Jacqueline Collins

Audio By Carbonatix

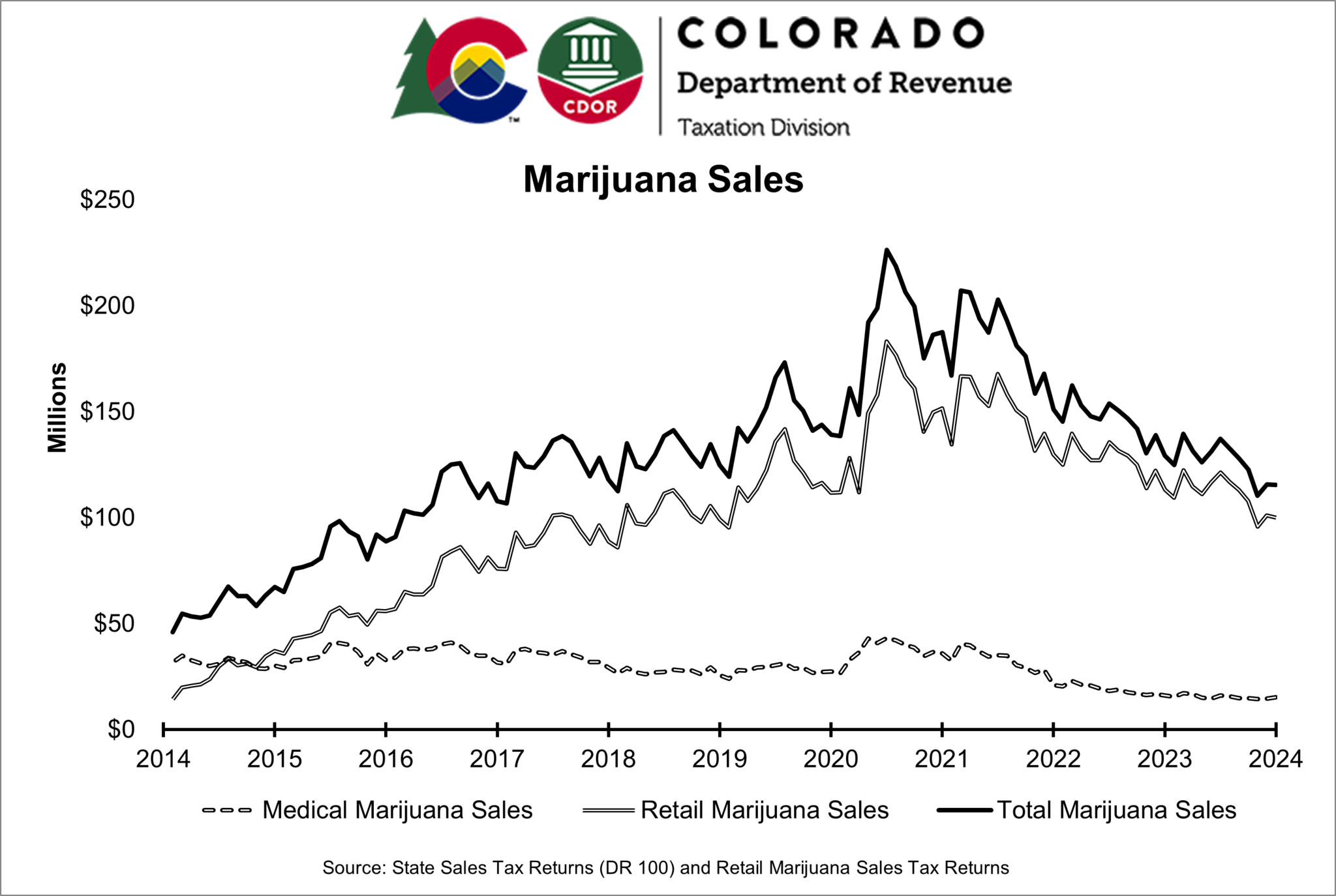

Colorado marijuana sales started off cold in 2024, reaching just under $115.4 million in January, according to recently revised numbers from the state Department of Revenue.

January’s sales figure represents a slight dip from the $115.8 million collected by dispensaries in December of last year, and around 11 percent less than January 2023’s $129.4 million in pot sales. It’s also the lowest total Colorado dispensaries have seen in January since 2017 – and nearly 49 percent lower than January 2021’s record $187.6 million.

