Chris Perez

Audio By Carbonatix

Home values have skyrocketed across the state of Colorado, according to county assessors – and property owners could pay a hell of a lot more in property taxes next year.

But that dire prediction didn’t stop some of the metro area’s assessors from taking a victory lap at a gathering held at the Denver City and County Building on April 26, when they revealed “historic” and “unprecedented” value increases for both residential and commercial properties.

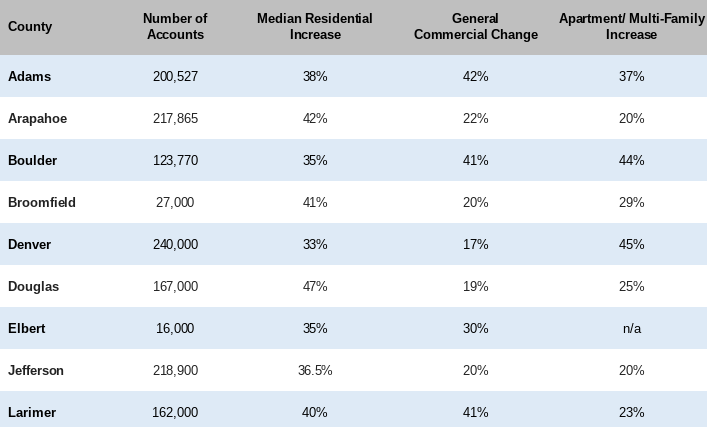

Residential property throughout the region saw a whopping 35 to 45 percent boost in value when assessed in June 2022. Denver County recorded a median increase of 33 percent in home values, while the second and third largest counties in the metro area by population – Jefferson and Arapahoe – reported median residential increases of 36.5 percent and 42 percent, respectively.

According to Denver County Assessor Keith Erffmeyer, there’s “good news” in the fact that property valuations have jumped, despite the predicted rise in property taxes.

“If you’re a property owner who might consider selling your property, an increase in values is a good thing,” Erffmeyer said. “Generally speaking, it’s better than the alternative. We’re not going through some sort of recession, where people are losing values on their homes and things like that. I know personally, I’d rather see my property value go up than down.”

But Douglas County Assessor Toby Damisch disagreed, and he blasted Erffmeyer’s “good news” claim from the podium. “I want to pour a little cold water on the notion that this is any kind of ‘kumbaya’ moment,” he said. “I happen to think this is very, very serious. Anecdotally, county assessors on a daily basis get to interact with small businesses, homeowners and renters, and the story that I hear every day is affordability is a crisis, and pricing in the real estate market is a very serious situation. And if you look at the past couple of years where we’ve seen pricing go up, interest rates go up, homeowners’ insurance skyrocket, and you look at what our mortgage payments are composed of…if state lawmakers don’t act immediately on this, then it will be a crisis, in my opinion.”

Douglas County is reporting a possible 40 to 50 percent increase in property taxes for 2024 and 2025.

After the Gallagher Amendment – which had put the majority of Colorado’s total property tax burden on non-residential or commercial properties – was repealed in 2020, proposals started coming in that would protect homeowners from major property tax increases. The assessors at the April 26 meeting, who hailed from nine counties, noted that several bills are still moving through the Colorado Legislature related to property taxes. But the legislative session must end by May 8, and there are still hundreds of other proposals under consideration.

“We’ve never seen, I think we would all agree, something this historic or unprecedented,” Erffmeyer said. “I’d be speculating in saying this, but I think if you took a poll of all 64 counties in Colorado, a vast majority of them would say this is the largest median increase they’ve seen in recent memory.”

