live.house.gov

Audio By Carbonatix

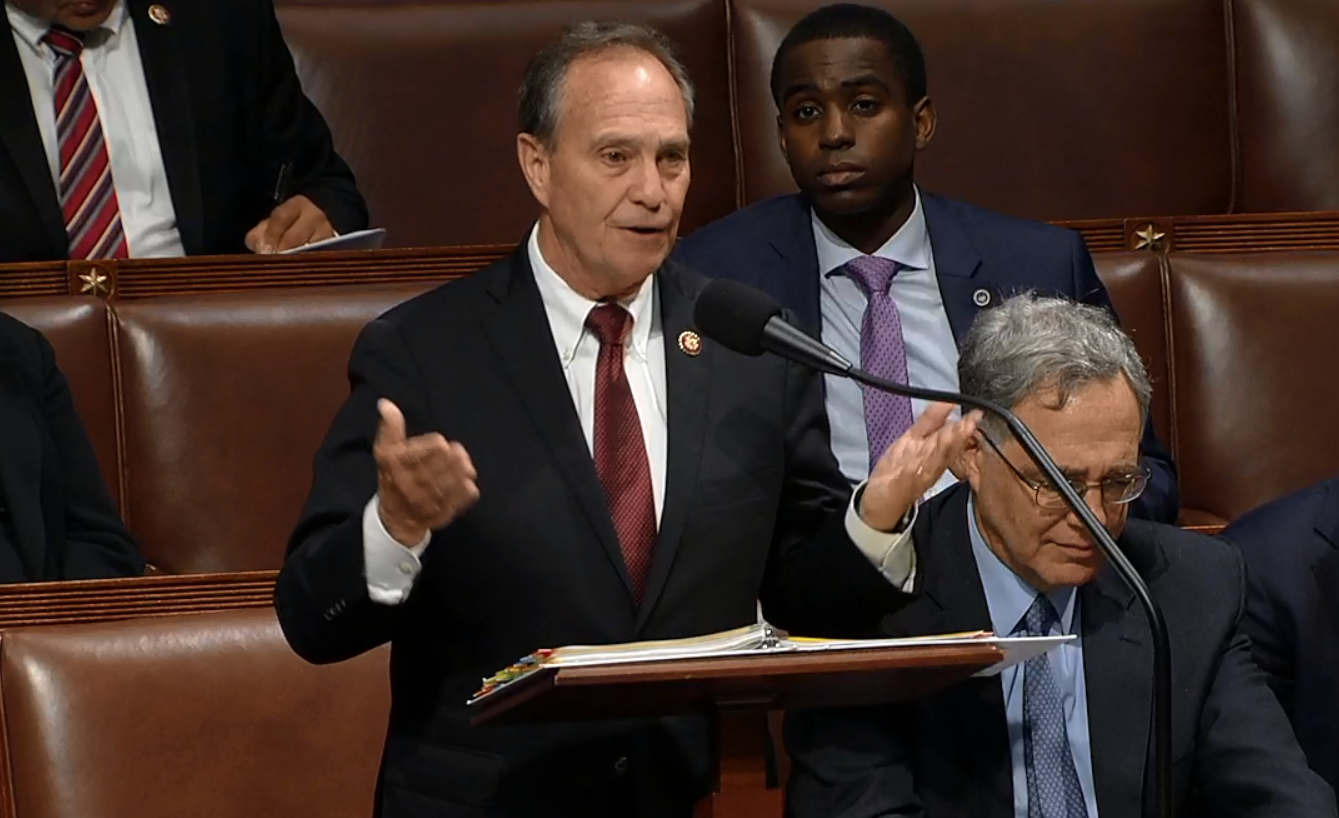

After the SAFE Banking Act, a measure that would allow banks and financial institutions to serve legal marijuana companies, passed the U.S. House of Representatives on September 25, Colorado Congressman Ed Perlmutter was confident of the bill’s chances in the Senate.

“There have been good signs coming out of the Senate indicating that they’re interested in moving this bill forward,” he told a crowd of marijuana regulators and business owners at Denver’s Marijuana Management Symposium in October, adding that he expected the Senate to vote on the bill “over the next two to three months.”

The SAFE Banking Act would provide federal protection to banks and financial institutions that want to supply loans, lines of credit, bank accounts and other services to cannabis businesses in states where they’re legal. Although 47 states have legalized some form of medical or recreational marijuana, the majority of banks and financial institutions won’t serve pot businesses out of fear of being hit with federal trafficking charges, because the plant and its derivatives are still considered Schedule I substances. As a result, many licensed pot businesses operate on a cash-only basis.

When the Safe Banking Act passed the House, it looked like Senate Majority Leader Mitch McConnell would be the Safe Banking Act’s biggest obstacle. Despite McConnell’s noted stance against legalizing marijuana, though, Perlmutter hoped that additions to his bill addressing banking services for industrial hemp – a crop embraced by Kentucky farmers after hemp’s 2018 federal legalization – would help push the bill.

