Scott Lentz

Audio By Carbonatix

Colorado’s vote to legalize recreational marijuana in November 2012 made the state flush with green in more ways than one. Just over a year after voters approved the landmark amendment, recreational dispensaries opened for business on January 1, 2014, and the country hasn’t looked back. Since then, 23 more states have followed suit.

As the only state with a decade of sales under its belt, however, Colorado has racked up some real records. Over $15 billion in sales, nearly $3 billion in tax revenue, and ten high and hungry years later, here are the numbers:

How Much Money Has Legal Marijuana Made?

Since 2014, Colorado dispensaries have sold almost $15.28 billion in cannabis and marijuana projects, according to the Colorado Department of Revenue’s most recent sales reports released in October, with recreational sales responsible for a little more than two-thirds of that amount, $11.78 billion.

Annual marijuana sales increased in Colorado for seven straight years after recreational sales began, going from about $683.5 million in 2014 to nearly $2.23 billion in 2021. Dispensary sales began decreasing in 2022, however, dropping about 20 percent year over year. Marijuana sales data from the DOR shows that 2023 dispensary sales are on track to break $1.5 billion for 2023, which would be around 12 to 15 percent less than the $1.77 billion Colorado dispensaries sold in 2022.

While more towns and counties in the state still ban marijuana dispensaries than allow them, most of Colorado’s largest cities, including Denver, Aurora, Boulder and Pueblo, have opted in over the last ten years. (Colorado Springs, the state’s second-largest city, allows medical marijuana sales, but still bans recreational dispensaries.) Although that list started out small, it has progressively grown over the past ten years, with Grand Junction the most recent notable outpost to joint the party. And some popular ski towns, such as Aspen, also allow dispensaries.

After years of growth and record-breaking performances during the COVID-19 pandemic, Colorado’s marijuana industry experienced an oversupply of product, decreasing prices and plummeting dispensary sales in 2021 and 2022. This led to a 30 percent cut in the state’s marijuana labor force in 2023 and a long list of business closures. Although wholesale prices are now slowly climbing back up, the years of $2 billion in dispensary sales could be over.

Marijuana Tax Revenue

Since 2014, Colorado’s marijuana industry has been responsible for just under $2.6 billion in tax revenue. The total comes from a handful of marijuana-specific taxes, such as a dispensary sales tax and grower excise tax, as well as business licensing fees in the pot industry. And this tally doesn’t count local marijuana sales taxes or licensing fees imposed at the county or municipal levels, which have brought in millions in revenue for local governments, as well.

For example, a recreational dispensary purchase in Denver currently is taxed at 26.41 percent, which includes the state’s 15.5 percent marijuana sales tax, Denver’s standard municipal sales tax and the city’s special taxes on retail marijuana. On top of local tax collections, Colorado towns and counties allowing recreational sales receive around 10 percent of the state sales tax on recreational marijuana, a 15 percent rate on dispensary purchases. Earlier this year, Denver crossed the $500 million mark in local marijuana tax revenue collection; the money helps pay for local housing support programs, youth marijuana prevention campaigns, law enforcement and social equity entrepreneurial funds.

As marijuana sales decline in Colorado, both the state and local governments are coming to grips with a drying well of funding. In Aurora, where around 25 dispensaries operate, marijuana tax revenue allocations are expected to decrease from around $3 million annually in 2021 and 2022 to $1.5 million in 2023, according to city officials. Denver marijuana revenue has dropped as well, going from nearly $73 million in 2021 to $54.8 million in 2022, according to the Denver Department of Excise & Licenses.

How is Marijuana Tax Revenue Spent?

According to DOR data, marijuana tax revenue accounted for about 0.7 percent of the state’s budget in 2022.

Educational funding was a major selling point for recreational marijuana’s initial legalization, but a common complaint among Coloradans since then has been a lack of transparency in how that money directly impacts schools. To be fair, though, the system is complicated.