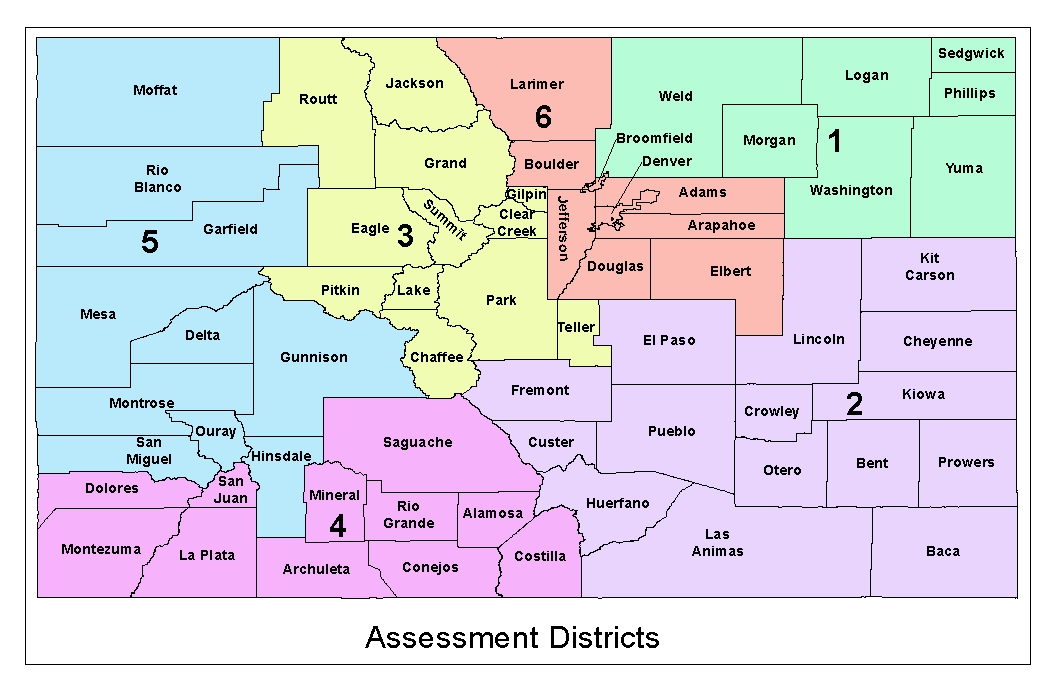

A map of the counties in each of Denver’s six regional districts.

Department of Finance

After the meeting, and in response to Damisch’s statements, Erffmeyer told Westword that he didn’t see anything wrong with being positive about the statewide increases in property values.

“I wouldn’t say it’s a bad news story, but I don’t know if everybody would be totally thrilled about their property value going up, either,” he said. “I think it can kind of be both, I think it can be a serious issue as it relates with property taxes; I don’t think that would surprise anyone – and it certainly isn’t surprising the legislature, because they’re wanting to do something about it. But at the same time, it can be true that, you know, I’d rather my property be worth more than less.”

Was the negativity surrounding the value increases simply an issue of not being able to please everyone? “It is,” Erffmeyer responded.

“We have 240,000 accounts – each of them have certainly different perspectives,” he noted. “Someone might be very happy that property values are going up because they’re about to sell and maybe downsize or move to Florida or something. Others might be entering the market and just see that and go, ‘I don’t think I’m ever going to be able to buy a house.’ So there are a multitude of different perspectives in terms of being pleased or displeased about property values going up.”

According to Erffmeyer, the county assessors’ main focus right now is on assessments, which form the basis of how much a property is taxed. “A thing I hear quite often, in terms of property taxes, is: ‘I don’t mind paying them, I just want to pay my fair share,'” he said. “And that’s kind of what our primary job is. Because fair share to us means your value is accurate as compared to everyone else.”

While a future recession could cause property values to drop, as Erffmeyer noted during his time at the podium, Coloradans wouldn’t see a reduction in their property tax bills until the counties issue new assessments in 2025.

“June 30, 2022, is the point in time in which we look at,” he noted. “A lot of things can happen between now and [next reassessment]. When that time comes, we’ll perform the same exercise we perform every two years, and probably have an announcement such as this about the result.”

The nine county assessors who showed up for the briefing included Erffmeyer, Damisch, Adams County Deputy Assessor Tom Swingle, Arapahoe County Assessor PK Kaiser, Boulder County Assessor Cynthia Braddock, City and County of Broomfield Assessor Jay Yamashita, Elbert County Assessor Susan Murphy, Jefferson County Assessor Scot Kersgaard and Larimer County Assessor Bob Overbeck.

Colorado Property Tax Administrator JoAnn Groff also made an appearance and urged residents not to take out their concerns over valuations on the assessors. “Don’t be mad at the people at this table,” she said.

Douglas County’s 47 percent median increase in property value led the way for counties in the metro area – with Arapahoe and Broomfield coming in next, with 42 percent and 41 percent, respectively.

“The areas within Arapahoe County with the largest gains in residential property value were Aurora, Littleton and Englewood,” said Arapahoe County’s Kaiser. “Single-family residential properties with the greatest level of demand and highest percentage increases were found in the lower price tiers, while the market for higher value homes was slightly softer, resulting in moderate percentage increases.”

Larimer County saw a 40 percent median residential increase, Adams came in at 38 percent, Boulder at 35 percent, and Elbert at 35 percent.

A chart showing property increases in the Denver metro area.

Department of Finance

“We encourage property owners to double-check their property information and review comparable property sales via our website. If they find any errors or disagree with the values, they are encouraged to file an appeal by the June 8 deadline,” said Braddock, Boulder’s assessor.

Under Colorado law, property in the state is revalued every two years during odd-numbered years. For this round of assessments, the primary data on transactions and market conditions was tallied between January 1, 2021, and June 20, 2022.

“Certified property values are one part of a three-part equation to determine property taxes,” according to the Denver Department of Finance. “The assessment rate, determined by the state legislature, and the tax rate (or mill levy), set by the various taxing authorities, are the other core components of property taxes. Residents will not know how much their property taxes due in 2024 are until the end of the year, when both the tax rate and the assessment rate are set.”

But in the meantime, property value assessments are already landing in mailboxes around the metro area…and the howling from homeowners has started.