Thinkstock file photo

Audio By Carbonatix

A new study estimates that it will take 83 percent of Denver millennial renters twenty years or more to save enough for a 20 percent down payment on a median-priced condo at current market value.

That’s the longest wait for the highest percentage of millennial renters living in any of America’s twenty largest cities, and it makes the goal of home ownership an impossible one for many residents of the Mile High.

The grim news is delivered by Apartment List in “2018 Millennial Homeownership Report: American Dream Delayed,” a report whose co-author, Rob Warnock, supplied Westword with the statistical breakdown on view below. As you’ll see, the figures are even more dire than they were in June 2017, when a previous Apartment List survey calculated that it would take most Denver millennials sixteen years to afford a down payment on a home.

While the situation in Denver is the most extreme among any of the biggest U.S. metros, it’s indicative of a common issue for today’s young renters.

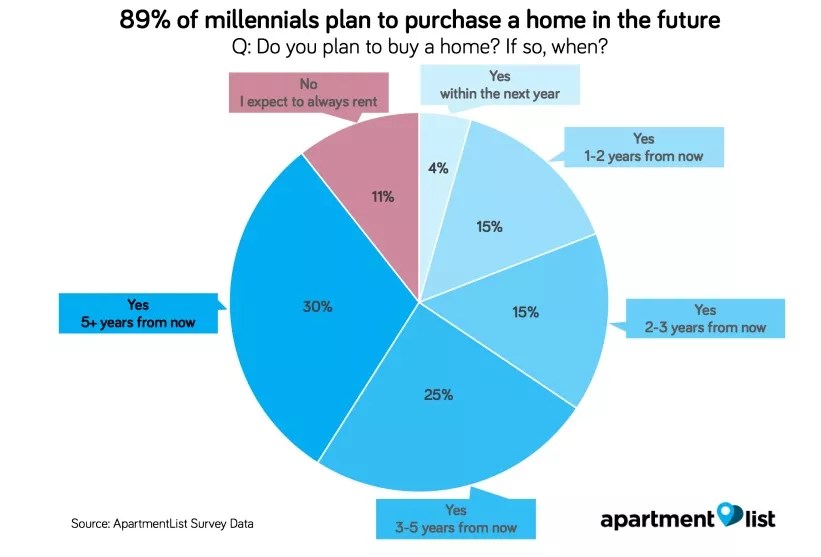

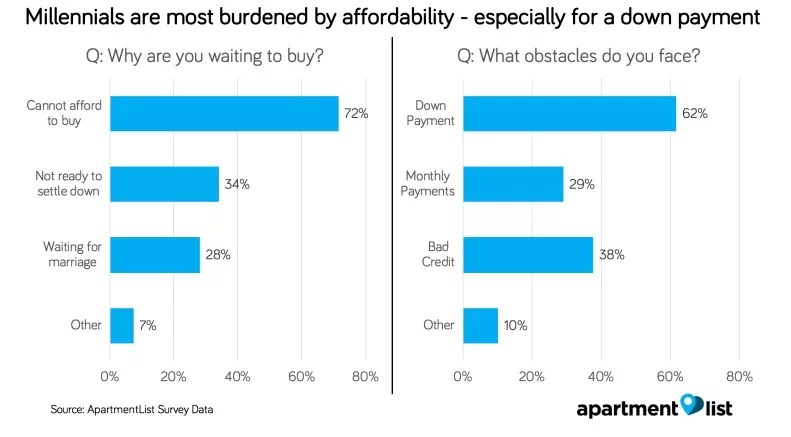

According to data gathered by Warnock and fellow author Chris Salviati and illustrated in graphics seen here, nine out of ten millennial renters want to buy a home of their own, but just 4.9 percent think it’s possible to do so within the next year. That’s because 72 percent of millennial renters with home-buying on their mind are putting off a purchase because they simply can’t afford it – and 62 percent pinpoint an inability to come up with enough folding green for a down payment as the reason.

That’s no surprise. After all, Warnock and Salviati note that 48 percent of millennial renters have no savings set aside for a down payment on a home, and only 11 percent have set aside $10,000 or more for this purpose. Hence, around two-thirds of millennial renters will need two decades or more to collect the cash necessary for a 20 percent down payment on an average condo in their city, let alone a standalone house.

