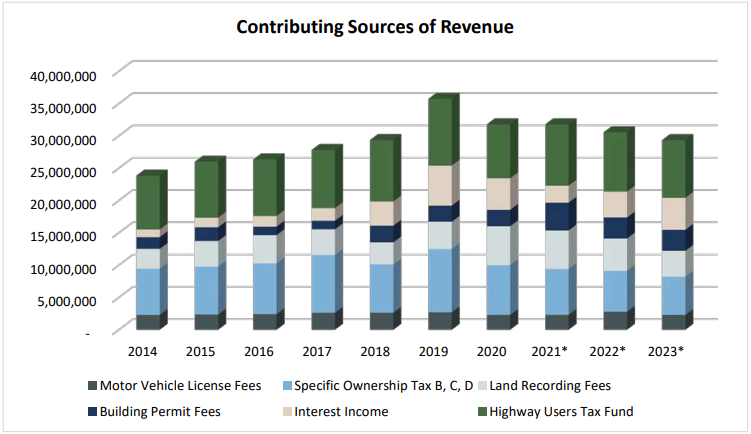

A graph showing some of Arapahoe County’s other sources of revenue.

Arapahoe County

According to Arapahoe County data, TABOR has been restricting the county’s revenue growth in recent years to around 5 to 7 percent year over year – depending on inflation and new construction.

While every county is set up differently in terms of what services it provides, many are going through similar TABOR-related dilemmas.

“Yeah, Jeffco’s got some TABOR problems,” says Jefferson County assessor Kersgaard. “Everyone that’s subject to TABOR has issues with TABOR.”

If you look at the history of valuations and taxes in Jefferson County, he explains, values tend to go up pretty much every cycle – prompting the county’s more than 200 tax entities to reduce their mills. “That puts a damper on how much taxes go up,” Kersgaard says.

He admits that Damisch has a good point regarding TABOR-exempt counties and municipalities possibly dragging their feet on tax-relief legislation. But he says he tries to stay as optimistic as possible when it comes to local government.

“There could be a temptation, in a job like this, to go, ‘I’m going to keep values high because the county needs the money and I need to hire more people,'” Kersgaard points out, adding that on the flip side, “There might be a temptation to say, ‘I want to try and keep values low, because I’m a homeowner and I don’t want to pay taxes.’ But those are both the wrong answers if you’re the county assessor,” he notes.

Still, the right answer isn’t easy to come by. “Put yourself in the position of a fire district, for instance, that is broke or basically broke,” Kersgaard says. “They don’t have the equipment they need to fight fires. And they get a windfall because values are up 30 percent. They’re going to look at each other and go, ‘New fire truck?’ So I get it. It’s not like Toby or [Arapahoe County] are wrong. I see things a little differently, but they’re not wrong.”

Kersgaard suggests that what Colorado needs most right now is a better understanding “of what we’re doing with property tax” following the state’s recent wave of historically high valuations. “Instead of the legislature stepping in pretty much every single year these days and changing the assessment rate…couldn’t we just talk this stuff out and figure out a plan that will work year to year?” he asks.

Roughly half of the tax money that Jeffco collects goes to its one and only school district; the county gets a little under 25 percent, and then the rest is “divided by the other 220 districts,” Kersgaard says.

“The 2023 Budget reflects our continuing effort amid these ongoing challenges to provide proactive, first-class services to the residents and businesses of our community, while constrained by TABOR-related revenue shortfalls exacerbated by the financial consequences of a global pandemic,” said acting county manager Kate Newman in a message included with Jeffco’s 2023 Budget report.

“Our ability to successfully navigate these post-pandemic challenges remains hindered by our budgetary limitations,” she added, noting that COVID-19 caused Jefferson County to “collect much less revenue in 2020,” and it’s still suffering as a result.

“Our TABOR revenue limit must now incrementally grow from this reduced funding for public services,” Newman continued. “The TABOR formula limits growth and ratchets down revenue during economic downturns and does not rebound during recovery, reducing our ability to respond to evolving public needs in a flexible, sustainable, and strategic way. Additionally, while population growth may be stabilizing, the formula used to determine TABOR revenue limits does not factor in population growth. Jefferson County must now also sustain and improve our infrastructure and service offerings for a population much larger than a decade ago. The total revenue the county was authorized to collect exceeded the TABOR limit by $17.3M in 2021, and as a result, the excess amount was refunded as required by law.”

While TABOR has largely done what it was designed to do in limiting government spending, many people wonder at what cost.

“In some ways, it’s at the cost of good government,” Kersgaard says. “I totally get people not trusting government – I get it. I get people not wanting to pay any more taxes than they have to pay. I mean, we’re all in that boat together. But I have a different view, I guess. I believe government has a purpose.”

Jefferson County has floated a number of ballot measures in recent years that would have partially de-Bruced the county and allowed it to keep grant money and other revenue that now go against the TABOR cap. “The voters have said no every time we’ve asked them,” Kersgaard points out. “And that’s interesting. It’s not contradictory, necessarily. Jeffco has gone somewhat liberal lately, so they like voting for people who are somewhat liberal. But they’re not going to give us free rein, either. So I don’t know what the answer is.”

According to CU researchers, there are a number of possible solutions for the TABOR restrictions and funding problems facing local governments. And all of them require getting voters on board.

“We use interviews from four city officials to formulate case studies of municipalities that have successfully passed TABOR-related ballot initiatives,” the CU researchers reported in 2015. “We discovered that without intervention, [TABOR’s] largest effect on local governments is not allowing them to provide high levels of basic services to its citizens. Our research suggests that municipalities wishing to pass a TABOR-related ballot initiative will be more effective if they pass revenue retention measures as opposed to tax increases, use ordinances rather than resolutions in the propositions, and avoid property taxes. TABOR can provide numerous difficulties to local governments, but with careful planning and well-thought-out ballot measures, many of TABOR’s restrictions can be mitigated.”

For their study, the CU researchers interviewed Cathy Noon, then mayor of Centennial; Kennedy, the chief financial officer for the City and County of Denver at the time; Matt LeCerf, then town manager of Frederick; and Patrick Rondinelli, who was the city administrator in Ouray.

“We believe that these four towns give us a good sample of different types of municipalities across Colorado,” the researchers said. “All four of these municipalities have passed different ‘de-Brucing’ measures of various scopes, and therefore have had the experience of dealing with TABOR both with and without relief from the restrictions set forth.”

When a municipality or county was struggling from TABOR restrictions, researchers determined that typically, the best option was to propose a ballot initiative that “grants the municipal government more revenue” instead of a tax increase.

Overall, the CU researchers reported that TABOR results in “many difficulties for local governments,” and noted that most of its restrictions can be “exacerbated” by public opinion.

“If a local government decides to mitigate the effects of TABOR, there are steps to take to pass a successful ballot measure removing some of TABOR’s restriction,” the researchers said. “By considering all aspects of how TABOR affects a community, and then creating a ballot measure that is crafted to the specific needs of a municipality and its populace, we can reduce the negative impacts that TABOR has on local governments.”