Marijuana prices and sales dropped rapidly in the latter half of 2022 and all of 2023, after record-breaking sales during the COVID-19 pandemic. The decline in dispensary sales reflects similar drops in the state’s marijuana workforce and number of business licenses, with cannabis jobs falling around 30 percent from 2022 to 2023 and retail cultivation permits dropping around 21 percent during the same span.

Business closures have followed Colorado’s marijuana sales decline, with a handful of notable stores and brands shutting down in 2023. This year is off to a similar start. In January, longtime edibles manufacturer 1906 announced it was ending operations in Colorado due to decreasing revenue. In late February, southern Colorado chain Maggie’s Farm revealed it had closed five of its seven dispensaries.

Monthly marijuana sales figures released by the DOR on Monday, March 11, originally touted a 7.5 increase in sales from December to January and over $124.5 in overall sales. This was because of a data entry error incorrectly showing a 170 percent increase in medical marijuana sales from December to January in El Paso County, according to DOR communications manager Heather Draper.

The DOR’s next monthly report could be even bleaker for dispensary sales figures, which traditionally drop from January to February, historical data shows.

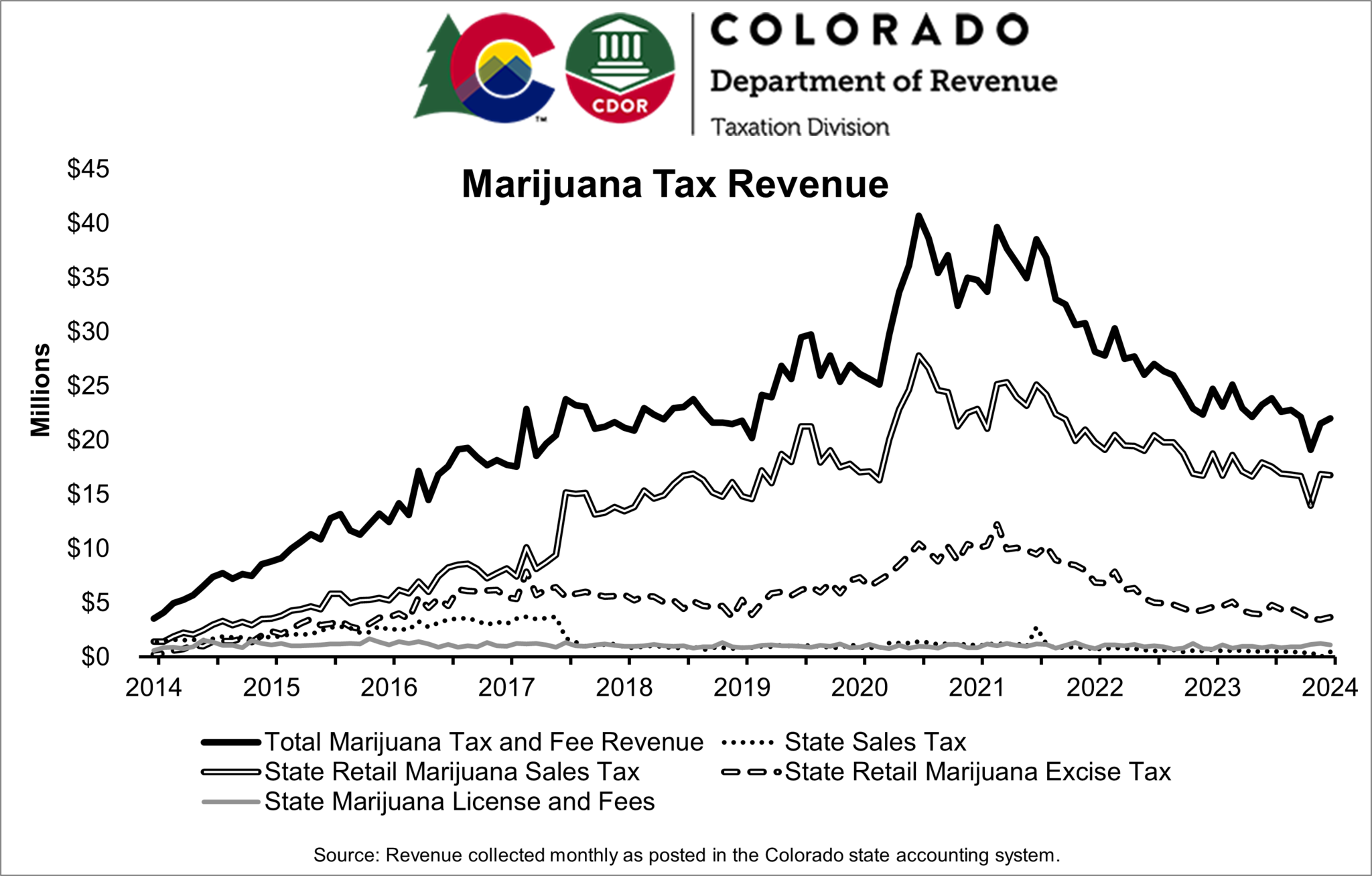

Even with a plateauing pot industry, legal marijuana still brings in hundreds of millions of dollars in tax revenue each year. Since 2014, the State of Colorado has collected almost $2.7 billion in taxes, according to DOR data, and local municipalities have collected millions more.

Colorado marijuana sales as of January 2024

Colorado Department of Revenue

Marijuana Tax Revenue in Colorado

Colorado collected just over $274.1 million in commercial marijuana taxes and licensing fees in 2023, according to the DOR, and has tallied a little more than $43.5 through the first two months of 2024.