The situation is worse in major cities, where the cost of living is often higher than in smaller communities. In twelve of the twenty municipalities on the Apartment List roster, the number of millennial renters thought to need at least two decades to cobble together a down payment exceeds the two-thirds mark, with Denver winding up at the barrel’s bottom in this respect.

Continue to count down the stats for millennial renters in the nation’s twenty most populous cities, ranked from the lowest to the highest percentage for estimates of twenty years or more to afford a 20 percent down payment.

ESTIMATED YEARS NEEDED TO SAVE FOR 20 PERCENT DOWN PAYMENT

Number 20: Miami, Florida

20 years or more: 50.5 percent

10-20 years: 18.1 percent

5-10 years: 17.1 percent

Less than 5 years: 14.3 percent

Number 19: Philadelphia, Pennsylvania

20 years or more: 59.8 percent

10-20 years: 17.1 percent

5-10 years: 8.5 percent

Less than 5 years: 14.5 percent

Number 18: Orlando, Florida

20 years or more: 60.8 percent

10-20 years: 13.5 percent

5-10 years: 12.2 percent

Less than 5 years: 13.5 percent

Number 17: Chicago, Illinois

20 years or more: 62.8 percent

10-20 years: 6.6 percent

5-10 years: 14.6 percent

Less than 5 years: 16.1 percent

Number 16: Charlotte, North Carolina

20 years or more: 62.9 percent

10-20 years: 9.7 percent

5-10 years: 14.5 percent

Less than 5 years: 12.9 percent

Number 15: New York, New York

20 years or more: 63.0 percent

10-20 years: 10.9 percent

5-10 years: 11.4 percent

Less than 5 years: 14.7 percent

Number 14: Houston, Texas

20 years or more: 64.5 percent

10-20 years: 7.5 percent

5-10 years: 9.7 percent

Less than 5 years: 18.3 percent

Number 13: Portland, Oregon

20 years or more: 66.7 percent

10-20 years: 14.8 percent

5-10 years: 16.7 percent

Less than 5 years: 1.9 percent

Number 12: Minneapolis, Minnesota

20 years or more: 67.4 percent

10-20 years: 16.3 percent

5-10 years: 12.8 percent

Less than 5 years: 3.5 percent

Number 11: Dallas, Texas

20 years or more: 67.7 percent

10-20 years: 15.0 percent

5-10 years: 11.3 percent

Less than 5 years: 6.0 percent

Number 10: Atlanta,Georgia

20 years or more: 68.0 percent

10-20 years: 13.4 percent

5-10 years: 10.3 percent

Less than 5 years: 8.2 percent

Number 9: Los Angeles, California

20 years or more: 69.0 percent

10-20 years: 14.2 percent

5-10 years: 9.1 percent

Less than 5 years: 7.6 percent

Number 8: Washington, D.C.

20 years or more: 70.7 percent

10-20 years: 6.4 percent

5-10 years: 8.6 percent

Less than 5 years: 14.3 percent

Number 7: Phoenix, Arizona

20 years or more: 71.1 percent

10-20 years: 11.1 percent

5-10 years: 8.9 percent

Less than 5 years: 8.9 percent

Number 6: Seattle, Washington

20 years or more: 73.8 percent

10-20 years: 4.8 percent

5-10 years: 7.1 percent

Less than 5 years: 14.3 percent

Number 5: Boston, Massachusetts

20 years or more: 75.0 percent

10-20 years: 13.4 percent

5-10 years: 6.3 percent

Less than 5 years: 5.4 percent

Number 4: Austin, Texas

20 years or more: 77.3 percent

10-20 years: 9.1 percent

5-10 years: 1.5 percent

Less than 5 years: 12.1 percent

Number 3: San Diego, California

20 years or more: 79.5 percent

10-20 years: 8.4 percent

5-10 years: 4.8 percent

Less than 5 years: 7.2 percent

Number 2: San Francisco, California

20 years or more: 82.3 percent

10-20 years: 9.7 percent

5-10 years: 1.6 percent

Less than 5 years: 6.5 percent

Number 1: Denver, Colorado

20 years or more: 83.3 percent

10-20 years: 9.7 percent

5-10 years: 2.8 percent

Less than 5 years: 4.2 percent