Jacqueline Collins

Audio By Carbonatix

The United States House of Representatives just approved a bill that would allow banks and financial institutions to serve marijuana businesses in states where it is legal without risking federal prosecution, marking a landmark step toward marijuana reform.

Introduced by Colorado Representative Ed Perlmutter, the SAFE Banking Act needed approval from two-thirds of the House’s 435 members, or 290 yes votes. It got 321, becoming the first marijuana-centered bill to reach a congressional floor for a vote – as well as the first to pass.

“The SAFE Banking Act will help thousands of employees, businesses and communities in Colorado and across this country who have been put at risk because they have been forced to deal in piles of cash,” Perlmutter explains in an email to Westword. “After Colorado and Washington legalized marijuana for recreational use in 2012, I started to hear from local businesses who were being forced to operate in all cash.”

Although 47 states have legalized some form of medical or recreational marijuana, the vast majority of banks and financial institutions don’t want to touch cannabis money out of fear of being hit with federal trafficking charges, because the plant and its derivatives are still a Schedule I substance. As a result, the majority of licensed pot businesses operate on a cash-only basis, despite legal marijuana companies accounting for around $10 billion in funding in 2018, with commercial pot sales predicted to reach $25 billion by 2025.

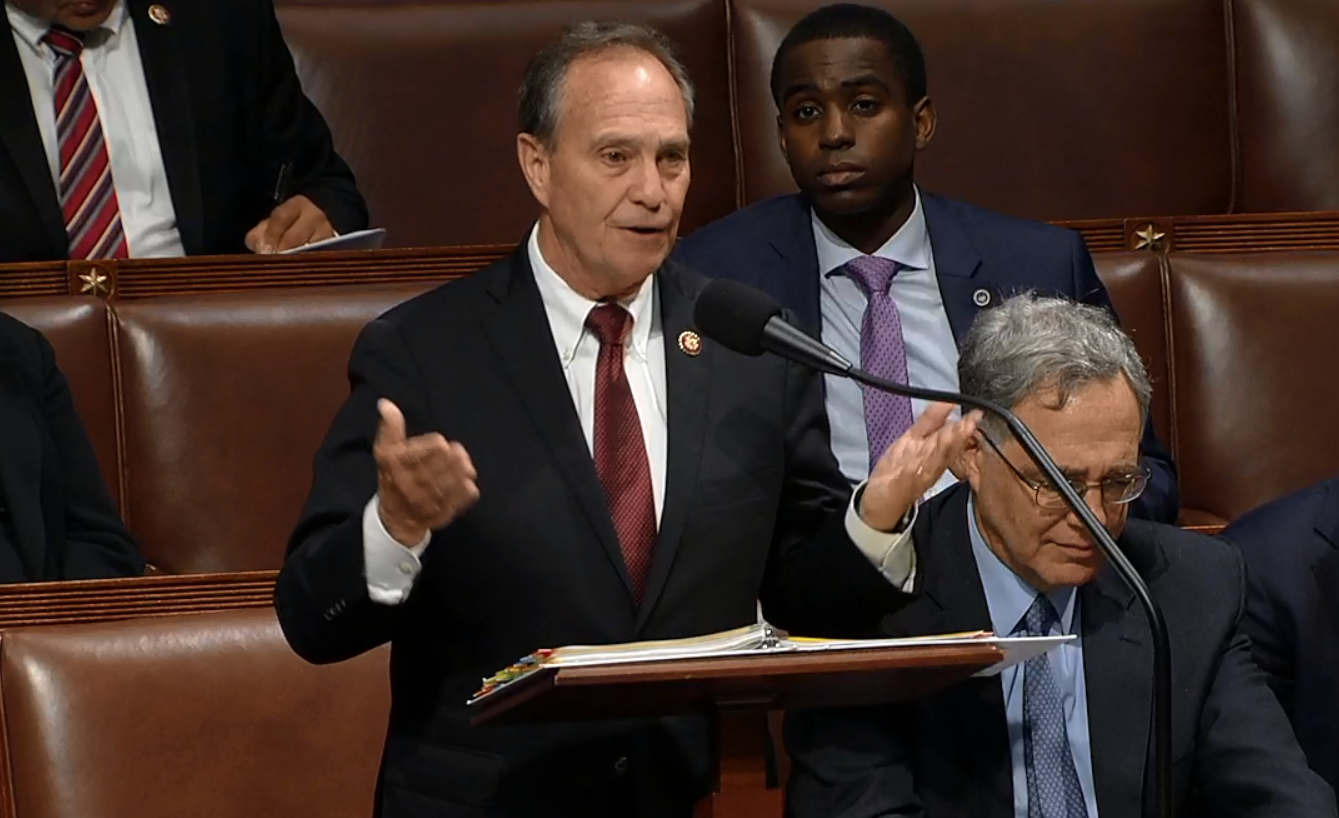

Colorado Congressman Ed Perlmutter lobbied on behalf of his marijuana banking bill in front of his colleagues in the House of Representatives on September 25.

live.house.gov

Ancillary businesses – businesses that provide goods and services for the pot industry but don’t touch cannabis – as well as industrial hemp and CBD companies face similar issues with financial institutions, according to Perlmutter, who says the SAFE Banking Act would protect those businesses, too.

Perlmutter introduced his original measure in 2013, but it didn’t make it to the full House until this March, when it passed the House Financial Services Committee 45-15. In July, a Senate finance committee heard the Senate version of the bill, but has not yet voted on it.

While it passed the House, the SAFE Banking Act doesn’t have as much momentum in the Senate, where Majority Leader Mitch McConnell hasn’t supported marijuana-related legislation. However, the Kentucky senator is more sympathetic to hemp, the federally legal and often-misunderstood cousin of marijuana; in McConnell’s home state, industrial hemp was a pre-prohibition cash crop and is now a growing part of the state’s agricultural industry.

Before the vote, Perlmutter told the House that he and his team had “worked with our Republican colleagues on a few changes to improve the bill since it was marked up in March,” and added “protections for financial institutions to provide services to hemp and CBD businesses.” Will that help the measure in the Senate?

“Despite the Farm Bill legalizing hemp, many hemp businesses continue to struggle gaining access to financial services – an issue we know Majority Leader McConnell is working to address,” Perlmutter tells Westword. “By clarifying protections for the hemp industry in the SAFE Banking Act, we hope to help these businesses and look forward to working with the Senate as they address this issue by taking up the SAFE Banking Act or as they work to develop and pass similar legislation.”

The cannabis industry was quick to celebrate the big step forward that Congress took on September 25. “The SAFE Banking Act would greatly improve public safety and transparency, and represents a chance to even the playing field by allowing small businesses and people from marginalized communities participating in this emerging industry to access traditional lending,” Aaron Smith, executive director of the National Cannabis Industry Association, says in a statement. “After more than six years of advocacy from NCIA, the bill sponsors, and allied organizations on cannabis banking, we are poised to take a huge leap toward more sensible cannabis policies at the federal level. We commend this Congress for finally addressing this issue.”