After more than ten full years of both medical and recreational marijuana sales, the state has collected a total of nearly $2.7 billion in pot tax revenue, DOR data shows. However, tax revenue has been falling since reaching a record high two years ago.

Colorado collects four forms of marijuana taxes and licensing fees from the legal marijuana industry: a 15 percent tax on recreational pot sales, a 15 percent excise tax on wholesale marijuana, a 2.9 percent sales tax on recreational and medical marijuana purchases, and various licensing and application fees that state-approved marijuana businesses must pay. And that’s not counting local marijuana tax rates, which vary depending on the county or municipality.

For example, a recreational dispensary purchase in Denver currently is taxed at 26.41 percent, which includes the state’s 15.5 percent marijuana sales tax, Denver’s standard municipal sales tax and the city’s special taxes on retail marijuana. On top of their own local taxes, Colorado towns and counties allowing recreational sales collectively receive around 10 percent of the state sales tax on recreational marijuana.

Earlier this year, Denver crossed the $500 million mark in local marijuana tax revenue collection; the money helps pay for housing support programs, youth marijuana prevention campaigns, law enforcement and social equity entrepreneurial funds. But as marijuana sales decline in Colorado, both the state and local governments are coming to grips with a drying well of funding.

In Aurora, where around 25 dispensaries operate, marijuana tax revenue allocations are expected to decrease from around $3 million annually in 2021 and 2022 to $1.5 million in 2023, according to city officials. Denver marijuana tax revenue has dropped as well, going from nearly $73 million in 2021 to $54.8 million in 2022, according to the Denver Department of Excise & Licenses.

