Jacqueline Collins

Audio By Carbonatix

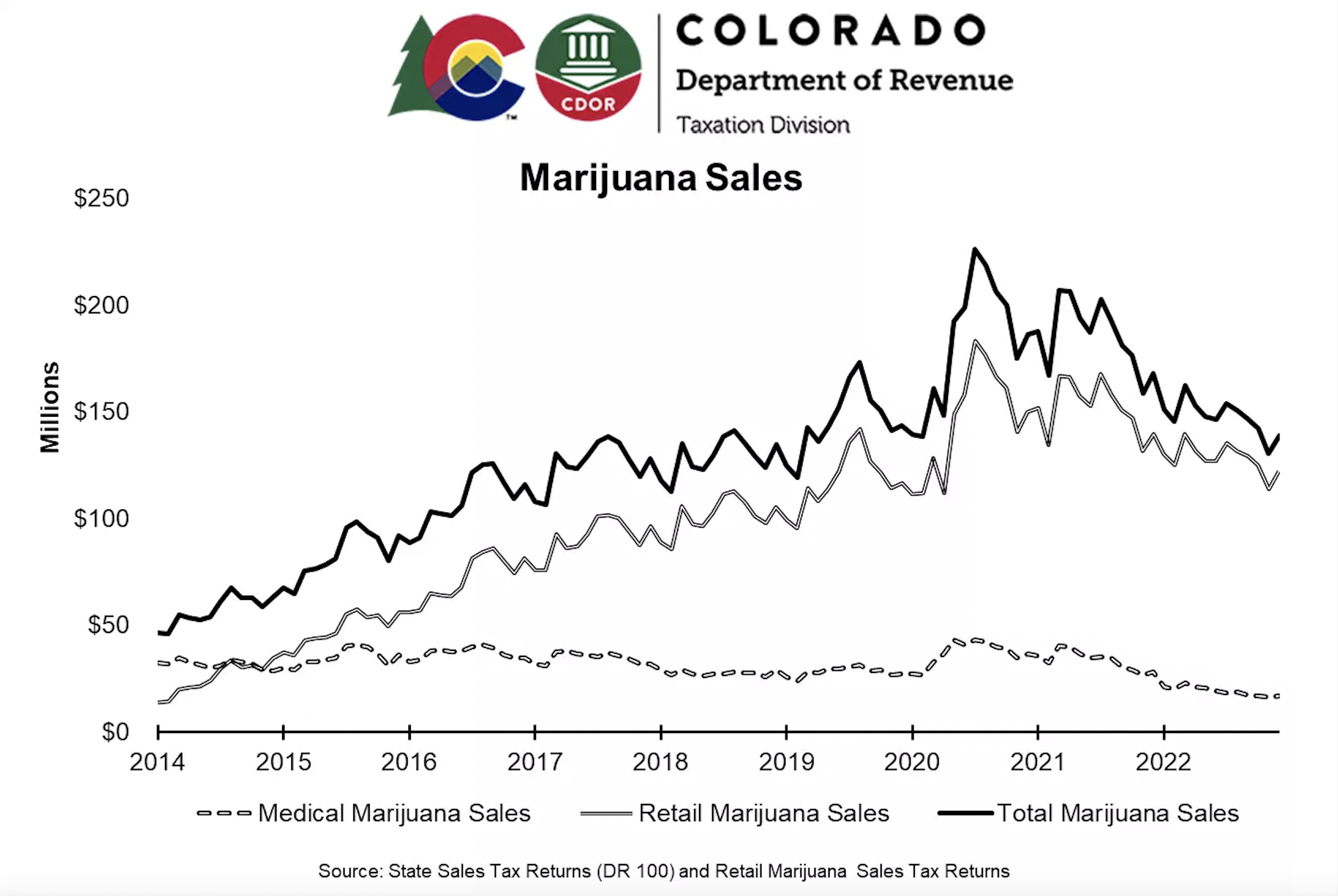

Annual marijuana sales in Colorado topped out at just under $1.77 billion in 2022, according to data released by the state Department of Revenue. While that number looks enormous, it’s a 21 percent drop from 2021, when Colorado dispensaries sold a record-breaking $2.23 billion.

Colorado marijuana prices and sales figures began sliding in 2021, but the industry hit a full-blown recession in 2022 and has yet to climb out from the basement. The average price per pound of flower fell nearly 62 percent from 2021 to 2022, hitting a record low, while medical marijuana sales also saw record lows. The drop in sales led to a decline in marijuana tax revenue, too, with state collections dropping from $423.5 million in 2021 to $325.1 million last year.

The year-plus industry dropoff has led to a burst of marijuana business closures and takeovers, with corporations shutting down large operations in Denver and southern Colorado. Despite the closures, however, well over a half-billion dollars was spent on marijuana business acquisitions in Colorado last year.

Dispensaries have sold nearly $14 billion worth of marijuana products since 2014, when recreational sales began in Colorado, according to the DOR. But Colorado has seen a sharp increase in competition over the past nine years, with recreational pot now legal in over twenty states, including Arizona, Oklahoma and New Mexico, all of which border Colorado.

Economic forecasts from the governor’s office don’t see the marijuana industry’s woes turning around until 2024 or 2025, and neither does the CEO of one of Colorado’s largest dispensary chains.

“Given the continued supply-chain issues, post-pandemic changes in demand, the saturation of product offerings and general inflation metrics, we’ll likely see an industry ‘correction’ in 2023, and potentially beyond, until these issues are stabilized,” Jon Boord, CEO of Native Roots and its twenty Colorado dispensaries, told Westword earlier this year.

Despite Colorado’s recent struggles, Boord believes that marijuana businesses in other states still look up to the first market to legalize recreational pot.

“The Colorado cannabis market has many attractive qualities. It is a mature market with relaxed residency requirements and a tried-and-tested regulatory scheme. There is also a sense of professionalism in internal operations that only comes from years of experience,” he said.

Colorado Department of Revenue