Scott Lentz

Audio By Carbonatix

Colorado officially hit a major marijuana milestone in August, when it crossed the $15 billion mark in dispensary sales, according to the state Department of Revenue.

The state saw just over $132.4 million in marijuana sales in August, pushing Colorado’s dispensary sales total to $15.028 billion since 2014, the year that recreational pot shops opened. (Medical marijuana dispensaries have been operating in Colorado since 2008, so the state likely reached $15 billion in dispensary sales months ago – but the DOR didn’t begin tracking sales and tax collection data until 2014.)

People love numbers, and $15 billion is a big one. That’s a lot of weed.

With $15 billion, you could match the GDP of a small country, buy a couple thousand Gulfstream G5 jets or purchase the Denver Broncos three times over.

The $15 billion milestone reflects the longevity of the market rather than its current condition, however. After years of successive growth and record-breaking performances during the COVID-19 pandemic, Colorado’s marijuana industry experienced an oversupply of product, decreasing prices and plummeting dispensary sales in 2021 and 2022, which in turn led to a 30 percent cut in the state’s marijuana labor force. Wholesale prices are now slowly climbing back up, but the years of $2 billion in dispensary sales could be over.

Even with a plateauing pot industry, legal marijuana still brings in hundreds of millions of dollars in tax revenue each year, according to DOR data. Since 2014, the State of Colorado has collected over $2.5 billion in taxes, and local municipalities have collected millions more.

How Colorado spends marijuana tax revenue

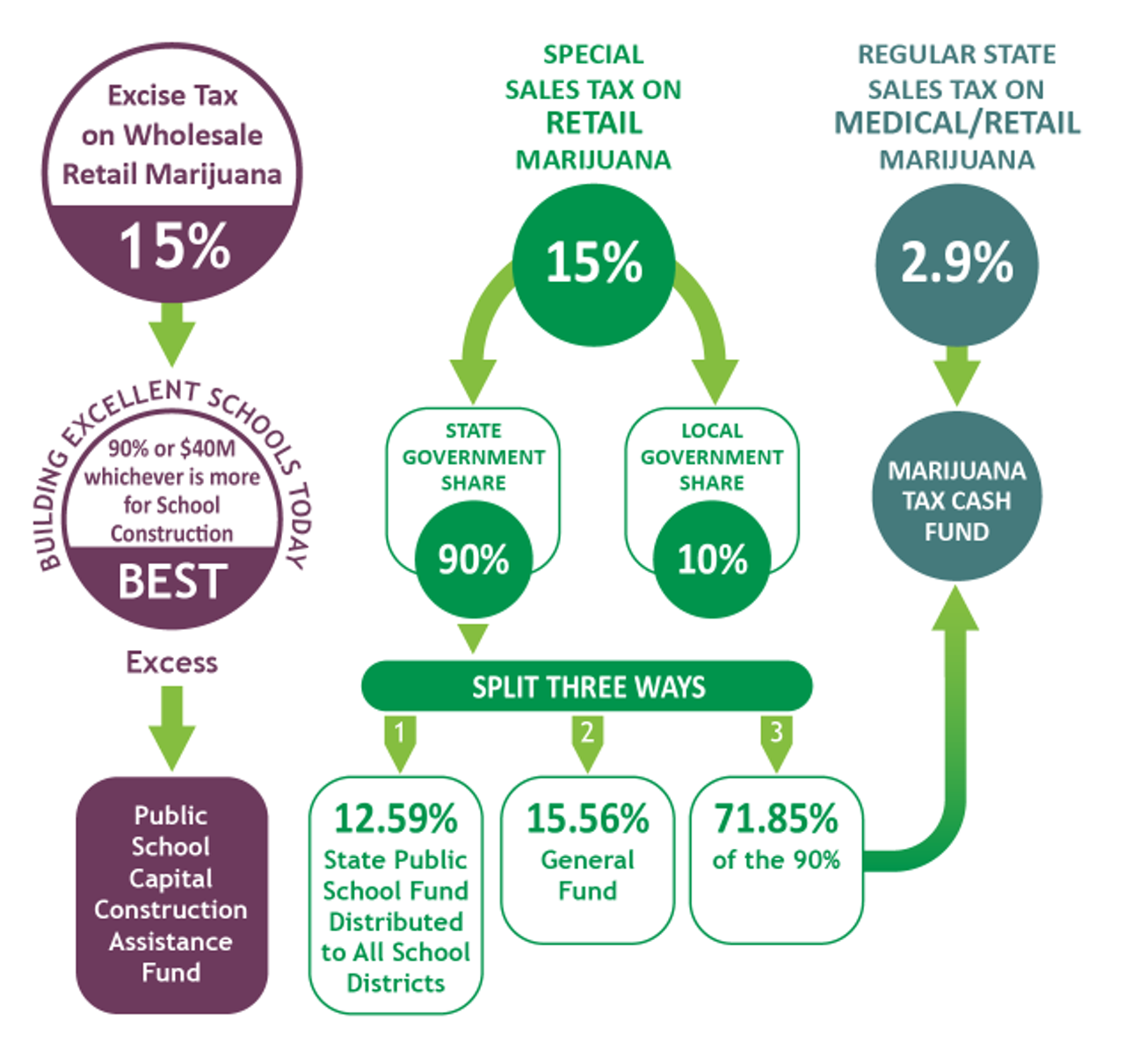

Colorado collects four different forms of marijuana taxes and licensing fees from the legal marijuana industry: a 15 percent tax on recreational pot sales, a 15 percent excise tax on wholesale marijuana, a 2.9 percent sales tax on recreational and medical marijuana purchases, and various licensing and application fees that state-approved marijuana businesses must pay.

Educational funding was a major selling point for recreational marijuana’s initial legalization, but a common complaint among Coloradans since 2014 has been a lack of transparency in how that money directly impacts schools. But to be fair, the system is complicated.

Public education in Colorado receives marijuana tax revenue through the state’s Building Excellent Schools Today (BEST) fund – a matching grant program – and the Marijuana Tax Cash Fund. Local governments can distribute their own marijuana tax revenue to schools, as well. The BEST fund annually receives either $40 million or 90 percent of the state’s 15 percent wholesale and excise tax revenue on recreational pot sales, whichever is greater.

Colorado Department of Education

A program that helps public schools rebuild, repair or replace primary educational facilities, the BEST fund has received over $580 million from marijuana tax revenue since recreational sales began in 2014, according to the Colorado Department of Education.

The state’s Marijuana Tax Cash Fund, built on the 15 percent sales tax, was created by the Colorado Legislature in 2014 to support health care, substance abuse services, law enforcement and marijuana-impact research, as well as public school programs.

Revenue allocated to the Colorado State Public School Fund – a general education fund built on 12.59 percent of the state’s nine-tenths share of the special sales tax on recreational pot and available to all school districts – has accounted for around $108.5 million from 2017 to 2021, with last year’s numbers not yet reported.

The remaining tax revenue from the state’s special sales tax on recreational marijuana goes to the General Fund and a local government shareback program for cities and counties with marijuana businesses, which receives 10 percent. Revenue from Colorado’s 2.9 percent standard sales tax on pot sales also goes toward the Marijuana Tax Cash Fund.