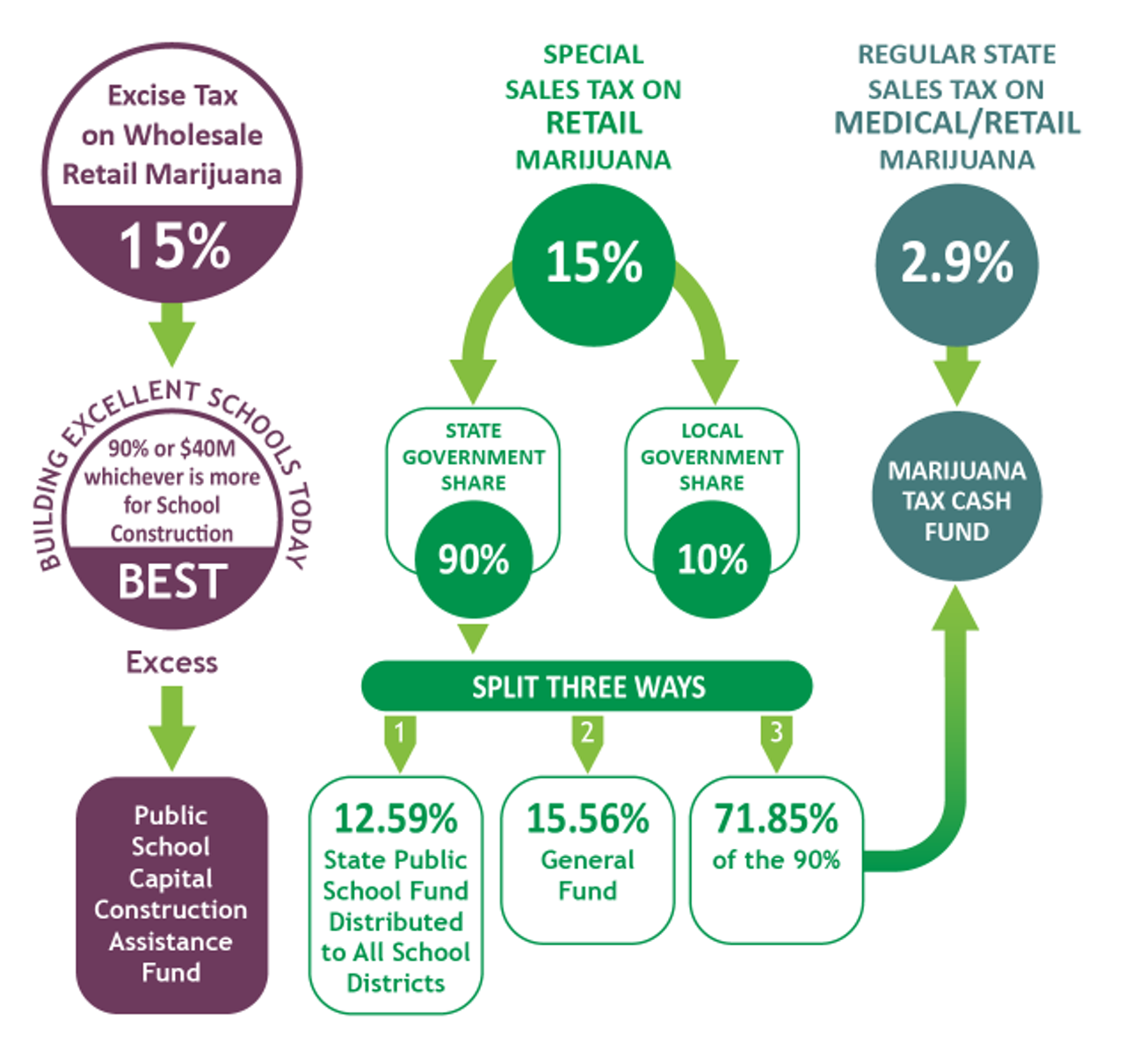

Public education in Colorado receives marijuana tax revenue through the state’s Building Excellent Schools Today (BEST) fund – a matching grant program – and the Marijuana Tax Cash Fund. Local governments can distribute their own marijuana tax revenue to schools, as well. The BEST fund annually receives either $40 million or 90 percent of the state’s 15 percent wholesale and excise tax revenue on recreational pot sales, whichever is greater.

Colorado Department of Education

A program that helps public schools rebuild, repair or replace primary educational facilities, BEST has received over $580 million from marijuana tax revenue since recreational sales began in 2014, according to the Colorado Department of Education. Revenue allocated to the Colorado State Public School Fund – a general education fund built on 12.59 percent of the state’s nine-tenths share of the special sales tax on recreational pot that’s available to all school districts – has accounted for around $108.5 million from 2017 through 2021, with numbers for the past two years not yet reported.

The remaining tax revenue from the state’s special sales tax on recreational marijuana goes to the General Fund and a local government shareback program for cities and counties with marijuana businesses, which receives 10 percent. Revenue from Colorado’s 2.9 percent standard sales tax on pot sales also goes to the Marijuana Tax Cash Fund. That fund, was created by the Colorado Legislature in 2014 to support health care, substance abuse services, law enforcement and marijuana-impact research, as well as public school programs.

Local governments are largely in charge of how they allocate their marijuana revenue. In Pueblo, an early adopter of commercial marijuana cultivations, local marijuana revenue has paid for college scholarships, while cities such as Aurora and Denver have used funding for affordable housing services and to build new recreation centers. During the COVID-19 pandemic, Trinidad’s surplus marijuana revenue was allotted to grants for struggling or shut-down businesses.