“We think the Majority Leader in the Senate – Senator McConnell – will move this forward,” Perlmutter said in October. But industrial hemp companies were cleared for banking by the Federal Reserve and several other federal and state banking regulators in December, and there’s been no movement in the Senate on the SAFE Banking Act.

So on January 21, Perlmutter and the other House co-sponsors of his bill – Steve Stivers (R-Ohio), Denny Heck (D-Washington) and Warren Davidson (R-Ohio) – sent a public letter to a powerful senator, urging him to further consider marijuana banking. But the letter wasn’t sent to McConnell. It was sent to Senator Mike Crapo (R-Idaho).

As chairman of the Senate Banking Committee, Crapo must bring the bill forward for committee consideration before the Safe Banking Act can receive the attention of the full Senate. Like McConnell, Crapo isn’t a fan of pot legalization. He made that clear in December, when he said that Perlmutter’s bill doesn’t address his concerns about public health and safety, marijuana marketing and product potency.

“I remain firmly opposed to efforts to legalize marijuana on the federal level,” Crapo said in a statement at the time. “I have significant concerns that the SAFE Banking Act does not address the high-level potency of marijuana, marketing tactics to children, lack of research on marijuana’s effects, and the need to prevent bad actors and cartels from using the banks to disguise ill-gotten cash to launder money into the financial system.”

Crapo also said that he’d like to see further studies focusing on marijuana’s effects on children, as well as a potency limit of 2 percent THC on legal marijuana products, which would essentially wipe out the inventory of every dispensary in Colorado.

Perlmutter and his House colleagues didn’t address Crapo’s comments on potency in their letter, instead taking a diplomatic approach as they urged the senator to work with them on the SAFE Banking Act, which the Colorado rep has been pushing in some form for over six years.

“We are also encouraged by your proposal of a national study on the health and safety effects of marijuana. We agree there is a lack of federal research evaluating marijuana and its effects, and additional research would be helpful for state and federal lawmakers so decisions can be made on the best available science. However, we should exercise caution before adding limitations to the legislation’s safe harbor that impose unworkable burdens on financial institutions, or would jeopardize the larger, bipartisan effort to address public safety concerns associated with cash-only transactions,” the letter reads.

“We respect your opposition to the legalization of marijuana at the federal level and in the state of Idaho. Many of the 321 Members of Congress who supported H.R. 1595 also oppose federal marijuana legalization. Our bill is about public safety. It does not change the legal status of marijuana and is focused solely on taking cash off the streets and aligning federal banking laws with the decisions states are already making regarding cannabis.”

Here’s the full letter:

Dear Chairman Crapo:

As the four lead sponsors of H.R. 1595, the SAFE Banking Act, we are encouraged by your December 18, 2019 statement concerning cannabis banking, and we appreciate the attention the Senate Committee on Banking, Housing, and Urban Affairs is giving this important issue. The primary objective of our bill is to address public safety concerns resulting from marijuana-related transactions being forced outside the regulated banking system. We welcome your ideas and solicitation for stakeholder feedback on how to improve this effort.

47 states, four U.S. territories, plus the District of Columbia have spoken and legalized some form of marijuana, including cannabidiol. By bringing businesses out of the shadows and into the well-regulated banking system, our legislation will improve transparency and accountability and help law enforcement root out illegal transactions to prevent tax evasion, money laundering, and other white-collar crime. Most importantly, this will reduce the risk of violent crime in our communities as these businesses and their employees are currently targets for crime, robbery, assault and more by dealing in all cash.

We share your goal of preventing bad actors and cartels from accessing the financial system. As witnesses at both the House and Senate hearings testified, the 2014 FinCEN Guidance Regarding Marijuana-Related Businesses is an important framework for depository institutions choosing to serve cannabis clients. We welcome the discussion about how this guidance addresses legacy cash and how we can further keep out bad actors and prevent illicit cash from entering the financial system.

We are also encouraged by your proposal of a national study on the health and safety effects of marijuana. We agree there is a lack of federal research evaluating marijuana and its effects, and additional research would be helpful for state and federal lawmakers so decisions can be made on the best available science. However, we should exercise caution before adding limitations to the legislation’s safe harbor that impose unworkable burdens on financial institutions, or would jeopardize the larger, bipartisan effort to address public safety concerns associated with cash-only transactions.

We respect your opposition to the legalization of marijuana at the federal level and in the state of Idaho. Many of the 321 Members of Congress who supported H.R. 1595 also oppose federal marijuana legalization. Our bill is about public safety. It does not change the legal status of marijuana and is focused solely on taking cash off the streets and aligning federal banking laws with the decisions states are already making regarding cannabis.

This is a constructive step forward for our legislative effort and an important step toward making our communities safer and providing regulatory certainty to banks, credit unions, and other firms-many of which are not directly involved in the marijuana industry-which are trying to operate their businesses in a safe and legal way. We stand ready to partner with you and your colleagues, and we look forward to continued progress on this issue.