Colorado marijuana tax revenue as of February 2024

Colorado Department of Revenue

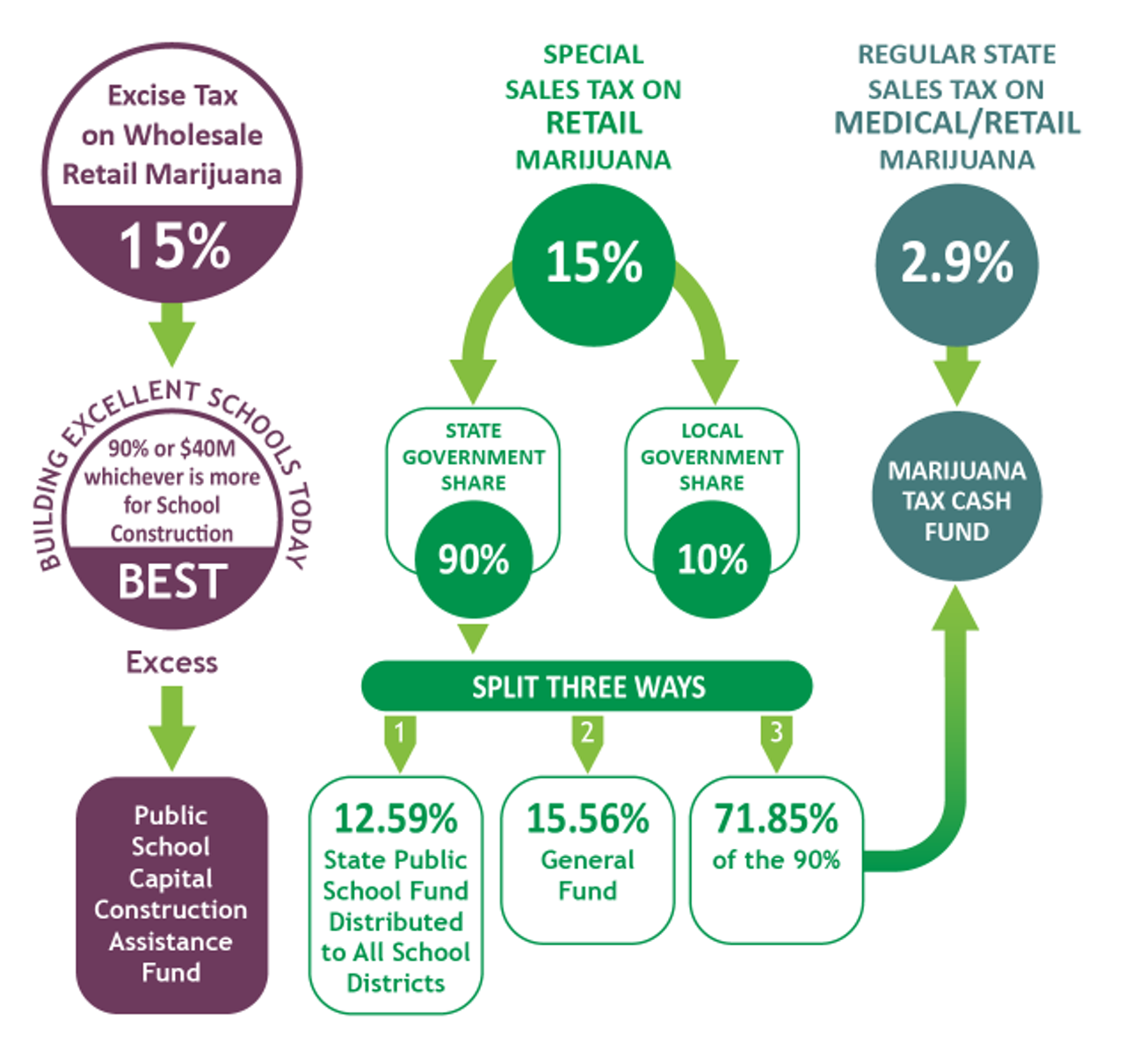

How Colorado spends marijuana tax revenue

Educational funding was a major selling point for recreational marijuana’s initial legalization, but a common complaint among Coloradans since 2014 has been a lack of transparency in how that money directly impacts schools. To be fair, though, the system is complicated.

Public education in Colorado receives marijuana tax revenue through the state’s Building Excellent Schools Today (BEST) fund – a matching grant program – and the Marijuana Tax Cash Fund. Local governments can distribute their own marijuana tax revenue to schools, as well. The BEST fund annually receives either $40 million or 90 percent of the state’s 15 percent wholesale and excise tax revenue on recreational pot sales, whichever is greater.

A program that helps public schools rebuild, repair or replace primary educational facilities, the BEST fund has received over $580 million from marijuana tax revenue since recreational sales began in 2014, according to the Colorado Department of Education.

Revenue allocated to the Colorado State Public School Fund – a general education fund built on 12.59 percent of the state’s nine-tenths share of the special sales tax on recreational pot and available to all school districts – has accounted for around $108.5 million from 2017 to 2021.

The remaining tax revenue from the state’s special sales tax on recreational marijuana goes to the General Fund and a local government shareback program for cities and counties with marijuana businesses, which receives 10 percent. Revenue from Colorado’s 2.9 percent standard sales tax on pot sales also goes toward the Marijuana Tax Cash Fund. The state’s Marijuana Tax Cash Fund, built on the 15 percent sales tax, was created by the Colorado Legislature in 2014 to support health care, substance abuse services, law enforcement and marijuana-impact research, as well as public school programs.

Colorado marijuana tax revenue as of December 2023.

Colorado Department of Education